Welcome to the 12th issue of this newsletter which covers market trends, Lightning Network developments and updates about LN Markets.

If you enjoy this content, feel free to spread the word!

🤓 Grieving attacks demystified

All major Lightning implementations now support Wumbo, making it possible to send large Bitcoin amounts through Lightning channels. Coupled with the implementation of Multi-Path Payments, this is a very positive signal for the whole ecosystem and the promise of more liquidity for the whole network (more on that here).

At the end of September, Bitfinex, the largest exchange to offer LN deposits and withdrawals to its customers, announced its support of Wumbo channels, giving all Lightning users the ability to open channels with a capacity of up to 2 bitcoins with their Lightning nodes.

That day, Joost Jager, independent Bitcoin/Lightning Engineer, published an insightful thread on potential attacks on these channels.

Antoine Riard also published an other interesting piece on several known Lightning vulnerabilities.

As the Lightning Network is maturing, and the need to solve these potential attack vectors is more pressing, it is important for a non-technical audience to understand these potential issues and the ongoing work to solve them.

Joost Jager was kind enough to answer our questions and demystify this topic for us! Thank you Joost 🙏

In layman’s terms, could you describe the possible attack on Wumbo channels?

Joost JAGER: The attack is a so-called grieving attack. It causes grief, but no loss of funds. It is to Lightning what a DDoS attack is to a website and allows an attacker to temporarily disable a channel by overloading it with dummy payments.

How could a node operator prevent this kind of attack?

Joost JAGER: It isn't very easy for a node operator to prevent this. In particular because the attack can also be executed from a distance. The attacker can route through a few hops first before reaching the target channel and Lightning's properties make it harder for the victim to trace back to the source.

There are several ideas on how to prevent this. One idea is to make your peers pay you for forwarding a payment. Another one is to apply limits to untrusted connections to make it harder for an attacker to launch enough of these dummy payments.

How would your current work on circuit breaker address these issues?

Joost JAGER: In the latest LND release 0.11.1, it is now possible to set a maximum to the number of payments in flight for a channel. This is a tool that can be used. This is however a static limit that can't be changed over the lifetime of a channel. So it won't be possible to upgrade the trust level on an existing channel.

Another approach is to use HTLC interception. This allows you to write a plug-in that inspects all to-be-forwarded HTLC and decides whether to follow through or cancel. Circuit Breaker is a very basic implementation of such a plug-in. It allows you to configure the maximum number of in-flight payments per channel.

In your view, what are the other known vulnerabilities that could affect the LN that we need to fix in priority to make the network more resilient?

Joost JAGER: Another vulnerability that has received a lot of attention already is the pre-signed fee on commitment transactions. Because it is pre-signed, it can't be changed after the fact and in a rising fee market, that will cause the commitment transaction to not confirm in time. Node implemenations are pretty far along in addressing this via the new so-called 'anchor commitment format' which allows users to bump the fee of a commitment transaction independently.

Having this new format be the default and getting the majority of the existing old-style channels replaced is a big step forward in terms of security.

Overall, what's your view on the future of LN?

Joost JAGER: Overall I think the future of Lightning is very bright. There is still a ton of work to do, but in my opinion the fundamental ideas are still standing firmly.

⚒️ Building

A lot of new cool stuff on LN Markets! The much requested LN Markets API is opening. More to come in the next issue. We have also pushed:

An optimized version of our trading engine that can deal with a much higher number of trades per second

The possibility to create take profit & stop loss for already running positions

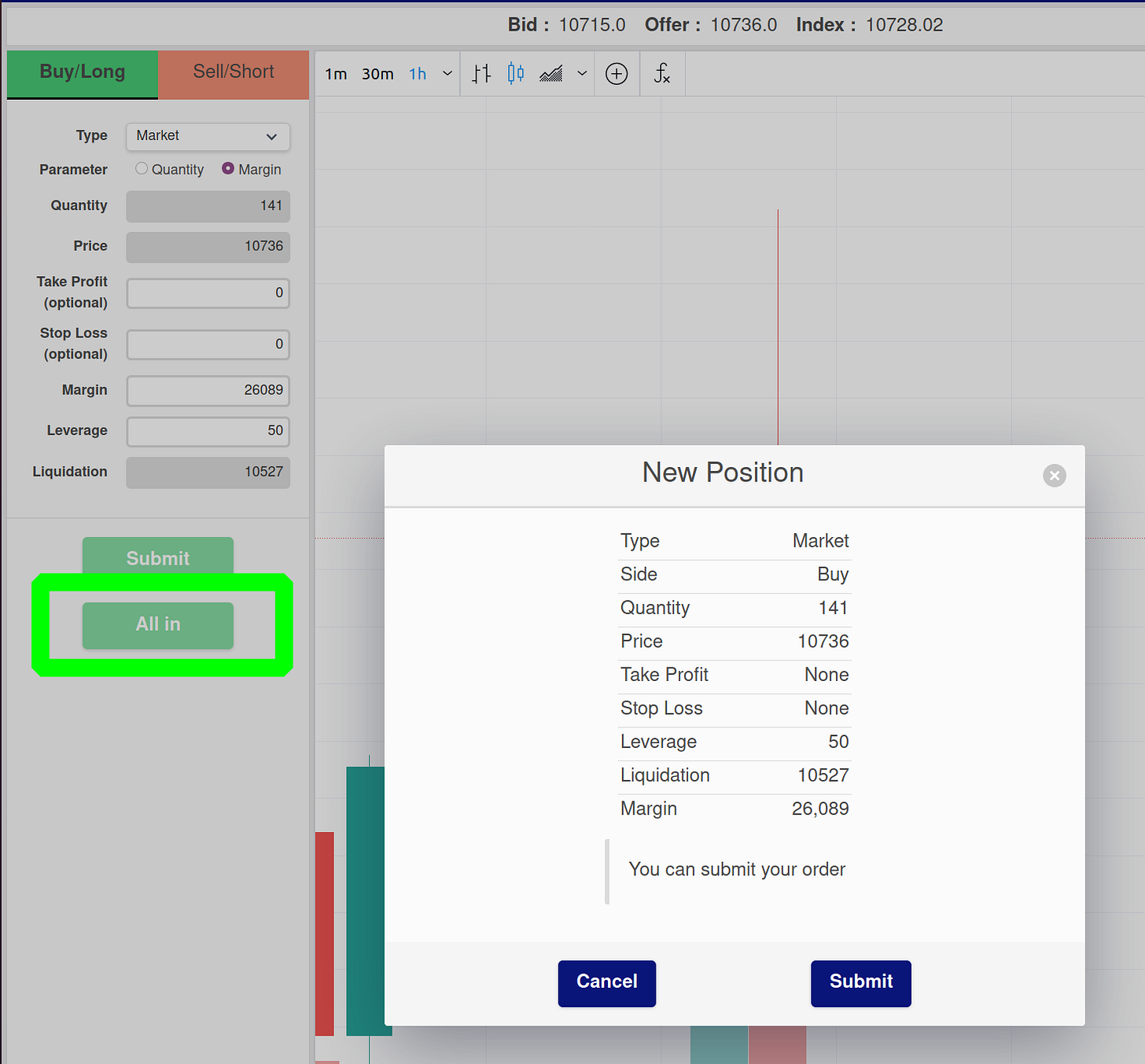

An All in button to go full degen long or short in one click! For a given side (buy or sell), the All in button generates a market order which maximizes the leverage and use of margin available:

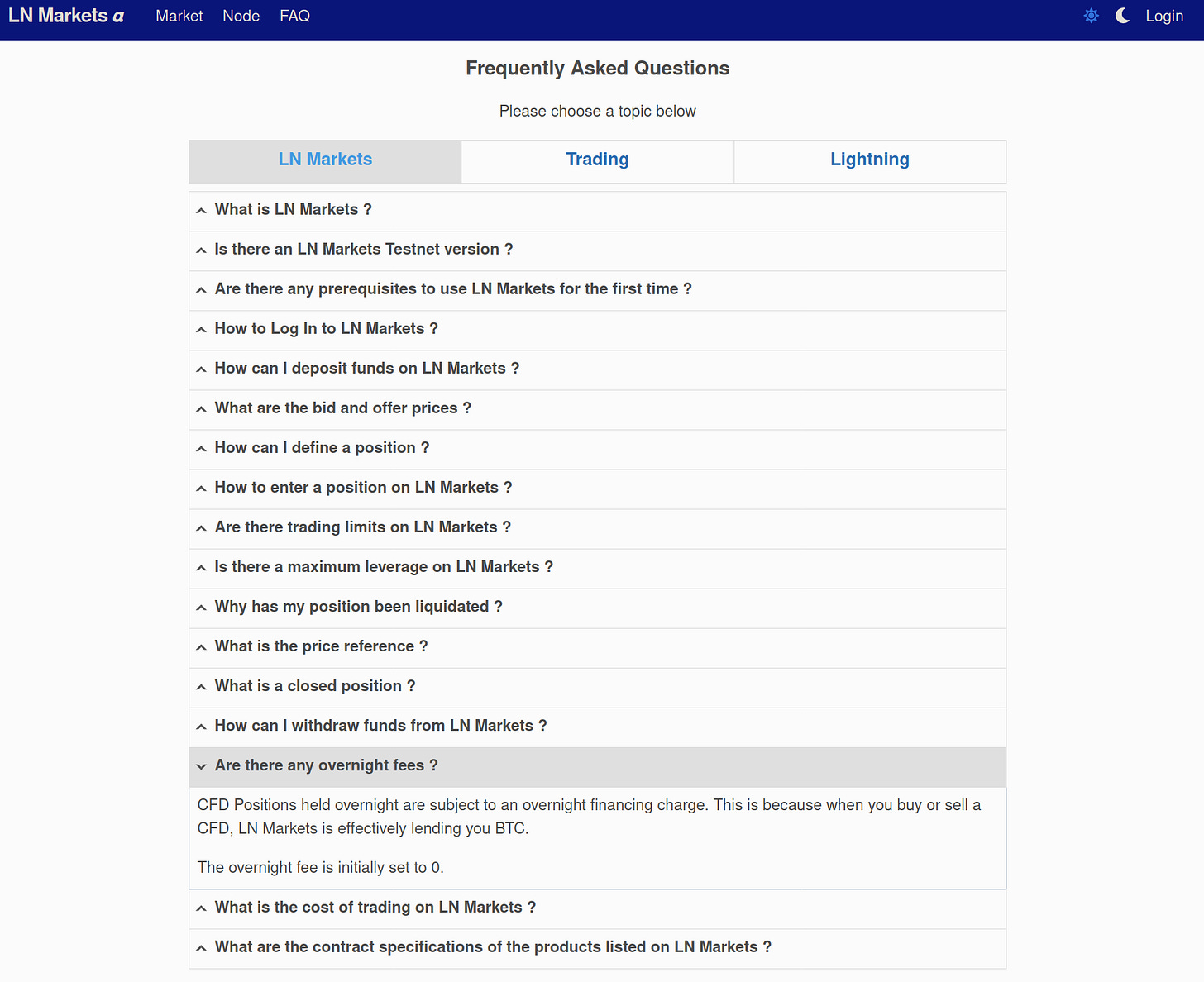

We also updated the LN Markets website with a Node tab summarizing our Lightning Network activity and a detailed FAQ with sections on LN Markets, Trading and Lightning:

Last but not least, we pushed a major logo upgrade. Our marketing budget is going through the roof 😬

🏦 Crypto will eat finance

It is a common view that for hyperbitcoinization to come, we first need financial institutions to embrace Bitcoin.

But to us, it’s the kind of completely new trading experience that Bitcoin and Lightning can power, such as instant trading and settlement, directly from any device, that will make Bitcoin mainstream and in the end enable crypto-finance to eat finance!

The recent launch by Bitfinex of Theter-settled perpetual contracts based on European equities is a good illustration of these new trading experiences, porting traditional stock markets to the digital asset space:

Speaking of crypto-finance, here is a massive piece by Arjun Balaji on the evolution of crypto market structure and what the future could look like. Quick summary:

Market Structure 1.0 - 2010 to 2017: from P2P trading over Bitcointalk to the first exchanges, OTC desks and the rise of Tether

Market Structure 2.0 - 2018 to Present: derivatives volumes grew over 25x, stablecoins grew 10x, while bid-ask spreads fell 10x, mainly driven by the rise of derivatives and lending/borrowing markets and the API-fication of OTC markets

Market Structure 3.0 - ~2020 to ?: the main drivers of the maturation of crypto markets would be CEFi <->DeFi convergence (“Scanning a QR code and signing a MetaMask transaction is accessible and closer to using Snapchat than fiddling with a traditional brokerage”) and capital efficiency through dedicated prime brokers, the emergence of a robust repo market, and crypto-native derivatives clearing.

A must-read!

🔮 Reading

According to a survey by Acuiti, the biggest concerns among all trading institutions that prevent them from entering the crypto space are security of the exchange, counterparty risk and custody.

Existing Bitcoin custody solutions are always a trade-off between these 3 types of risks. Here, Thibaud Maréchal from Knox Custody does a great job at explaining these trade-offs in detail:

On a different topic, this is an enlightening thread by Ryan Gentry on the trade offs of various scalability designs:

⚡ Bonus

Great (and short) tweet storm by Giaccomo Zucco on how it’s time to make strong tools again!

And finally, a big thanks to all our users for their support, help on bug fixes and for bringing us joy with these great tutorial video and cool logo suggestions!

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!

Why when updating the "Stop Loss" on an existing ITM position do you get the error " The stoploss is not between the price and liquidation" if the stop loss is between the original price of the contract and the market price? It seems to be calculating using the wrong price. Shouldn't it be using the market price when updating an existing position and not the original contract price? There is no way to protect a position once it is ITM. Thanks.

the new version of lnmarkets that just released has no way to login. can you check it out? thanks