Welcome to the 15th issue of this newsletter which covers everything at the intersection of the Lightning Network and Finance, as well as updates about LN Markets.

If you enjoy this content, feel free to spread the word!

🔥 Metrics

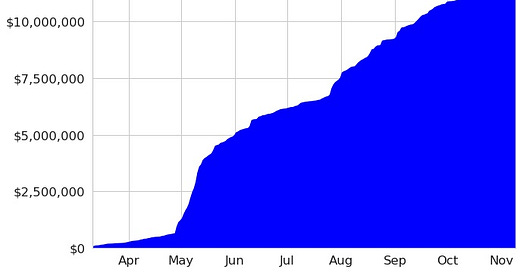

The launch of our API and the bull market season have fueled a surge in LN Markets’ trading volume! We have now reached $18 million in aggregate trading volume since our launch last March - despite the small-trade limit currently set to 0.01 bitcoin per user:

And we had our 6 biggest trading days over the past two weeks! A few stats on our activity:

More than 38,000 orders processed

Node capacity: 9.5 BTC

176 channels opened

Thank you all for your support!

🤓 Pool with Ryan Gentry

With the release of Pool, Lightning Labs announced the launch of the first non-custodial marketplace to buy and sell Bitcoin liquidity on Lightning. With Pool, users can trade channels, making it easy to get access to liquidity or earn a bitcoin-native yield.

It opens mind-blowing possibilities, which are not yet easy to fully conceptualize. That’s why we reached out to Ryan Gentry with a few questions! A massive thanks to him for helping us understand better this whole new kind of marketplace and its potential implications 🙏

What is the inbound liquidity problem and how does Pool intend to solve it?

Ryan Gentry: When Alice downloads lnd, funds her wallet with Bitcoin, and opens a channel, she has the ability to send Bitcoin over the Lightning Network (what we call outbound liquidity) but cannot receive Bitcoin through that channel yet. This is the inbound liquidity problem. There are a few solutions to this today - Alice could Loop Out some of the funds in her channel, she could request peers open channels to her out of altruism, or she could purchase a channel from OTC services like Bitrefill’s Thor, LNBig, etc. - but theoretically if inbound liquidity is a scarce resource, then a marketplace will be the most efficient and scalable way to allocate it.

Pool makes a market for inbound liquidity so that anybody who wants to receive coins on the Lightning Network (new users, merchants, exchanges, etc.) can purchase channels from a variety of capital providers.

Our hope is that pooling liquidity in this manner will allow for fair price discovery for inbound liquidity, which will provide more routing nodes with an additional source of revenue, which will bring more nodes onto the Lightning Network and improve the experience for everybody.

What are Lightning Channel Leases (LCLs) and how do they compare with real-world contracts and financial instruments?

Ryan Gentry: LCLs are standard contracts for inbound liquidity. Remember Alice? Using Pool, she would download lnd, fund her Pool account with Bitcoin, and purchase an LCL for a small percentage of the size of the channel which would result in a peer opening a channel in her direction (providing her inbound liquidity) for a standard duration of 2016 blocks. We call this a “lease” on purpose because the seller of the channel is not giving up custody of their coins, just giving up the opportunity cost of providing liquidity to any node other than Alice’s.

LCLs have elements of a traditional fixed income asset (like a bond) and peering agreements as used on the Internet to help coordinate the allocation of bandwidth between ISPs. The auction mechanics that Pool uses to find a fair price for LCLs are inspired by the methodology that the US Treasury uses to sell T-bills. But though it has real-world comps, this is a brand new type of financial instrument and it will take time for market participants to figure out how it works.

Can you describe the Pool auction process? How to ensure that LCLs are non-custodials?

When Alice funded her Pool account in the above example, she sent Bitcoin to a 2-of-2 multisig wallet with one key owned by her node, and the other key owned by the Pool auctioneer node. The Pool auctioneer cannot move funds out of that wallet without Alice’s key also signing the transaction, so Alice has not given up custody of her coins. In order to buy an LCL, Alice submits a bid to the auctioneer with the interest rate she is willing to pay. When that bid is matched with an ask from a capital provider, the auctioneer coordinates Alice and the capital provider signing the new channel open transaction, and then submits the signed transaction on-chain.

The main benefit of having an auctioneer node is that it can submit many signed LCL transactions together in a single batch, saving significant on-chain fees for the participants versus if they were to open the channels on their own.

The process is non-custodial for the users because the default behavior in case of any malicious actions by the auctioneer is to sit, wait, refuse to sign any transactions, and withdraw coins from their account. Under no circumstances can the auctioneer move a user’s coins without their consent.

LCLs introduce the concept of non-custodial risk-free rate: is this really risk-free? How could we mitigate the existing hot wallet risk of running a Lightning node in the future?

US Treasury bills are considered “risk-free” because the only circumstance in which they are considered worthless is if the US federal government defaults on its debts. This risk exists, but is considered so small to be “risk-free”. LCLs are “risk-free” in a stronger sense because sellers do not give up custody of their coins to a counterparty, so there is no default risk. You correctly identify hot wallet risk as existing, which (in addition to opportunity cost of capital risk) is the reason why LCLs can be sold for a premium, but the goal is to ruthlessly minimize it as much as possible with a combination of PSBTs, Tor services, and other techniques. Every Bitcoin exchange on the planet has a hot wallet funded with hundreds to thousands of Bitcoin today, I like to view Lightning wallets in the exact same way.

Most importantly, US federal government default risk is global - if the worst case occurs, it affects every US Treasury bill holder. Hot wallet risk is local - if the worst case occurs, only the single Lightning node that has been exploited is affected. This makes LCLs as an instrument much more risk-free than Treasuries, in my opinion.

Can you tell us more about the concept of shadowchain? What are the possible implications?

Shadowchains are just incredibly cool new constructions. In my humble opinion, sidechains have not taken off on Bitcoin because they require users to give up custody of their coins to a set of validators who may or may not give the coins back. Shadowchains are like sidechains where you maintain custody of your funds, and get a chance to validate every transaction that involves your funds, rather than needing to trust an external set of validators. The tradeoff is that you need run a node, but that’s the price of trustlessness.

For application developers, shadowchains give you an Ethereum-style account model to develop with, but with real Bitcoin. I think the implications are enormous and will take 6 months to a year for people to fully digest. But the best possible outcome is that people realize you can build decentralized, non-custodial exchanges directly on Bitcoin, no token or new blockchain required.

Could non-custodial yield curves, node ratings agencies, be the building bricks of a decentralized financial system true to the ethos of Bitcoin? What may come next?

Yes absolutely. We are right on the precipice of a very exciting time for Bitcoin-native capital markets. Once Pool gets deep liquidity (which may take some time!), it will produce a non-custodial yield curve which is the base primitive upon which everything else will be built. I definitely expect node rating agencies to pop up and follow the trajectory of SEO companies in the 2000s. The next step is p2p lending and borrowing, which we saw a hint of with Hodl Hodl’s new product release last week or the week before. I believe the really exciting non-custodial applications require Bitcoin Core to soft fork in covenants (e.g. OP_CTV or something like it), but regardless the future of building on Bitcoin is incredibly bright.

Finally, you often use analogies between Bitcoin mining and LN. Can you expand on that?

For the vast majority of Bitcoin’s history, mining was the best way to earn Bitcoin as an individual. In the CPU era, anybody with a laptop could mine and do well, though variance of rewards was a problem. Mining pools solved that problem. Then in the GPU era, mining became a bit more expensive, but still in reach for most people. Finally in the ASIC era, mining has professionalized and is only really profitable for sophisticated organizations.

I think that LN has superseded mining as the best avenue to earn Bitcoin as an individual, and I expect running a node to follow the same path as mining (with some obvious caveats). To date, anybody could set up a node and do well, competition has not been very high, though variance of fees earned has been a problem. Lightning Pool should help to solve that problem. We are likely approaching an era post-Wumbo when running a competitive node becomes a bit more expensive from a cost of capital perspective. 100k sat channels don’t cut it anymore, but only 50 nodes on the network have more than 10 BTC of capacity which means a competitive node is in reach for most people. Hopefully Pool’s reduction in earnings variance gets more enterprises on boarded into LN which brings more volume which will bring more earnings to routing nodes which will induce competition, and take us into the final era when routing will have professionalized. The timing on all of this is incredibly hard to predict, but I’m optimistic the trend will stay intact.

To go further on Pool, we suggest the reading of this technical deep-dive and listening to the fantastic Marty Bent’s podcast with Ryan (discussion on Lightning starts at 1h57).

🌈 RGB

The development of the RGB protocol is making impressive progress! During the latest weekly call, Dr Maxim Orlovsky has presented LNP node, a new rust Lightning node written from scratch using LNP/BP set of technologies, which supports RGB assets. The latest release of the node includes:

Channel funding

Channel operations, HTLCs

RGB node integration

Adding assets to the channel (funding with assets)

Transfers of RGB assets

Here is a video of the demo:

🌱 Ecosystem

Things are moving so fast right now for the whole Lightning Network ecosystem!

The inventor of the Podcast Adam Curry has presented a demo of Lightning integration for podcasting made with Sphinx chat. At a time when Spotify announced that they would start charging for some pods, this is huge because it enables podcasters to easily build up their own monetization system. You can watch the demo here:

The Australian Bitcoin exchange Bitaroo leads the way for other exchanges to integrate Lightning easily. The whole thread is worth a read for its Lightning-bullishness!

Ethan’s quote is 100% in line with LN Market’s vision on how Lightning is a game changer for exchanges:

“We are (an unwilling) BTC Custodians”

And more food for thought from Alex Bosworth! So much to digest right now 😅

⚡ Bonus

We were proud to be a part of #LNflambeau, a French Lightning-for-good Torch initiative! The progress of the torch can be followed here, it is opened until block 660,000 and all funds will ultimately be sent to the Human Rights Foundation:

Finally, thank you Cryptomode for this great (and not sponsored!) review of LN Markets:

Please feel free to reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!