Welcome to the 19th issue of this newsletter which covers everything at the intersection of the Lightning Network and Finance, as well as updates about LN Markets. If you enjoy this content, feel free to spread the word!

⚒️ Building

Just like Bitcoin, our past few weeks have been filled with new All-Time-Highs for all our metrics! This has led us to re-scale most of our IT infrastructure, having us well prepared for the epic $42K bull run:

During winter holidays, we have worked on a few UI improvements to keep LNM trading experience smooth as butter.

LN Markets is all about instant trading at very low cost, privacy first.

We made this short video to demonstrate how easy it is to go in and out of the Bitcoin market straight to your wallet in less than a minute:

🇪🇸 We have created a new Telegram support group in Spanish, feel free to join here: https://t.me/lnmarkets_spanish

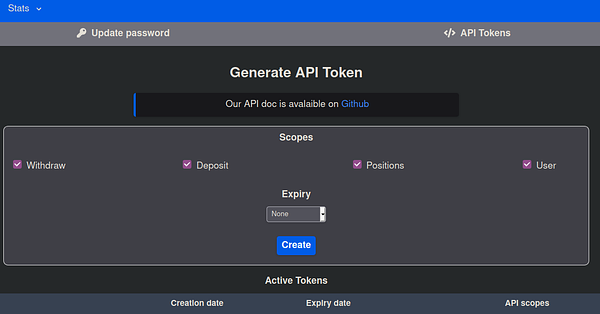

And our first API tutorial for non-coders is out, starting with Python:

Our next developments will include the possibility to add and remove margin to an existing position.

🌱 Ecosystem

Phoenix wallet is finally coming to iOS! They wrote a very interesting blog post on why it took so long. Well, simply because it has involved building a new multi-platform Lightning engine in Kotlin, on which Phoenix iOS app and a new version of the Phoenix Android app are built!

After launching a private Beta on Testnet, the team is close to a Mainnet release.

Game development studio ZEBEDEE announced Infuse, a new feature developed for the popular e-sports game “Counter-Strike: Global Offensive” with the ability for players to instantly earn a prize pool of satoshis. With Infuse, instead of creating new games, ZEBEDEE can "add Bitcoin into games people already love" according to its co-founder Christian Moss.

Jack Mallers has been all over the news! First, by enabling NFL athlete Russell Okung to be paid half of his $13 million yearly salary in Bitcoin with Strike. Apparently Strike swaps dollars for bitcoins directly sent to a cold storage held by Russell.

Second, by announcing Strike Global, that could be a total game-changer for international remittances. It could enable to send money all over the globe, from one local currency to the other, instantly and at low cost, using Lightning rails. Here is a demo for USD/EUR:

How does it work under the hood? As Jack Mallers explains:

“The movement of US Dollars to Euros was comprised of two transactions:

A BTC/USD BUY (from the sender’s USD to BTC)

A BTC/EUR SELL (from the BTC to the receiver’s EUR)

We believe the true exchange rate between two individual fiat currencies are the net of a BUY and a SELL between them and Bitcoin. Strike maintains a live Forex rate and compares that to its own rate before every transaction.

However, in our testing, a Strike international transfer has never been done at an unfavorable exchange rate when compared to Forex rates. Shockingly (or maybe not) it was even cheaper sometimes, exposing the flaws and lag in Forex rates and how they are used. Bitcoin, as the most liquid, globally transferable asset is already acting as the new world reserve currency with Strike.”

Umbrel is building what may be the most simple way to get your own Bitcoin & Lightning node running on a Raspberry Pi. And they just announced their Umbrel App Store for a seamless integration of BTCPay Server, Sphinx Relay, Lightning Terminal, RTL, ThunderHub, etc.

While Kraken is staffing a dedicated Lightning team, UK Bitcoin exchange CoinCorner now enables Lightning deposits and withdraws, adding more exchange support for “the most decentralized and trustless scaling solution” according to their CEO:

Suredbits announced the execution of a Discreet Log Contract for Difference (DLCFD), a Bitcoin-native solution that could enable, for a given expiry, to deleverage a Bitcoin position in USD without leaving custody of the coins:

A great read to better understand how DLCFDs are constructed:

“A DLC consists of a single on-chain funding transaction, and a set of off-chain transactions called Contract Execution Transactions (CETs). There is a single CET for every possible outcome and the outputs on the CET reflect each party’s payout for that outcome. Each CET spends the on-chain funding transaction’s 2-of-2 multisignature output and the oracle contract is enforced by making this spending contingent on an oracle signature of a specific message unique to that CET. […]

This scheme supports an arbitrary number of outcomes (and hence arbitrary oracle contracts) in theory. However, in practice we need to compress our set of outcomes to a reasonably small number to accommodate communication and computational constraints. […]

Continuous intervals of constant-valued outcomes can be compressed into negligible sizes by having oracles sign each binary digit (aka bit) of the outcome individually. This allows us to ignore the least significant digits to construct transactions that cover many outcomes, for example if the last 10 bits can be ignored (as no matter their value the payout is the same), then we can construct a single transaction which covers 2^10 = 1024 outcomes at once. This means we only need to create, send, and store a single adaptor signature in place of 1024!

Our oracle, Skrik, committed to signing the BTC/USD price as 17 binary digits (supporting all values between $0/BTC and $131,071/BTC).”

Speaking of oracles, Bitfinex announced a pay-as-you-go data purchase solution via the Lightning Network that could certainly be useful for a signed oracle data scheme:

💬 End the FUD with Jean-Claude Trichet

We did not manage to get a short interview of Jean-Claude Trichet, the former president of the European Central Bank and one of the Euro architects.

But he recently gave a masterclass interview on how to fit all the most uninformed critics of Bitcoin in less than 3 minutes. Since bull markets generally tend to trigger these kind of reactions, we tried out concise arguments to debunk them efficiently (that is, without having to pay a visit to the island of Yap..).

“Bitcoin does not represent anything at all, except its scarcity” - JC Trichet

Federal Reserve Bank of St. Louis:

“Bitcoin has no intrinsic value. […] It is not the only currency that has no intrinsic value. State monopoly currencies, such as the U.S. dollar, the euro, and the Swiss franc, have no intrinsic value either. They are fiat currencies created by government decree. The history of state monopoly currencies is a history of wild price swings and failures. This is why decentralized cryptocurrencies are a welcome addition to the existing currency system.”

“It happens to be a speculative instrument like gold, much more than gold.” - JC Trichet

Bitcoin’s volatility is a by-product of its scarcity. When a fixed supply meets a fluctuating aggregate demand, the result is fluctuating prices. Bitcoin is indeed more volatile than gold. But while gold has been used for millennia, Bitcoin is an only 12 years old fully bootstrapped monetary network.

“This is absolutely pure speculation, which is based only on the fact that the players agree to play. They are around their virtual monopoly table and find it fun to have fun with this instrument” - JC Trichet

$750Mio investment in Bitcoin is "primarily a protective move for portfolios" to "act as a hedge" against "some of the risks that we see in a fragile monetary system and distorted financial markets."

“It is extremely serious, instrument used for financing terrorism, organized crime, for all kinds of illegal operations. I find it incredible that we have allowed instruments of this nature to prosper and grow” - JC Trichet

“Cryptocurrency [represent a] “low risk” for money laundering and terrorist financing activities” - FATF

🔮 Good stuff to read

Who needs holidays books when you can just read Lyn Alden? A very (very very) interesting piece on The Fraying of the US Global Currency Reserve System:

A great read by Ben Carman on what Taproot could bring to us: The Future Of Bitcoin Upgrades: Off-Chain Contract Execution.

And an insightful thread on Lightning’s on boarding challenges:

⚡ Bonus

🧑🌾 It ain't much but it's honest work!

😬 Good question

🤑 Good call

🇫🇷 The pride of the French Bitcoin scene

Please feel free to reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!