#21 - February 8th, 2021

⚡ Counterparty risk reduction, False narratives, Ecosystem and much more!

Welcome to the 21th issue of this newsletter which covers everything at the intersection of the Lightning Network and Finance, as well as updates about LN Markets. If you enjoy this content, feel free to spread the word!

Disclaimer: this issue has been written in the pre-Musk buying $1.5bn Bitcoin world

✌️ A new hope: the playbook to drastically reduce counterparty risk in Bitcoin markets

Since we launched LN Markets, our ambition has been to create a new and simple way to trade. In particular, instant funds transfer through payment channels radically change the user experience: no more reasons to let funds on the exchange and to take useless risk of counterparty.

That is the theory. But has our ambition materialised in the real world?

After 10 months of operation, we have been able to observe that the proportion of funds which stay at risk on LN Markets is very low: counterparty risk is drastically reduced!

Let’s compare the funds we hold in custody through Lightning channels versus a pure derivatives trading platform like BitMEX (source). (Ok, we know that we don’t play in the same league, but still!)

BitMEX (Jan 2020): Ratio daily volume (BTC) / cold wallet (BTC) = 1.7

LN Markets (Jan 2021): Ratio daily volume (BTC) / LN Markets “cold wallet” = 7

With LN Markets, the ratio of daily volume on funds in cold wallet is at least reduced by x4!

What’s more, max leverage on LN Markets is half the one of BitMEX, so this factor 4 is largely understated.

And also TOO less-risky! (if that means anything..)

🧐 False narrative: Robinhood & DeFi

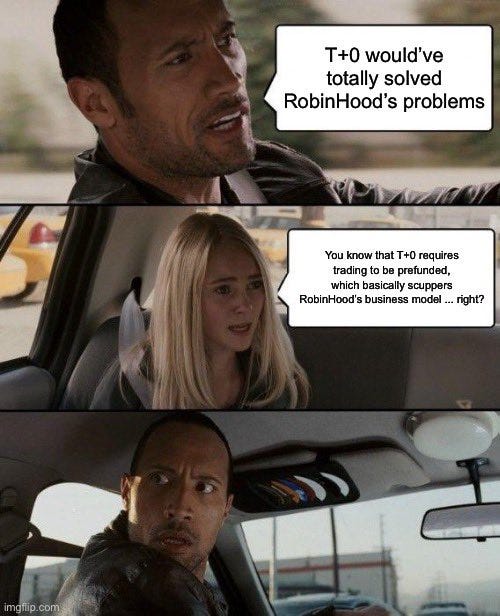

Robinhood’s liquidity crunch last week forced the FinTech to raise $3.4bn because clearing houses demanded billions more to keep clearing its trades. In this thread, Robinhood’s CEO explains why he thinks it is now time for real-time trade settlement:

A lot of people on crypto Twitter have interpreted this as “Robinhood CEO makes the case for DeFi”.

To us, this is a false narrative. Financial institutions could easily move to a T+0 or even real-time settlement. They prefer not to because the status quo is more advantageous to them. As John Paul Koning puts it in his essay on The siren call of T+0, or real-time settlement: “Slow isn't necessarily a bug—it's often a feature. “

“Why not go straight to real-time, or T+0? The move from T+3 to T+2 means one less day over which brokers can 'net out' their respective debits and credits so as to conserve on transactions costs. T+0 means no netting-out window whatsoever—and that would impose a terrific amount of work on the system.”

Financial institutions will not adopt DeFi as the only possible financial architecture that would enable them to speed up their settlement process. It is an industry choice to keep it slow. Put it another way:

The Robinhood story has also been used to show how blocking trades could have never happened with DeFi. On this matter we tend to agree with Hasu, none of this is permissionless (yet):

🌱 Ecosystem

After OkCoin, Kraken and Bitfinex, OKEx is the latest major exchange to integrate Lightning.

Lightning Labs has announced the beta release of LND v0.12 including anchor output channels (which allow for fee bumping the commitment transaction if a channel is force closed), a speed up in Lightning graph synchronization and node startup times, automatic database compaction, and a sneek peek of Lightning Pool’s front-end:

Polar, so useful for Lightning development and testing, has released its v1.2.0 which now supports the latest LN nodes implementations.

Arcane Crypto has announced Teslacoil, a software for business which enable them to accept payments from across the globe, and end up with their local currency in their bank account. Teslacoil is built on the Lightning Network to ensure payments settlement orders of magnitude faster than in the traditional payments world, without chargeback risk. Teslacoil is being rolled out to a selection of pilot customers for the moment.

Brad Koeppen from CMT Digital and Ryan Gentry from Lightning Labs have written a very interesting piece “Bitcoin: Be Your Own Prime” on how the traditional prime brokerage model can be built in a complete different way, more secure and less centralized, just relying on the Bitcoin and Lightning stack:

“In the long term, traders should wean themselves off of prime brokerage to eliminate counterparty risk, keep costs low, and avoid complicating their operations.”

💯 Much agreed, that’s exactly what we are trying to build with LN Markets and LN Clear!

Another successful Lightning auction by scarce.city, this time for a Bitcoin full node sculpture, with a winning bid by Jeff aka @SatoshisArk for 172 million sats!

And finally, thanks to Zebedee, Bitcoin-powered Counter Strike is now a reality!

🔮 Good stuff to read & listen to

A highly intellectually stimulating debate between Nic Carter and Mike Green of Logica Funds, mostly focusing on the macro-economics and geopolitics of Bitcoin:

Here is a great intro to why Bitcoin matters as a reserve asset for corporations, by Ross Stevens, founder and CEO of Stone Ridge and founder and Executive Chairman of NYDIG. In Chapter 1 - “Bitcoin-the-asset” - Ross covers why central banks can no longer take sound monetary decisions, the sole purpose of money (“a technology for making our wealth today available for consumption tomorrow”), and why Bitcoin is the current best money available (with its salability across time and space):

In Chapter 2 - “Bitcoin-the-network”, Ross explains how for the first time we have an electronic bearer asset called bitcoin and an electronic money network, also called bitcoin, that together can achieve cash finality anywhere in the world anytime 24/7/365. A very powerful talk.

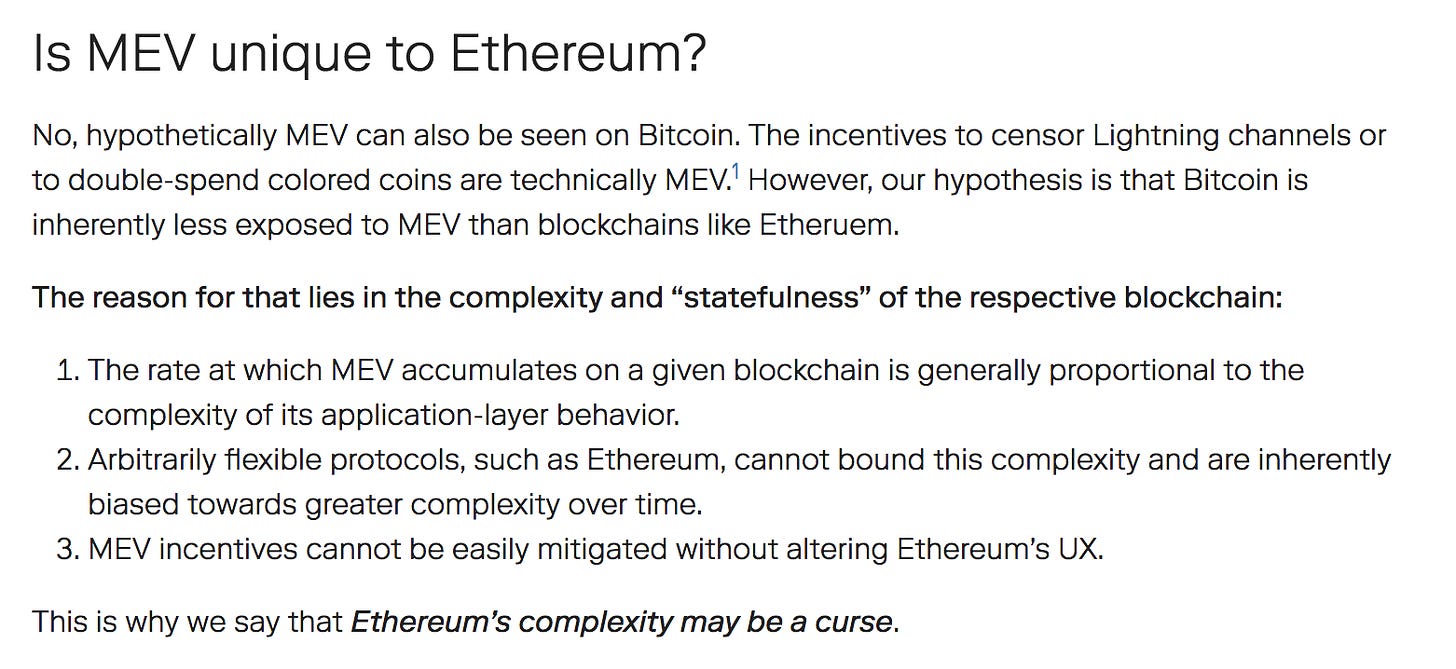

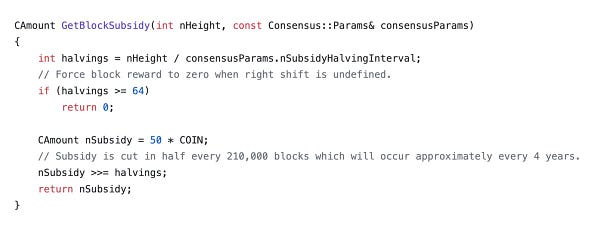

A very enjoyable read on a complex topic! Charlie Noyes dissects Miner Extractable Value (defined as the “measure of the profit a miner (or validator, sequencer, etc.) can make through their ability to arbitrarily include, exclude, or re-order transactions within the blocks they produce”) and its possible implications for Ethereum.

Charlie thinks that it’s unlikely that MEV would affect Bitcoin:

"If the Lightning Network created untenable MEV on Bitcoin [...] we could remove the opcodes needed to create payment channels from Bitcoin’s limited ruleset (Script) in a relatively straightforward way."

And an insightful read by Deribit on how Stratum v2 protocol will strengthen Bitcoin’s decentralization.

⚡ Bonus

☂️ We had a good laugh on this one, well done!

🖌️ Woh is this a real Monet NFT? (Btw fascinating to see that Hal Finney foresaw the rise of collectibles in 1993..)

☮️ And no, we certainly won’t fight you on this one Meltem:

Please feel free to reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!