#23 - OKCoin, Anton - 2 builders in the LN space

⚡ Everything at the intersection of the Lightning Network & Finance

If you enjoy this content, feel free to spread the word!

🚀 OKCoin goes full Lightning

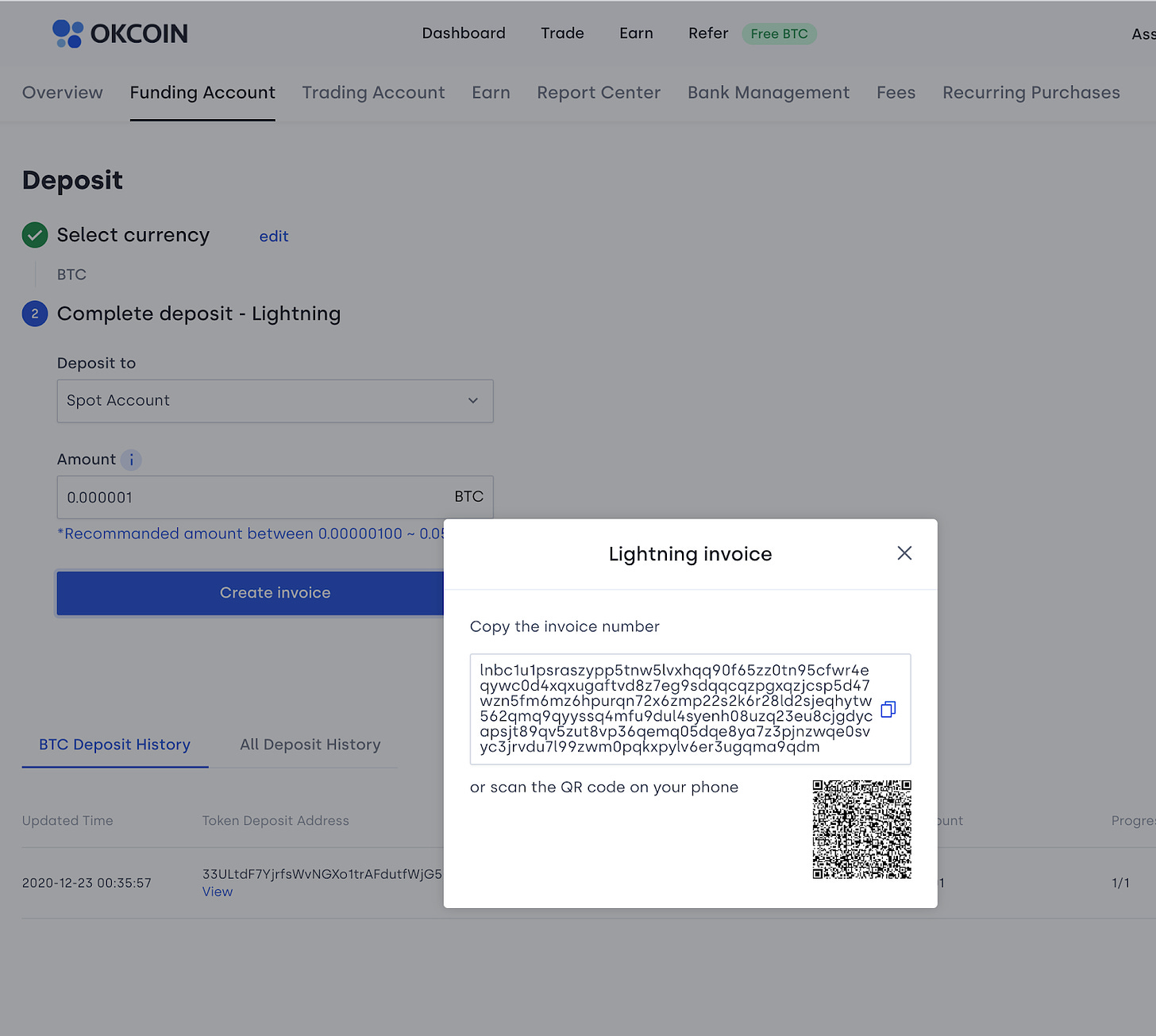

OKCoin has now officially implemented Lightning! Here comes instant deposits/withdrawals and bitcoin network fees reduction to pennies. Jason Lau, OKCoin COO, was kind enough to guide us through the rationale behind this integration.

Why has OKCoin decided to add support to the Lightning Network?

Jason Lau: There are two things that we’re passionate about - our users and bitcoin. For us, supporting Lightning was a great way to check both boxes.

As an exchange offering users an easy way to move between USD and EUR to bitcoin (and 25 other assets), we wanted to make sure users had the choice between on-chain bitcoin transfers and instant, cheap Lightning transfers.

With bitcoin’s price rise, on-chain transactions fees have also gotten a bit pricier (doubled in 2021), and we felt the time was right to offer users an alternative method to move in and out of the exchange.

Another aspect was to play our role in supporting the expansion of the Bitcoin ecosystem.

We see huge potential in Lightning and its ability to bring new use cases and open new audiences to bitcoin. To do that, more of the existing ecosystem needs to add Lightning support. While we are humbly following the lead of other industry leaders, we do hope that our move inspires others to add support and help show the way.

Did you meet any challenges (from a technical or business perspective) in the integration of the Lightning Network? If yes, how did you solve them?

Jason Lau: We have been monitoring Lightning for a while now, watching its development and adoption. So we weren’t starting from zero. However a few challenges do come to mind - how to prioritize development, how to roll it out, and overcome some of the technical hurdles.

On prioritization, given that the ecosystem is still growing, we weren’t sure how many existing users would use it, or even be able to use it. The data just wasn’t quite there.

On the roll out and technical side, it took us about 6 weeks to get it all together.

And we received a lot of help from the broader community. The Lightning Labs team was amazing, and others like Bitfinex, Blue Wallet, Muun Wallet, BitRefill, and more all lent us great feedback. It was also easier to have seen some of the implementations out there, and the lessons learned from those.

Ultimately, we’re passionate about Bitcoin and we just had to take the plunge and see how things go. It’s been a week since launch, and we’ve seen an enthusiastic response from our users and the community. That said, we’re still learning and will continue to devote resources to improve the Lightning experience.

Lightning could enable the rise of a new low latency and cost efficient inter-settlement network for exchanges. This would imply channels to be fully collateralized by all counterparties ahead of time. Do you think other exchanges are ready to move in that direction?

Jason Lau: First of all, we’ve been grateful for all the support from the community, especially from other exchanges.

One idea that has been floated is large dedicated channels to facilitate inter exchange flows. This is something that we’d love to see.

Once we gain more customer data, more liquidity, and experience in managing channels, we’ll be sure to revisit this with some of our counterparts.

How do you plan to support the development of the ecosystem?

Jason Lau: We announced our latest open source developer grant on March 4 - this time sponsoring Antoine Riard, a lightning developer. For the next 12 months, he’ll be supported by our grant to do the work that he loves - which is to improve Lightning’s security and adoption. I’d encourage anyone interested to learn more about Antoine and his work here and to attend our reddit AMA session this Thursday.

In addition, we will continue to work with the community to encourage adoption and establish deeper liquidity to wallets, exchanges and Lapps. Stay tuned!

What is your view on the future evolution of the Lightning Network?

Jason Lau: Bitcoin as a store of value is a near complete product, but Bitcoin as a financial network is just getting started - and we think Lightning has a big role to play there.

Whether it’s micro-earnings and micropayments, or remittances, or just gaining bitcoin exposure, Lightning’s going to make a real difference in the lives of real people, particularly in emerging markets where there are still large percentages of unbanked. I’m also personally interested to see how Lightning could bring machines (internet of things) into the world of bitcoin and permissionless finance.

🌟 Anton, the “one-man army”

Anton is the legendary Lightning builder behind BLW, in our view one of the most user-friendly wallets to date. Anton is now focused on building a new Lightning implementation, Immortan, which could power the first routing mobile wallet!

We are fans of Anton’s work, and thankful that he agreed to share more details on his work.

Hi Anton, we first heard from you as “Anton the beast” or “the one-man army”. Can you tell us a bit about your background and what has led you to Bitcoin and the Lightning Network?

Anton: Initially it started with a desire to learn programming proper by doing some real project, a bit later I've also got fascinated with Bitcoin so developing a wallet seemed like the best way to get there.

What are the key takeaways of building BLW?

Anton: For sure it has been an educative experience. Currently BLW is a mobile wallet which does non-routing private channels and at this point I consider this approach a mistake.

The reason why is that effectively only wallet owner is able to move funds in and out of such wallets by making LN payments, a peer on the other side of channel can not get its balance out in any other way but closing a channel altogether and obtaining those funds on chain. This economic issue constantly leads to bad user experiences and more channel force-closes than necessary.

The good news is that recently a new and exciting idea has popped up in LN dev space which is called trampoline routing, generally it tries to address hard and real problems such as effective graph management and minimization of liquidity issues while routing payments.

When in comes to private channels in particular, trampoline technique finally allows them to be used for routing while retaining mobile wallet privacy and even allowing wallet owners to earn routing fees, increase overall network liquidity and reduce the number of unnecessary channel closes.

Adding trampoline support to BLW is my number one goal at the moment.

You are now focused on building a new Lightning implementation, Immortan. What is Immortan and why have you decided to build it?

Anton: I believe there is a place for specialization when it comes to LN node software: up until now the most attention was given to full nodes which typically run on servers and have public channels while being backed by full Bitcoin nodes.

Lite, resource-contrained mobile nodes with private channels were always an afterthought, while a lot of important stuff could be done differently to better suite their needs.

So this is what Immortan is all about: it aims to power lite nodes and does a lot of specific optimizations to allow for the best mobile wallet experience possible.

Whats the next UX improvement for lightning ?

Anton: Better wallet privacy and higher payment delivery rates, all thanks to adoption of trampoline routing.

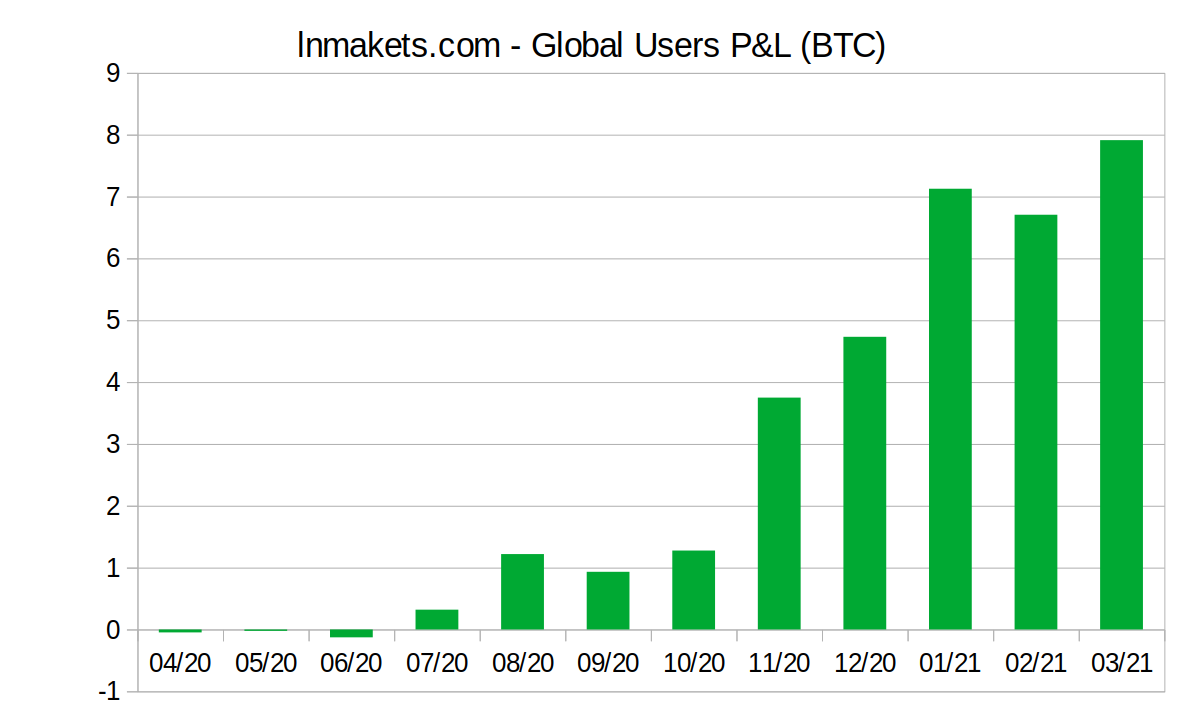

🐳 The new sat bourgeoisie

Hats off to all of our users on LN Markets, spread around 70+ countries throughout the globe! Collectively, you have amassed a net P&L of 800 million sats 🤑🤑🤑

But of course, we know that most of you are in it for the tech anyway!

🌱 Ecosystem

Strong words from Kjell Inge Røkke, chairman of Aker ASA (3rd largest energy company of Norway):

“On a personal note, I am frequently frustrated that I give away usernames, passwords, locations, credit card details and other information to read newspapers or watch movies. I’m fascinated by the prospect of bitcoin Lightning wallets that may enable instant credit via micropayments without the need to offer personal information that my counterpart can monetise without approval or compensation.

So if you insist on being anonymous, doesn’t that mean you are hiding from the law? Of course not. To the contrary, I believe Bitcoin holds the promise of much more sophisticated KYC (know your customer) and AML (anti money laundering) procedures that enables access when there is legal grounds but keeps everything anonymous in all other circumstances. After all, the legacy bank systems are themselves arcane, complex, and vulnerable, which means there is room for innovation.”

River Financial is doing an impressive job building a state-of-the-art Bitcoin-only exchange. Congrats to the team on their $12M Series A funding round!

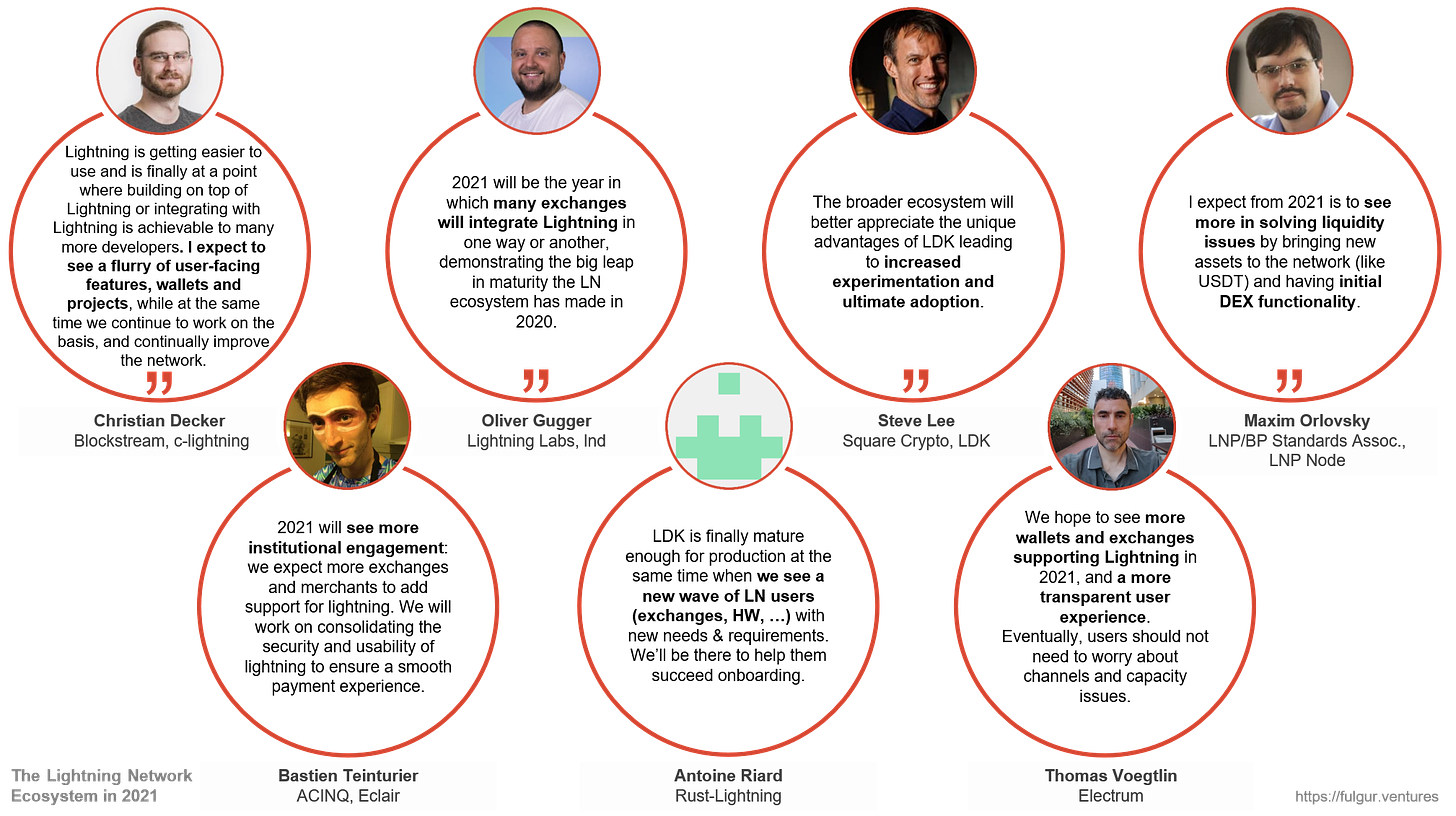

Fantastic piece of research on Lightning Network implementations by Fulgur Ventures here. Bonus: what to expect from 2021 by LN experts:

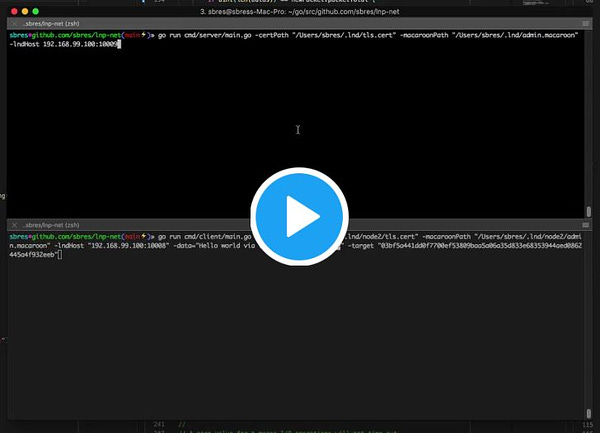

A Bloomberg chat-like coming to Lightning? Impressive work in progress here:

#LightningHacksprint: LN developers out there - save the date for the next weekend of improving LN, on March 27th/28th, organized by our friends at Fulmo!

How to open batch channels from your cold storage: a very interesting step-by-step guide, which leverages LND 0.12 to fund single or multiple channels using a hardware wallet. Quite useful in the current high fee environment!

🎙️ Lightning native podcast

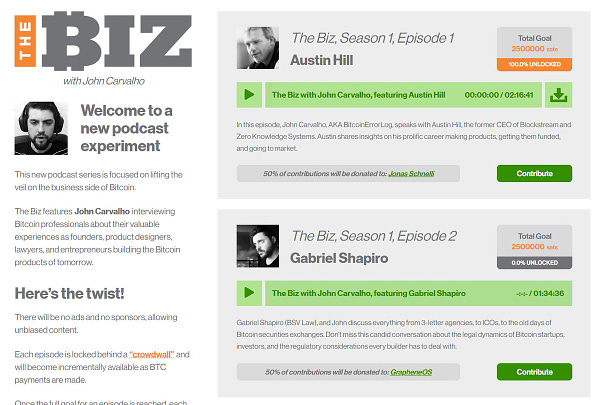

John Carvalho has just launched a new podcast series called The Biz which introduces an innovative pricing model based on Lightning: a crowdwall.

Anyone can pay any amount, and when the total funding goal is reached, the podcast is unlocked for everyone. No ads, no sponsors, and 50% of proceeds are donated to a cause chosen by each guest:

Fascinating to see such new monetization models emerge!

⚡ Bonus

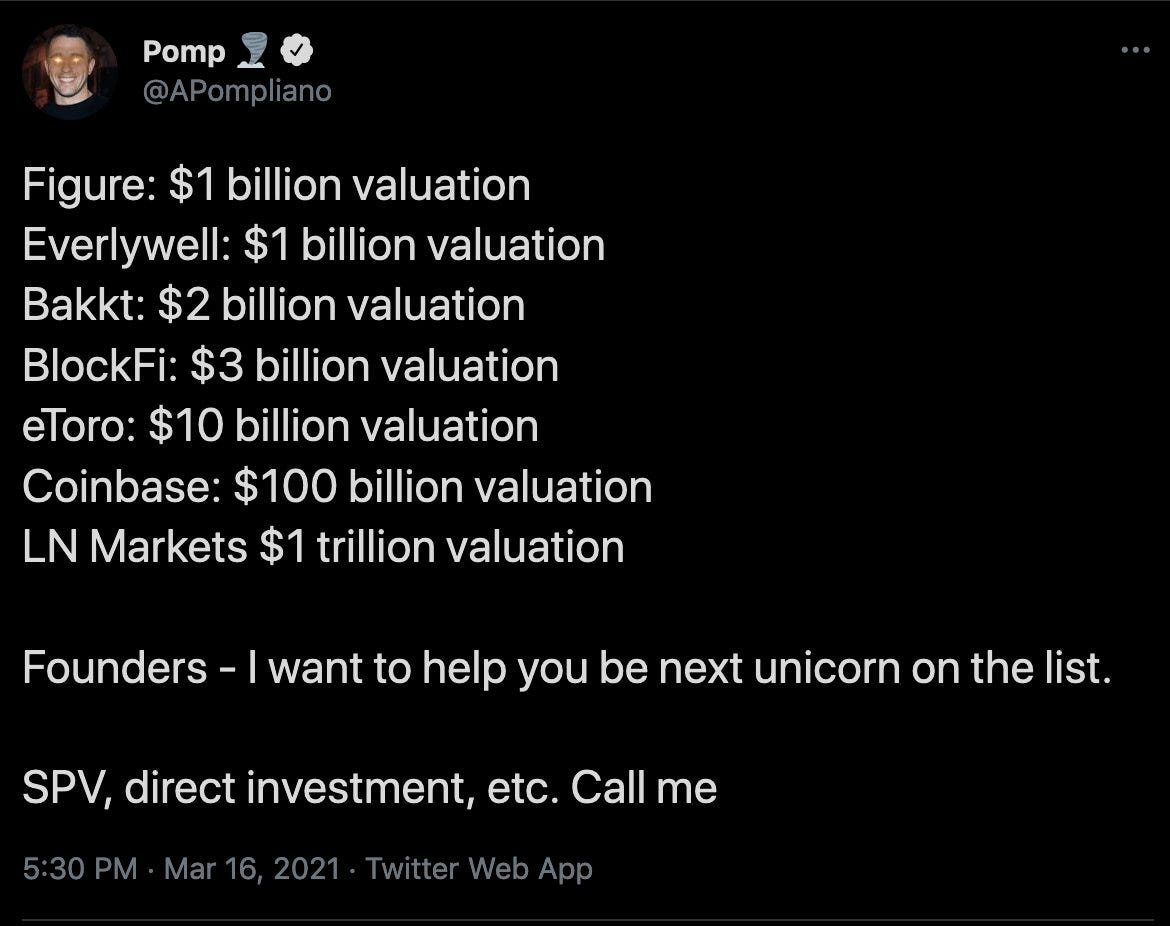

💎 Thanks for the shoutout Pomp!

🧐 A fairly accurate description of crypto markets dynamics

🤔 An informative (and hilarious) thread on a new coin called USD

Please feel free to reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!