#25 - Taproot, Lightning footprint, Bitcoin culture and much more!

⚡ Everything at the intersection of the Lightning Network & Finance

If you enjoy this content, feel free to spread the word!

🟩 Taproot & Lightning with Giacomo Zucco

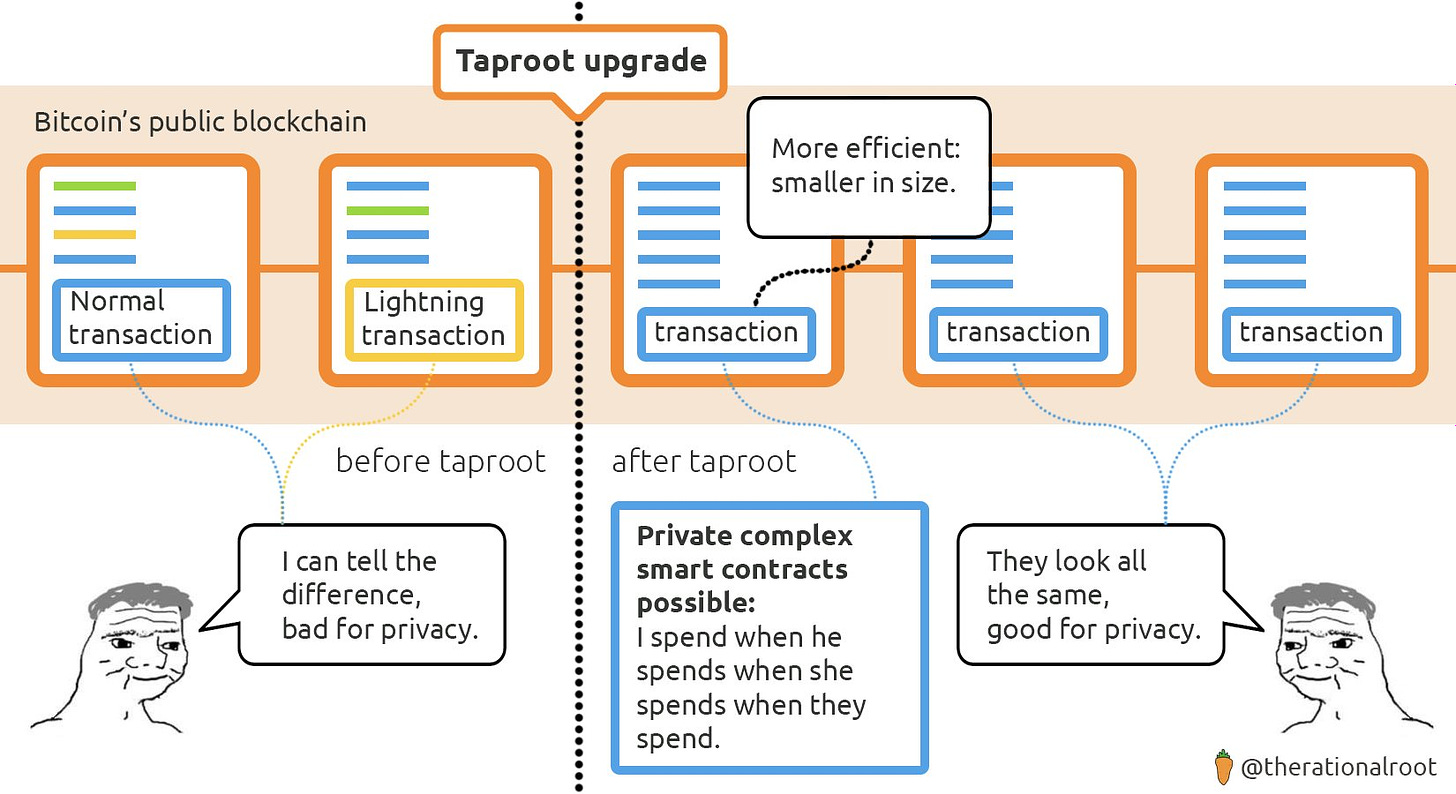

Taproot is the most important Bitcoin upgrade since SegWit in 2017. If the upgrade process goes smoothly, we will have by November more fungible and private Bitcoin transactions. Bitcoin Magazine has published a great explainer on Taproot. And here is a shorter pedagogical meme thread:

What could be the impact of Taproot for the Lightning Network? Bitcoin consultant and Educator Giacomo Zucco has been kind enough to enlighten us 🙏

After the Bitcoin Taproot upgrade, what benefits can we expect for the Lightning Network?

Giacomo Zucco: The main benefit we can expect is decrease in privacy leaks and block space costs for closing lightning network channels. Right now opening a Lightning Network channel is just a normal Bitcoin output. But closing it actually requires to expose the multi-sig + HTLC contract.

While after Taproot a cooperative channel closing, which is the most frequent kind of closing, will just look like a normal single-sig Taproot transaction.

This will certainly decrease the size of the closing transaction, making it relatively less expensive. And it will also increase its privacy, but only its privacy in relation to the anonymity set of the new kind of Taproot transaction. So, for the very first phase of this change, a Lightning channel opening and closing with Taproot will stand out even more, because nobody will be using Taproot at the beginning, so the anonymity set will be very small. But when it increases, it will include both normal single signature on-chain transfers and multi-sig cooperative situations (possibly including Lightning Network channel closings) that will look just the same.

Of course, this is easier said than done, because people will have to redesign the Lightning Network standards in order to be expressible as a Taproot script. So it’s not something that we will get automatically after the activation. There will be a lot of work in redesign and in actual development of the Lightning implementations, wallets, tooling, and everything else that is needed.

How can Taproot enable Discreet Log Contracts for Lightning Payment channels?

Giacomo Zucco: Discreet Log Contracts are possible right now with ECDSA, but Schnorr signatures and Taproot will make them more flexible and possibly also more private in their resolution, so it will be an improvement in that regard.

But it’s partly orthogonal. What you need for Discreet Log Contracts is not just a new kind of cryptography on-chain, but you also need a lot of oracle infrastructure, you need an incentive mechanism for oracles, you need interaction tools in wallets, so there is still a lot of work to be done on DLCs.

With Schnorr signatures, can we expect the development of channel factories to accelerate?

Giacomo Zucco: Yes, there are a few things that may be improved by Taproot.

Even if probably most of the evolution in this kind of development in channel creation will actually come from another future possible soft fork, the one introducing the new SIGHASH needed for Eltoo style of constructions.

What is your current work focused on? What excites you the most about the future of Bitcoin & Lightning?

Giacomo Zucco: My work right now is mostly focused on Bitcoin custody for institutional clients, mostly in Switzerland. That’s my main job. But I use part of my time to sponsor, coordinate and help in different kind of ways some open source non-profit efforts:

One is the BDK project by Alexos Filini, which aims to build a collection of tools and libraries that are designed to be a solid foundation for cross platform Bitcoin wallets, along with a fully working reference implementation wallet called Magical Bitcoin 🧙

The second one is the RGB project about experimenting client-side validation, the idea by Peter Todd, with the development of these asset protocols sponsored by Bitfinex, Fulgur Ventures and Poseidon group in the past.

Also, I’m still trying to find ways to support other kind of notarization standards like OpenTimestamps, by Riccardo Casatta and Peter Todd, and Proof Marshals.

And there are a few other things that I’m sponsoring here and there in terms of protocol standardization like the universal address format and other kind of efforts, but mostly I’m focused on custody.

About Lightning, I think that what is more exciting right now will be not really a change in protocol, but a change in tooling.

Right now your Lightning wallet is very clumsy because you have a new on-chain part, then you have all these channel logic and then on top of that you have to actually do the transactions. But in the future I imagine a smart wallet being able to request a payment and the other smart wallets being able to decide in real time to try a payment in the channel if there is a channel, otherwise to try routing if there is routing. But if the waiting time and the cost of routing would exceed an on-chain transaction cost and waiting time, then it would just initiate in real-time, without asking anything to the user, the creation of a new channel with the payee. And the payee would just receive a payment (for now a partially-trusted payment) inside the newly created channel, instead of just sending an on-chain transaction without the channel. So the network would improve automatically without any kind of manual channel creation.

And then I also look forward to seeing these logic interacting with other kinds of on-chain optimizations. Like what your wallet would decide to do with coin selection, with privacy related coin control and all these other stuffs. There may be a privacy-oriented wallet that creates and closes lightning channels within PayJoins, which would be very exciting.

📊 LN Markets’ Node Activity

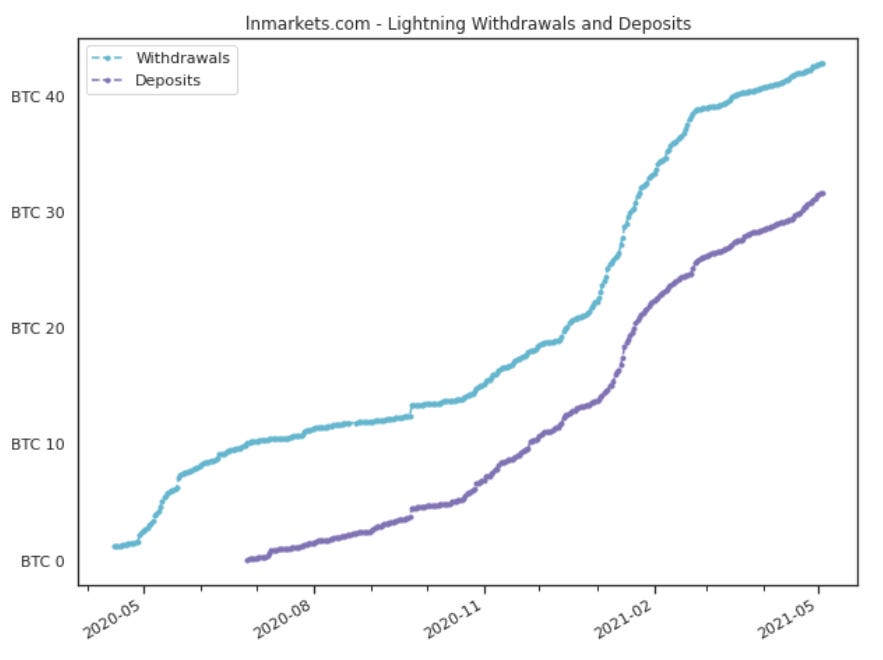

Inspired by the excellent Lightning Chronicles article, we have crunched some data to check our lightning footprint. Please note that the following metrics only concern public channels, while a sizeable share of our activity goes through private channels.

Transactions

There are two types of Lightning transactions with LN Markets’ node: withdrawals and deposits - added to the platform in July 2020. Over our first year of activity, we have processed (with trading limit set at 0.01 BTC):

32,000 Lightning withdrawals and deposits

for a total of 75 BTC

with an average transaction size of 231,000 sats = $132

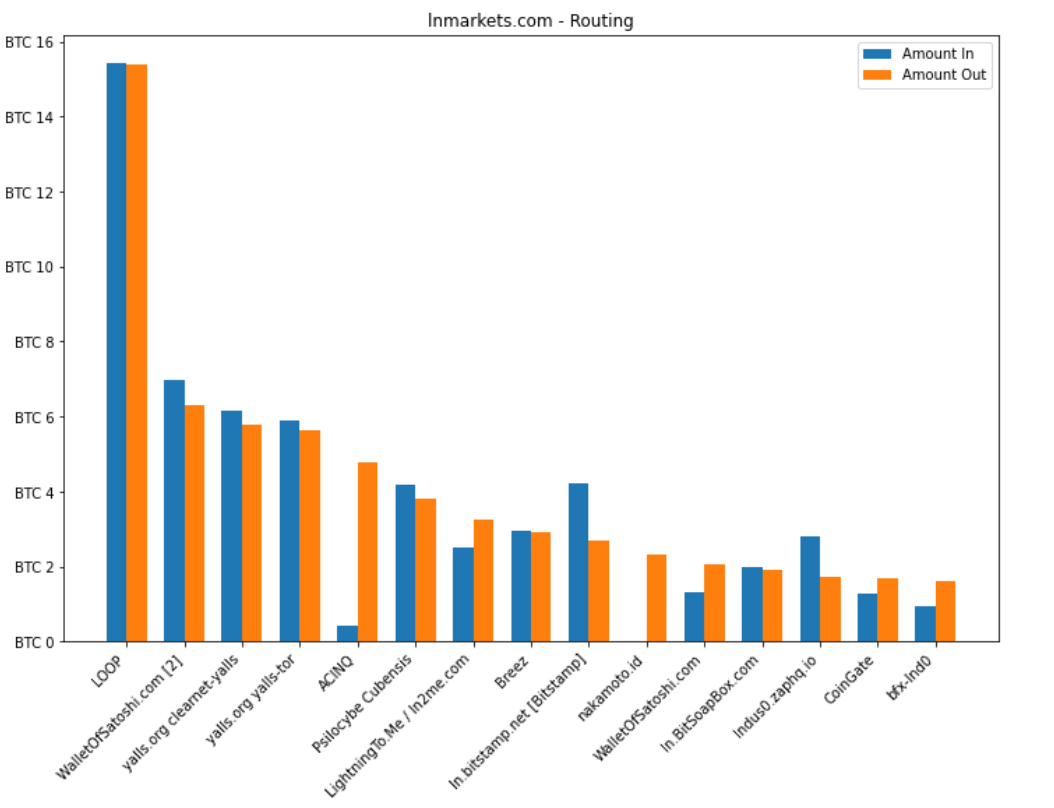

Routing

Along with the strong growth of the Lightning Network over the past year, the payments we have forwarded have steadily increased both in numbers and volume:

45,000 payments forwarded

for a total of 105 BTC

and routing fees of 350,000 sats (yes, we have very affordable/sub-optimal routing fee policy)

Our best routing partner is LOOP by far! It is interesting to note that these payments are fairly balanced, with very little re-balancing cost on our end:

Fascinating to be part of the strong growth of the first instant & trust less payment network!

🌱 Ecosystem

Lisa Neigut from Blockstream has announced the first “dual-funded channel” implemented with c-lightning protocol. In a dual-funded channel, both parties can add funds the funding transaction and the resulting channel balance is split between both nodes. And it is a big deal!

Because dual-funded channels can directly send payments in both directions. Both users will be able to send and receive sats immediately after a channel is opened. It should also improve the overall economics of the Lightning Network.

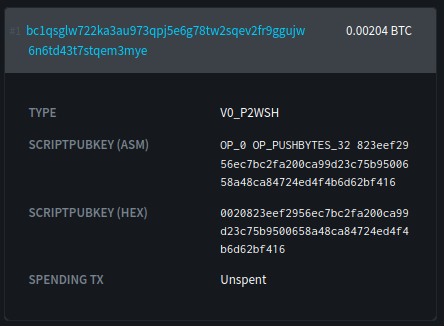

You can see a dual-funded channel opening in block 681,753 in this Bitcoin transaction:

You can watch this webinar held by Lisa for more details and try it yourself with latest version of c-lightning! (more details here)

✌️ Bitcoin Culture

Inspiring read from American pro-surfer Bethany Hamilton on how she got into Bitcoin, found out about the Bitcoin Beach in El Salvador and the tragic faith of local surfer Katherine Diaz.

As Miles Suter puts it:

Bitcoin Beach is a first of its kind global experiment, attempting to kickstart a circular bitcoin economy in the name of financial inclusion and economic empowerment within a small community on the coast of El Salvador.

On top of supporting local families, Bitcoin Beach funded the El Salvadoran surf team to go to the Olympics this year. But the frontier from fairy tale to tragedy can be very thin. The same day, Katherine Diaz who just signed her first ever sponsorship deal was tragically killed as she exited the water.

To honor her memory, Bitcoin Beach has launched a fundraising campaign to open a one-of-a-kind surf center. Feel free to learn more and donate here 🙏

⚡ Bonus

🙌 We feel you Alex!

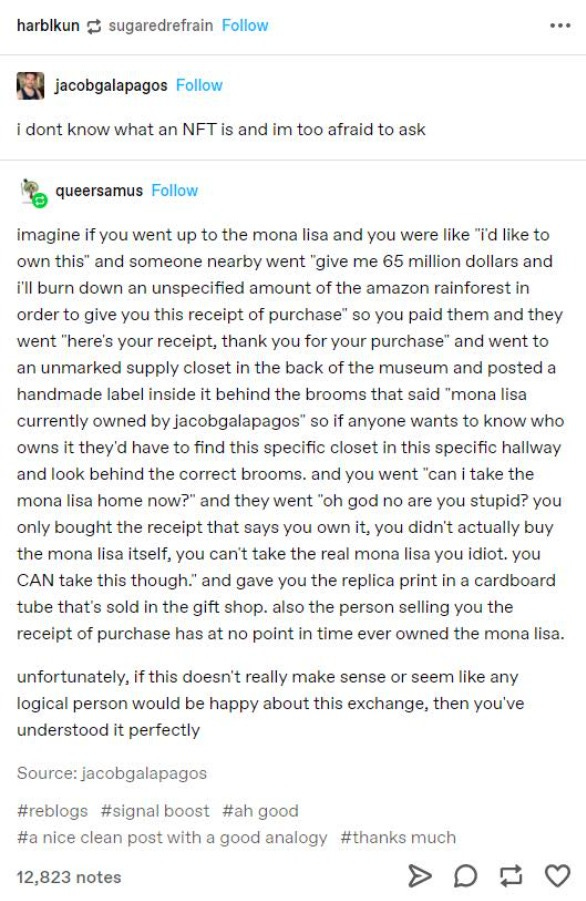

📖 The internet doing the work for the Cambridge dictionary

👀 Look ahead! Best advice for both surfing & Bitcoin

You can reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!