#28 - $200 million, Building, Bitcoin Finance and much more!

⚡ Everything at the intersection of Bitcoin & Finance

⚒️ Building

Your response to LN Markets’ latest major release has been amazing, thank you all 🙏

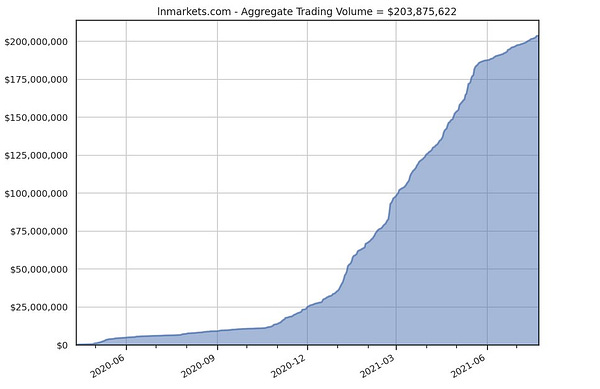

As the Lightning Network capacity surpasses 2,000 BTC, we have also hit a new milestone: $200 million in aggregate trading volume since our launch last March 2020:

The API url has changed and new API doc is available here (the old one will be deprecated at the end of the summer). We have updated our python and node.js tutorials and will release API connectors for seamless algorithmic Lightning trading.

We have cool new features coming soon and to meet popular demand, an App Store integration you might like! (a hint ☂️).

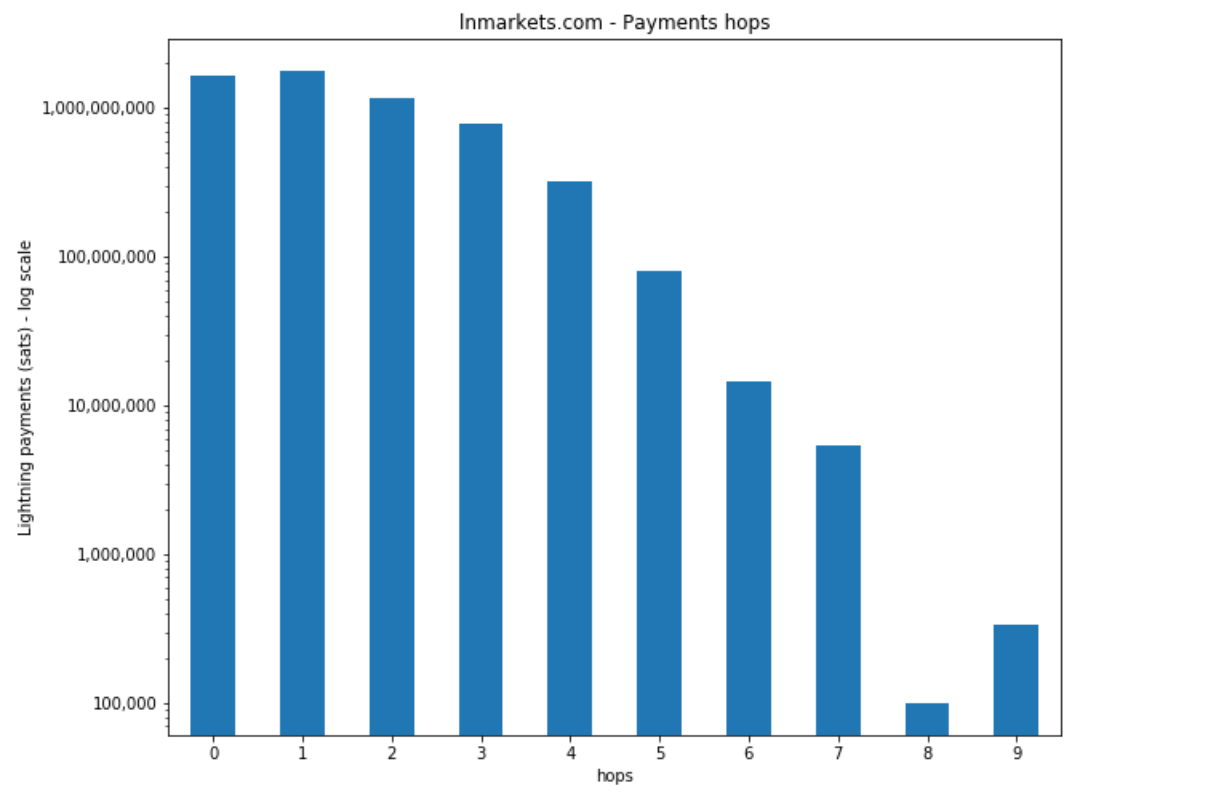

Fun to see payments routing in action for LN Markets: Bitcoin P&L withdrawals with up to 9 hops!

As always, please feel free to share any ideas or new features you would like to see on LN Markets on Twitter & Telegram!

🤓 Bitcoin Finance - Part 2

While Bitcoin is true decentralized finance, new services are emerging to provide Bitcoin-based trust-minimized financial uses cases. Let’s use the term “Bitcoin Finance” to refer to these solutions. They can be built on Bitcoin’s Layer 1, Layer 2 or on sidechains, with varying trust assumptions.

After providing in our previous issue an overview of some Bitcoin Finance projects already live or being developed on top of Bitcoin’s Layer 1 & Layer 2, let’s explore an additional Bitcoin Finance project on Layer 1 before moving to sidechains.

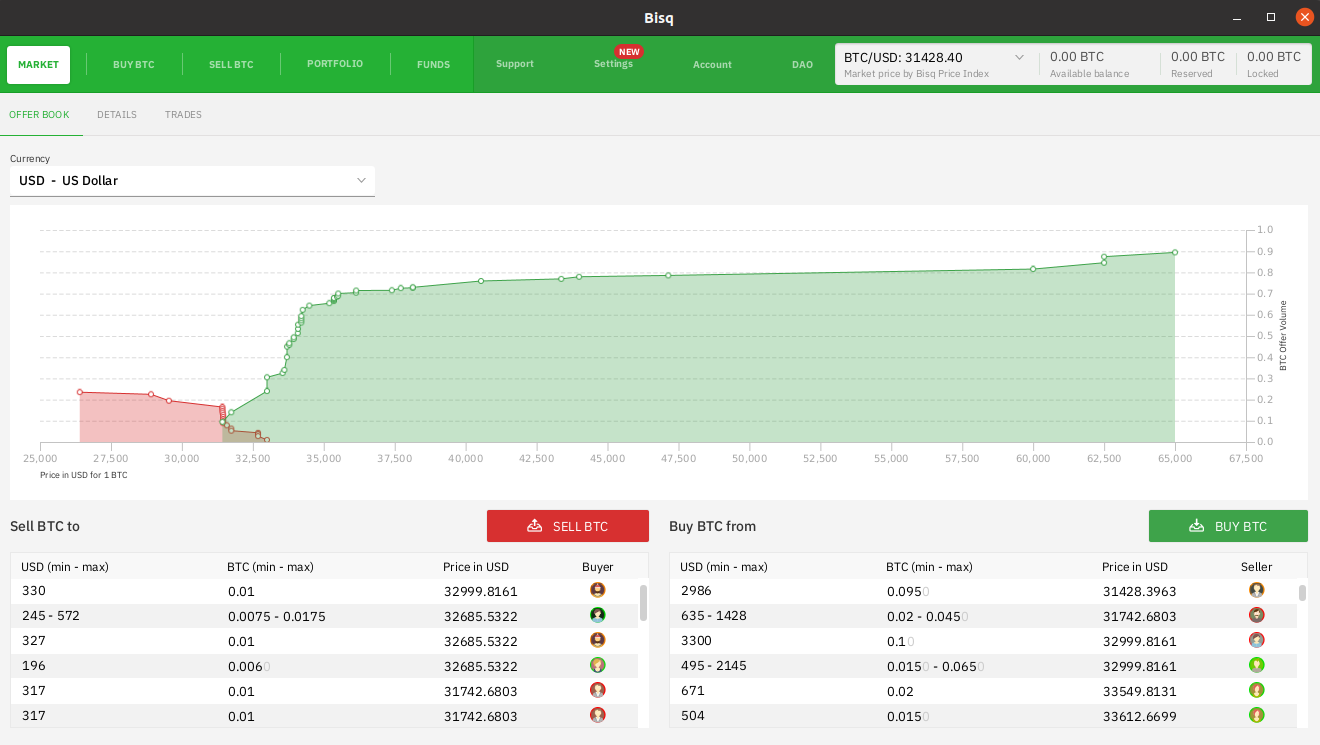

Bisq

Bisq is not a centralized exchange, but an open-source software you can run on your own hardware to access a peer-to-peer trading network. Since its launch in production in 2016, anyone can trade Bitcoin for fiat currencies and other cryptocurrencies in a non-custodial way: Bisq neither holds bitcoin nor fiat currencies. All bitcoin used for trading is held in 2-of-2 multi-signature addresses controlled solely by the trading peers themselves. National currency is transferred directly from one trader to the other using traditional banking and payment services. All data is transferred over its own P2P network, built on top of Tor.

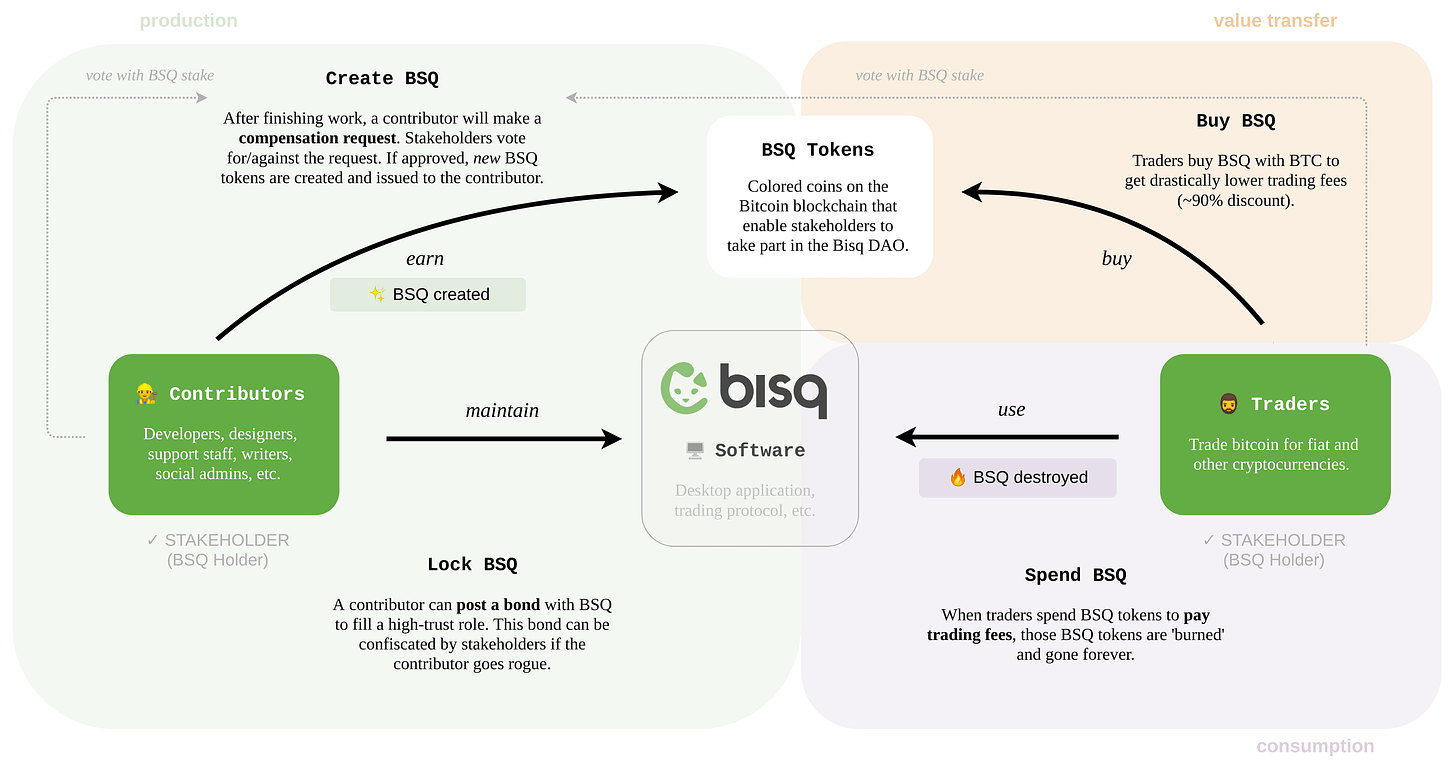

Bisq is not a company but a DAO built on top of Bitcoin organised around the BSQ token, a coloured coin issued on Bitcoin (not associated with any kind of ICO or capital-raising initiative). Here is how the Bisq DAO works:

For example, anyone could propose to become a mediator in case two counterparties have issues completing their trades. Once a proposal to become a mediator is approved by DAO voting, the mediator must lock a 10,000 BSQ bond to become active. If the mediator performs his duties properly, he will earn newly-minted BSQ, else the bond can be confiscated by DAO voting in extreme circumstances.

According to the stats page, there have been ~17,000 downloads of Bisq’s latest release, with around 100,000 trades per month.

Bitcoin Finance on Sidechains

A sidechain is a side blockchain that is linked to another blockchain, referred to as the main chain, via a two-way peg - a cryptographic mechanism to enable digital assets to move back and forth from the main chain. There are several Bitcoin sidechains such as Liquid, RSK, Stacks, etc. Their design varies depending on what they are built for.

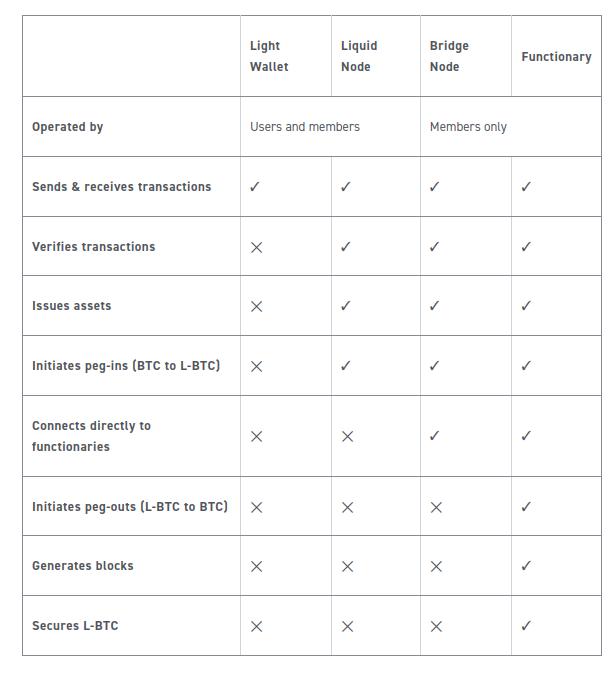

Let’s take the example of the Liquid network, designed for traders and exchanges. Its stated goal is to provide confidential, fast and final settlements: around 2 minutes for Liquid Bitcoin (L-BTC) and to enable the issuance of tokenized assets on top of it.

There is a 2-way peg between Liquid and Bitcoin. To join the Liquid network, users must peg-in their Bitcoins, sending their BTC to a specific peg-in address. After 102 blocks confirmations (~17 hours on average), users can claim the equivalent quantity of Liquid Bitcoin (L-BTC) that can be used on the Liquid network. To exit Liquid, users create a peg-out transaction in the Liquid transactions, which will be processed in between 11 to 35 minutes.

Functionaries validate blocks - each block needs to be signed by at least two-thirds of the functionaries - and manage and secure the BTCs held by the federation on Bitcoin blockchain:

This is a sidechain trade-off: instead of being extremely robust and secured by proof-of-work like Bitcoin, Liquid consensus is federated and relies on a set of trusted functionaries, primarily crypto financial institutions.

The big difference between layer 2 solutions and sidechains is that layer-2 solutions generally rely on the security on the main chain, while a sidechain has its own security properties. While layer 2 solutions should be trustless, sidechains require trust.

Hodl Hodl

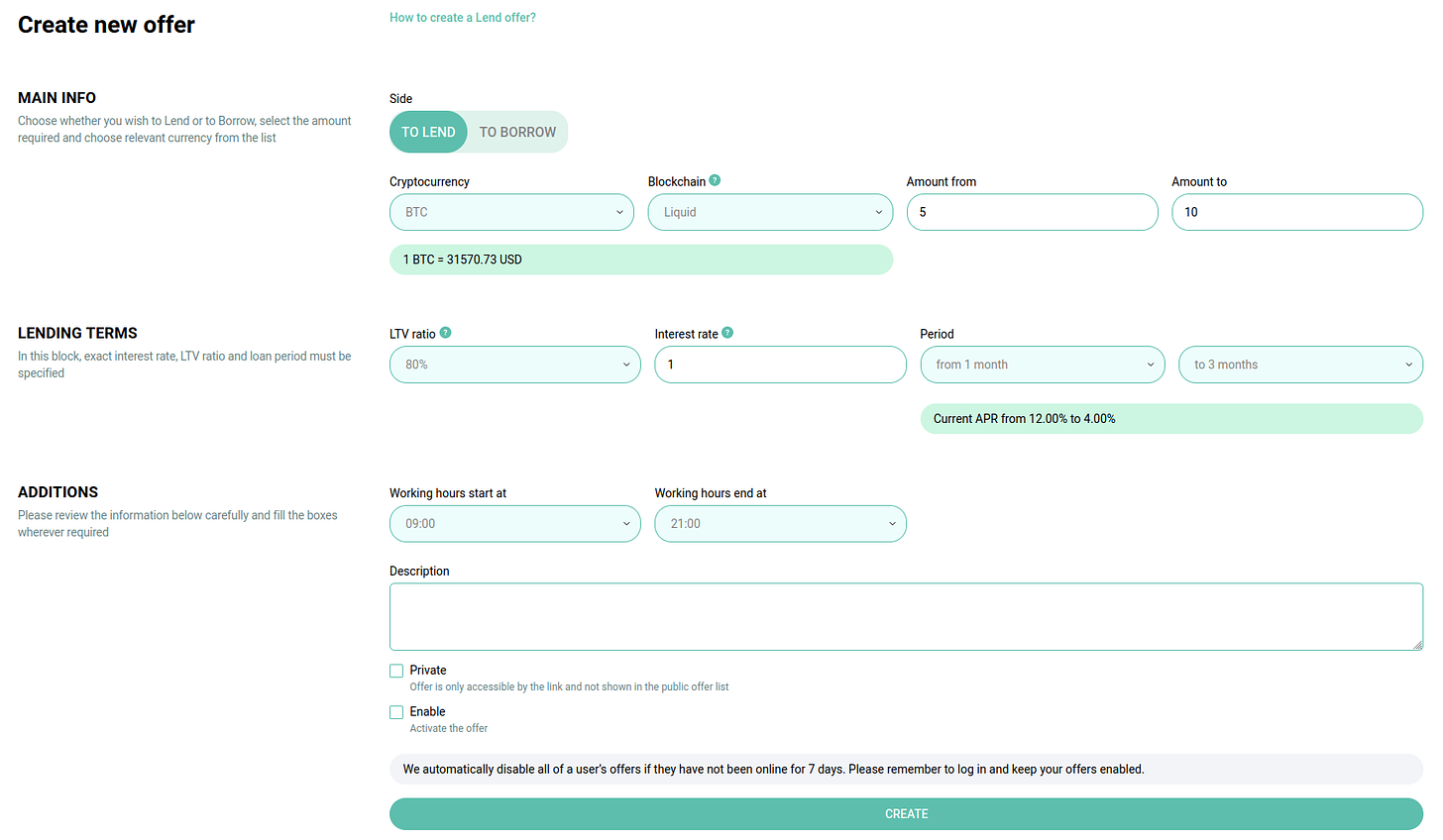

Let’s now dive in into an example Bitcoin Finance solution built on top of Liquid: Hodl Hodl. Hodl Hodl first launched as a Layer 1 P2P Bitcoin trading platform. Each time a contract is created between two parties, Hodl Hodl generates a multisig escrow Bitcoin address. The seller sends Bitcoin to this account, and when the Bitcoin is locked in escrow, the buyer sends fiat to the seller. The seller then releases the locked Bitcoin from escrow using his payment password, and the buyer receives them into his wallet. Following the same logic but this time on Liquid, the team has launched a non-custodial lending/borrowing platform for L-BTC and issued assets: Lend at Hodl Hodl

The team recently announced a new investment from Bitfinex, which would provide more liquidity for lending, along with other institutional investors. As of June 21, 800 loans had been issued worth over $10 million in total.

Sovryn

Sovryn is a smart contract based system for Bitcoin trading built on RootStock (RSK), a Bitcoin sidechain compatible with Ethereum’s Virtual Machine (EVM). One of its goal could be to bring DeFi “a la Ethereum” to the Bitcoin ecosystem.

Sovryn launched in December 2020, and has raised a total of $16mio in investment and token sale. Anthony Pompliano has recently led a syndicate to invest in the Sovryn’s governance token (SOV) for a total of $10mio. As Pomp puts it: “While some people want to bring bitcoin to Ethereum via tBTC or WBTC, I have been a big believer that decentralized infrastructure will get built on top of, and around, bitcoin.”

Sovryn’s trading platform functionalities include:

Spot exchange: direct purchase of SOV against rBTC on RSK (the team recommends Liquality wallet) and Automated Market Making for swaps between tokens listed on RSK (rBTC, rUSDT, SOV, ETHs, BNBs, etc.)

Margin trading with up to x5 long/short trades borrowed from the lending pool

Lending, borrowing and yield farming with liquidity pools

Sovryn is also bridged to Ethereum and Binance Smart Chain, and its volumes show impressive traction:

The next steps for Sovryn could be to develop perpetual swaps and to launch Bitcoin-back stablecoins.

More Bitcoin Finance in our next issue!

🌱 Ecosystem

🔥 Blue Wallet has announced a new lightning implementation powered by the Lightning Dev Kit which enables to fund your channels straight from your hardware wallet!

📱 Phoenix is one of our favourite Lightning wallets to onboard new users to LN Markets. This gem is now available in the Apple ecosystem. The team had to build a new multi-platform Lightning engine in Kotlin to make it happen, impressive work.

🧰 Suredbits has announced the alpha release of their open source Discreet Log Contract wallet! A giant leap for decentralized financial services on the Bitcoin blockchain. The team also announced that with Taproot scheduled for activation, they are beginning to work with Lightning implementations to integrate DLCs “so that lower value DLCs are feasible along with a more streamlined user experience (no confirmations)”. Can’t wait!

💥 Not exactly fresh news, but still, we could be more bullish on Bitcoin Finance?

⚡ Bonus

🛗 New elevator pitch for LN Markets!

😅 Thanks to Google translate, we now know that “sábados” is the official Spanish translation for sats. If you feel confused, join our amazing Spanish-speaking community instead!

You can reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!