#30 - Bitcoin Options Dashboard, Lightning UX for Billions, Ecosystem and much more!

⚡ Everything Bitcoin & Finance

📊 Bitcoin Options Dashboard by LN Markets

We believe that Bitcoin options trading is poised to become a huge market. Open Interest in Bitcoin options has grown from $100 million early 2019 to 5 billion today:

Options are financial contracts which give their holder the right, but not the obligation, to buy or sell a specified quantity of the underlying asset at a specified price at a predefined time in the future.

Our own experience trading options with Bitcoin as the underlying asset led us to believe that we can add value to Bitcoin options trading & data visualization.

This is why we have built our own Bitcoin Options Dashboard, which is now live on LN Markets:

In our dashboard, we propose an alternative approach to current market practices:

We quote Bitcoin options with BTC as domestic currency, like is the case for inverse futures

We shift Bitcoin options visualization from a sticky-by-strike to a sticky-by-delta approach

We offer a very synthetic visualization of the market activity where every interest can be seen on the same table

This dashboard is a first step towards adding Bitcoin Options trading to our offering.

Domestic Currency

In the fiat world, a domestic currency is the legal tender of an economy. It is issued by the monetary authority for that economy. A spot operation is an exchange between two currencies of two different economies. The Foreign Exchange (FX) spot rate represents the number of units of domestic currency needed to buy one unit of foreign currency at time T and is named FOR/DOM. For a market player of this economy, the domestic currency is also considered as the risk-free currency: once your assets have been exchanged for that currency, you are not any more in risk.

If we translate this to the crypto economy, one could argue that the mining process plays the role of the monetary authority and that the token secured by a network is the legal tender of that economy.

Therefore, in the crypto world, a domestic currency is the token secured by a network and it is issued by the mining process for that network. The domestic currency of Bitcoin - the network - is bitcoin - the token. And USD/BTC is the rate to exchange USD for BTC.

Inverse Future

Derivatives platforms that have been built over the Bitcoin network use the domestic currency of the network, BTC, for collateral.

The spot rate reference for them is USD/BTC, but for ease of use they usually express the price as BTC/USD. That is why futures quoted as such have been called inverse futures. The P&L is calculated so that the profit on the collateral you use matches the denomination of the contract as price adjusts.

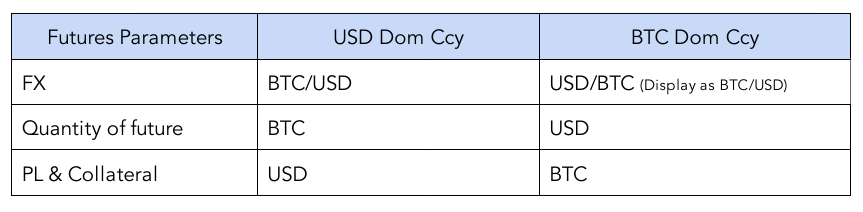

For many different reasons, this Future - BTC domestic currency style - has been the most traded and is still the most liquid BTC future today. If we want to compare the difference between the choices of USD or BTC as domestic currency:

So far, BTC options trading platforms have made the choice of USD as the domestic currency and did not adapt to the possibility of BTC as a domestic currency like it was done with the inverse future a few years ago. So in the same trading environment, the two conventions coexist, one for the future market and the other one for the option market.

Trading Futures and Options under the same conventions can be very convenient and ease the risk management. It can also simplify the possibility to change the type of delivery of the option from cash to physical, that is to be delivered the underlying future contract at the expiry of the option instead of a PL.

Pricing

Options are defined with a strike (K) and an expiry (T) and the payoff at the expiry is:

Where XT is the value of the underlying at the exact time of expiry.

Unlike futures, there is no simple linear formula for evaluating an option. The complexity comes from the valuation of the right to do something (and not the obligation) at a predefined time in the future.

For the past 3 decades, the market has found a consensus in the Black-Scholes formula to evaluate this premium. Its big advantage lies in its simplicity: we only need 2 market parameters (Forward and Volatility) to price this premium correctly.

Forward is the price of the underlying discounted at the time of expiry of the option.

Volatility depends only on the interests of the participants' market and it can be viewed as the covariance of the underlying.

There is not much room for discussion on the forward and the only real “free” parameter is the volatility. For this reason, the option market quotes in volatility only.

When trading an option, the seller receives a premium and buyer receives a contract, promise of a payment at the time of expiry. This premium is the price of the option at the time of trading.

Parameters and units

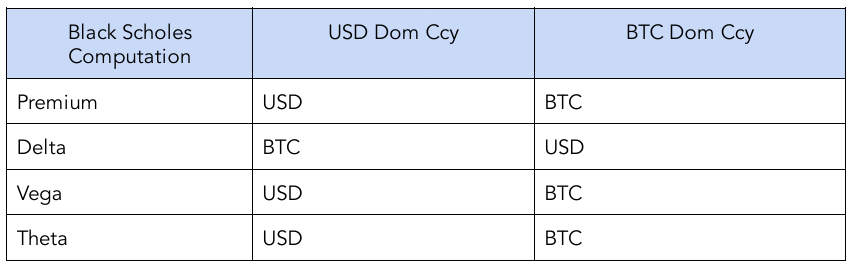

Here is the difference between choosing USD or BTC as the domestic currency for options:

The notional is the amount of underlying that the holder of an option is entitled to exchange. The implication of this choice for the Black-Scholes computation is:

Distribution

The Black-Scholes model assumes that prices follow a log normal distribution. It makes the computation simple and fast but it is a very strong assumption and it is not even close to the reality.

The «real» distribution is somehow made visible by the difference between the volatility of 2 options of the same expiry but a different strike.

To get the full distribution of one forward, it is necessary to know the volatility for each possible strike. This construction is called the smile.

Sticky-by-delta

In practice, it is not possible to observe in the market every possible strike. Instead there are only a few strikes that are liquid enough. To be able to build the smile from there, we need an interpolation.

To get a good interpolation, it is much better to have reference points well distributed across the possible strikes rather than having all them concentrated in the same area.

Also, one strike could be interesting one day and completely out of scope the other day: a 4,000 strike is interesting when the forward is at 5,000 but is totally out of interest when it is worth 40,000.

One easy way to always have good reference points is to shift from a strike view to a delta view. Instead of keeping the options with the same strike as time goes, the idea is to do it with the options with the same deltas.

That way, it ensures that at every moment the reference points are well distributed and straddle the level of the forward whatever its level.

Heptacurve

Our smile is built with the same 7 reference points for each expiry

3 points on the put side: 25%, 10% and 5% delta

3 points on the call side: 25%, 10% and 5% delta

one point in the middle: the delta neutral

We call it the Heptacurve:

Dynamic

The sticky-by-delta surface assumes that as the underlying security moves, the volatility of a given delta does not change. Equity markets typically use the sticky-by-strike approach when computing deltas, assuming that the volatility of a given strike does not move when the underlying moves. In practice, both are wrong, but one can be a better call than the other.

In a very volatile market, we believe that the sticky-by-delta can be the one. Only history will tell.

Smile

From the Heptacurve, we find the intermediate delta using a cubic spline interpolation and project the results on the strike dimension. For a given expiry, the visualization is:

Order Map

Interesting strikes are not the same for every expiry. For a long term expiry, the range of strikes is much wider than for a short expiry. Then, it is impossible to visualize on the same table all the strikes for all the expiries and trading platforms usually have one table for each expiry.

We want to offer a very synthetic visualization of the market activity where every interest can be seen on the same table. This is possible using the deltas instead of the strikes as referential.

This is the order map:

We hope you will find our Bitcoin Options Dashboard useful. As always, we are hungry for feedback: feel free to contact us on Twitter and Telegram!

🤓 Lightning UX for billions

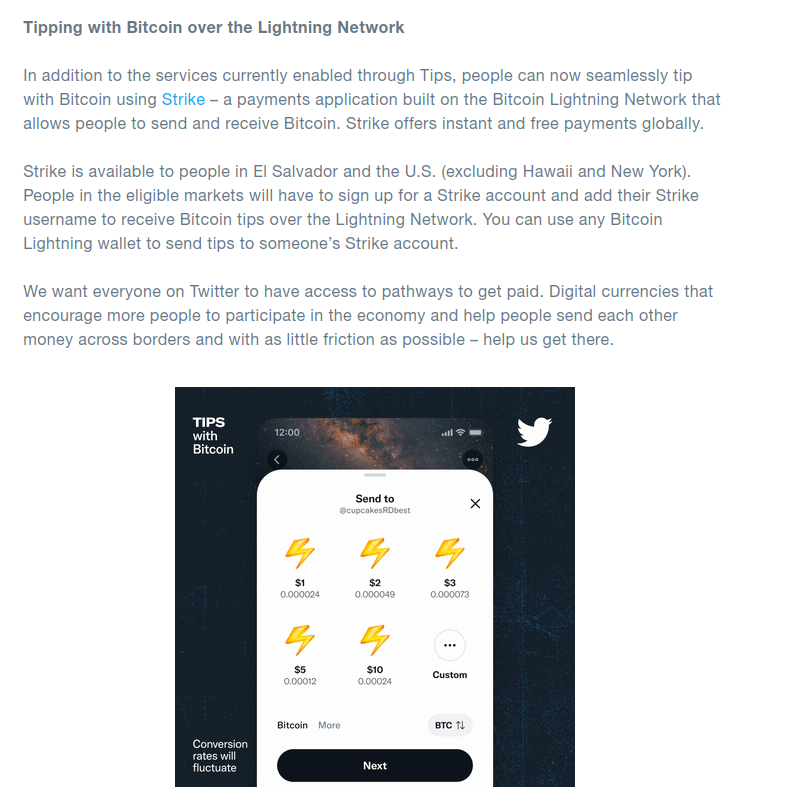

Hard to miss the news: Twitter’s new tipping feature will enable users globally to add a Bitcoin address to their bio and to tip with Bitcoin over the Lightning Network:

While this is a fantastic showcase for Lightning, this announcement has also sparked a debate - on Twitter of course - on the “best” way to transact on the Lightning Network. Of course “best” is a subjective notion, but if we can simply add a Bitcoin address to our Twitter profile, why can’t we just do the same with Lightning, instead of going through Strike API?

Some think Lightning Address is the solution. As covered in our previous issue, Lightning Address is an Internet Identifier that allows anyone to send you Bitcoin over the Lightning Network. No scanning of QR codes or pasting invoices necessary. You can for example deposit to LN Markets using username@lnmarkets.com and withdraw instantly to another Lightning Address. Under the hood, Lightning Address is an UX tweak to make it easier to use LNURL-pay, one of the four protocols of LNURL.

To use Lightning Address in a pure non-custodial fashion requires you to self-host your own HTTP / LNURL infrastructure. However, if you already have a Lightning node, you can use a Bridge Server to ensure your Lightning Node can properly receive payments from your Lightning Address.

Others think BOLT 12, a type of meta-invoice with experimental support already in c-lightning, is the most elegant path forward for payments on Lightning. BOLT 12 is a proposal to bring a different payment UX at the protocol layer. It is a draft specification for “offers", a type of meta-invoice that could be used for recurring Lightning payments. In effect, we could use offers as static, re-usable invoices to receive payments on a Twitter picture, a web page or a billboard.

BOLT 12 has been proposed by Rusty Russell, who wrote the BOLT 11 specification which defines Lightning invoices we use today. According to BOLT 12 proponents, BOLT 11 invoices work fine, but they have a couple of limitations:

For each invoice, the amount to be settled is in satoshis, which exposes you to volatility risk if you want to issue the invoice in advance

The invoice can only be used once: indeed, with HTLCs, the hash of the secret can not be used multiple times for security reasons

BOLT 12 is essentially a way for nodes to communicate directly through a static and reusable “offer” or “meta-invoice”, while the payee can generate new invoices on the fly when requested, allowing for more flexibility:

Lightning nodes can communicate directly and calculate an exchange rate at the last moment, fixing the volatility problem

Invoices are created at the exact time you want the payment, even though the static meta-invoice was created a while ago, solving the secret problem

What’s more, you could automate regular subscriptions (for daily, monthly, yearly payments) with BOLT 12. You can see some simple examples here.

But how could we create new ways to communicate between nodes, that would enable this “meta-invoicing”? Thanks to an extension of BOLT 7, which specifies how the Lightning Network uses the onion routing to send messages to route payments. This extension is a proposed change to decouple the messaging from the payment: you could send a message to any node, which would forward it even though there is no payment route between these nodes.

As we can see, LNURL and BOLT 12 are very different undertakings to improve the payment experience on Lightning. The former is at the application level with support by the main Lightning wallets already, while the latter is at the protocol level and is yet to be implemented by other Lightning implementations and wallets.

They both have in common to aim to make it much easier to onboard billions to Bitcoin and Lightning. It’s great to see these different proposals gain traction and this is the sign of a vibrant ecosystem!

🌱 Ecosystem

👀 Hard to summarize here the must-read report The State of Lightning by Arcane Research, which provides the most comprehensive overview of usage on the Lightning Network seen to date. The report is powered by OpenNode and supported by Lightning Labs. You can download it here. Just one appetizer chart maybe:

🤓 A whole different type of applied research project, nonetheless very useful, has recently been published under the explicit title “Stealing Sats From Other Users: Attacking Lightning Network's Custodial Services”. Its goal has been to figure out if the discrepancy between real Lightning routing fees and service's transaction fee could be exploited for a profit. The white hat developer who has run this experiment only published these findings after the susceptible services have been contacted and flaws fixed.

For example, on LN Markets we have had a quite generous withdrawal fee policy to ensure a smooth user experience: we paid for routing fees on behalf of our users, with a fee limit of 1% of the total amount. This policy could, and has been, exploited:

Great work and this type of white hat attacks are much welcome to make the network stronger!

🤩 An other amazing project by Ben Arc from LNbits, who leverages LNURL to create a very cheap setup to accept Bitcoin even without internet! We can’t wait to see it live at Adopting Bitcoin:

😑 A fun short video by Andreas in which he explains how he mistakenly went from creating a black hole that sucked all HTLCs in the network to a supernova that repelled all HTLCs!

By the way, Mastering the Lightning Network is now finished and we can’t wait to order our copies.

🤔 And finally, an excellent thread on why we Bitcoin:

⚡ Bonus

😲 …

🏃 Still time to register for Road2Bitcoin! You can walk, run, bike or use a more creative mode of travel for this relay race with 21 stages from Genoa to the European Parliament to form a giant ₿, in the European map!

👊 He’s right you know!

You can reach out to us on Twitter and Telegram.

Thank you for your support, let’s build the future of finance together!