After sharing our first impressions of Bitcoin adoption on the ground, it was time for us to head up to San Salvador for the Lightning summit Adopting Bitcoin.

According to co-host Nicolas Burtey, the goal of the summit was two-fold:

“First is to regroup many of the developers working on Lightning, so that they understand the issues faced on the ground. Second is to let all the companies and interested parties on the ground meet the experts in the field, with the goal to facilitate a successful rollout.”

Well, it turns out that Adopting Bitcoin far exceeded all our expectations. And the good news is, a Lightning Summit will happen again in 2022 (probably in a different country). We already can’t wait, because this edition went way too fast 😅

Adopting Bitcoin has gathered 700 attendants from 30+ countries, with plenty of options to learn new stuff and have fun, with an Econ track, a Dev track, a cool hacker space, fun booths and of course the chill-out-by-the-pool option.

In this post, we will cover our highlights from the 3-day conference, which are far from being exhaustive!

🪄 Day 1 - It’s a kind of magic

It all started with a powerful talk from other co-host Chris Hunter in front of a big, enthusiastic crowd:

Chris drew a parallel between Bitcoin and the foundation of the United States. Back then, the Founding Fathers wanted to separate the Church from the State. Today, Bitcoiners want to separate Money from the state. To him, Bitcoin is among the greatest inventions of all times, with fire, the wheel, the steam engine, and the internet.

Then María Luisa Hayem, Minister of Economy of El Salvador, took the stage. She promoted her government’s commitment to innovation and willingness to attract investments to an enthusiastic crowd.

“This currency [Bitcoin] has given, in a short time, access to payments and services that Salvadorans didn’t previously have. We are also seeing a lot of interest from investors, not only in technology, but also in the tourism and real estate sectors; this will be a source of employment.”

We concur.

El Salvador’s government wants to take advantage of the country’s strategic location to transform the country into a digital hub for Bitcoin, AI, and tech outsourcing.

We moved to the Dev track and missed the following panel with the Salvadorians and Americans behind the Bitcoin Beach initiative. Luckily, our friend Antoine covered it in his excellent newsletter. After El Salvador’s tragic 12-year civil war, which took the lives of 80,000 people and ended in 1992, moving to the US to send money to relatives has long been the only dream of young Salvadorans. As Antoine puts it:

“When parents emigrate, they often leave their kids behind in El Salvador. Growing up without their parents, these kids fall prey to gangs who offer them a sense of belonging, a second family, and economic opportunities. Social projects in the beach town of El Zonte - that would later become “Bitcoin Beach” - initially focused on breaking that cycle to show young Salvadorans that they could build a future in El Salvador. Bitcoin was the perfect tool to empower the local community. Before the Bitcoin Law, only 1.8 million people in El Salvador (28% of the population) had a bank account. Now according to government sources, 3 million people have a Bitcoin wallet.

Unbanked people could not save: they spent all their hard-earned money at the end of the month. For the first time in their life, they can save. Community leaders used Bitcoin as a tool for financial education in El Zonte, teaching kids what money is and why saving is essential. The discussion gets extremely emotional when one Salvadoran speaker cries, mentioning all his friends who didn’t have this opportunity to use Bitcoin before, and I guess, ended up in gangs or poverty. That’s why for all the speakers, Bitcoin is hope. There’s also a new sense of pride among the diaspora to see El Salvador eventually presented positively. Panelists are confident that Bitcoin will also increase tourism in the future, but for them, Bitcoin is already changing life.”

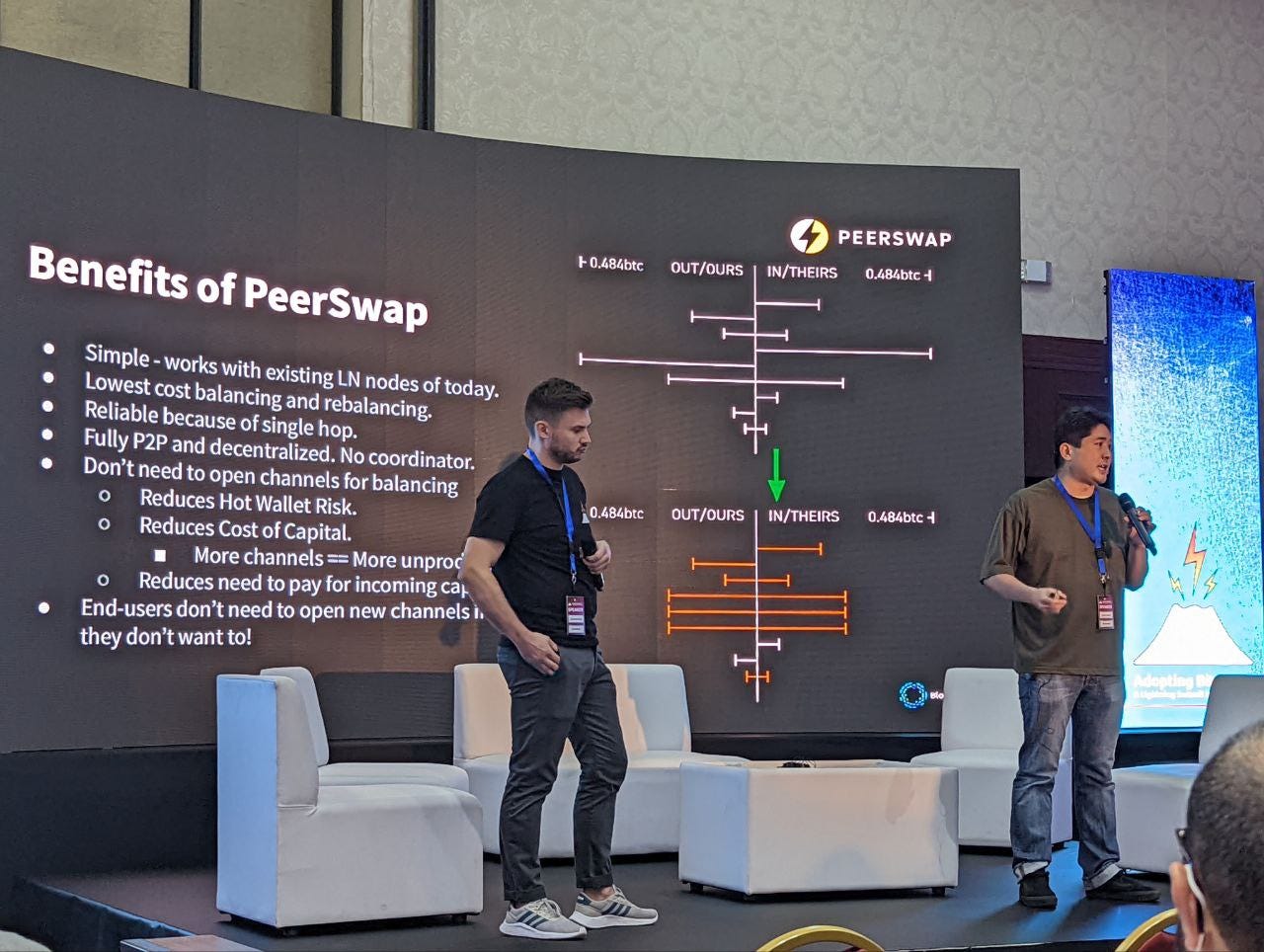

Meanwhile, on the Dev track, we attended the announcement of PeerSwap, a decentralized LN balancing protocol by Blockstream:

A difficult problem when you open a new Lightning node is how to rebalance channels, because your capital can be tied up in unbalanced channels. You can try circular rebalancing with several peers, or open new channels. But what if instead a balance could be paid on-chain to a peer in exchange for the equivalent amount being shifted in the existing channel? PeerSwap wants to help you do just that!

It’s a protocol for direct channels with your peers to be refilled easily and at a lower cost without unbalancing other channels. PeerSwap should move to public release later this month after review (you can join the Discord here).

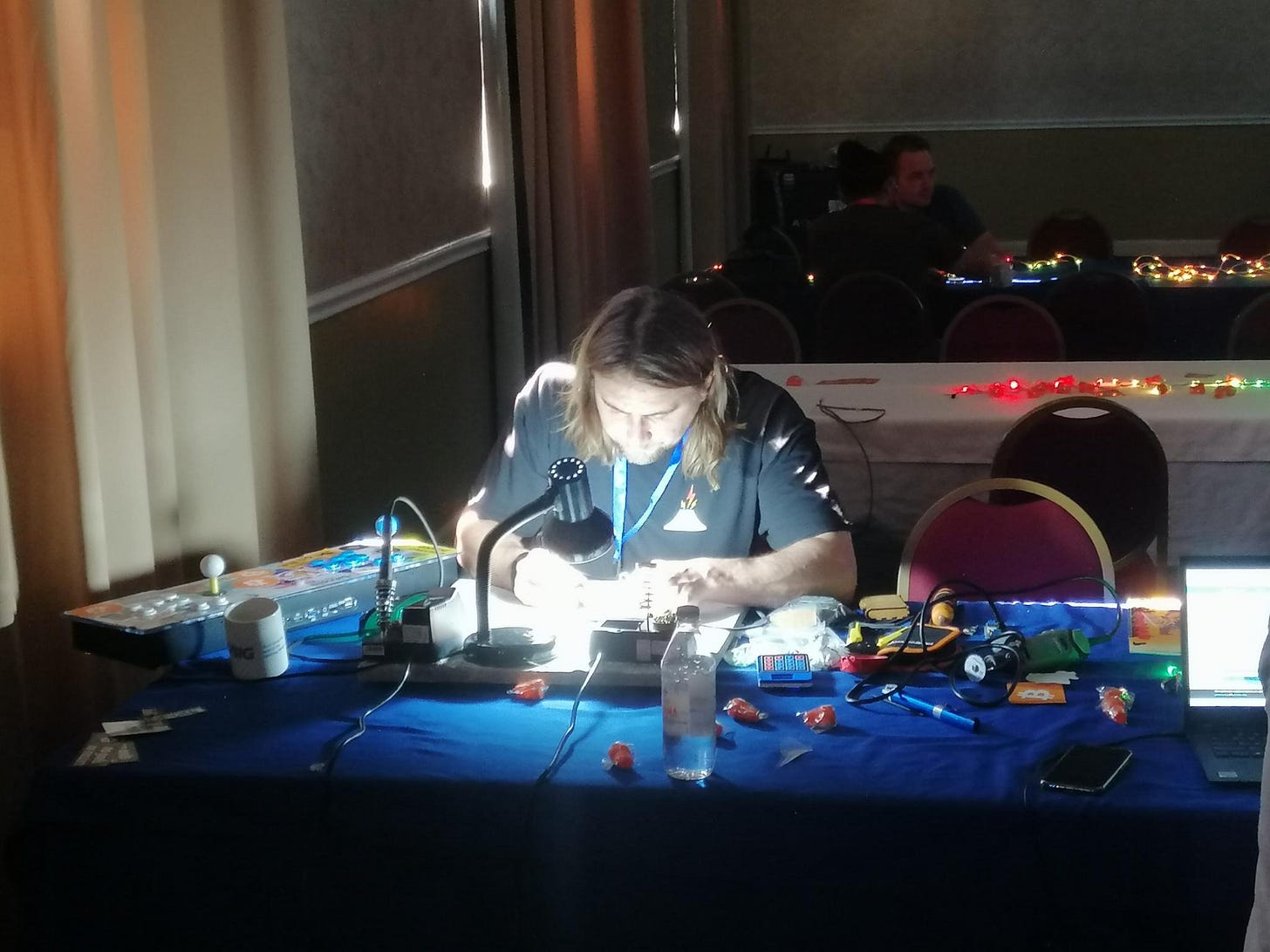

Meanwhile, Ben Arc was preparing his magic in the hacker space:

Conor Okus shared how Square Crypto tries to 10x the developer experience with the BDK, a customizable tool to build cross-platform Bitcoin wallets, and the LDK, a generic Lightning library in Rust based on the BDK. LDK is a set of APIs to make it simple to inject Lightning functionalities to your Bitcoin wallet. Asked if Square Crypto intended to develop on other chains, Conor replied:

“What we are trying to build is sound money. So we focus on Bitcoin only.”

After lunch break, John Carvalho unveiled the ambitious project he had been working on in stealth mode for the past 20 months: Synonym. Synonym is a new Tether-owned company created to make products that strictly use Bitcoin as the only blockchain. It is a very ambitious project which aims to:

Obsolete the banking system: replace it with the Lightning Network with better products - a mobile wallet (Synonym), a Lightning Service Provider, and tokens on Lightning, starting with instant Tether

Obsolete regulations: with a web of trust using cryptographic keys to identify yourself digitally (Slashtags)

Obsolete Big Tech: with a files network, a publishing platform, and decentralized social media based on Bitcoin and the web of trust

Synonym has released open-source libraries and instant Tether is coming soon!

The tallest (and very cool) Bitcoiner Ryan Gentry showed how Bitcoin is freedom money: freedom to spend, freedom to save, and freedom to earn.

Interesting discussion on the the trade-offs between custodial and non-custodial wallets with Roy Sheinfeld from Breez, Conor Okus, and Galoy co-founder Nicolas Burtey. Custodial wallets like Bitcoin Beach wallet make perfect sense for newcomers to the space. While non-custodial wallets are more in line with Bitcoin ethos, can ease compliance, and could ultimately enable end users to earn fees routing payment. Participants seemed to agree that the economics of Lightning will be key for the future of the network. Or as Roy puts it:

“All success of the Lightning Network depends on liquidity management”

At the end of the first day, we attended Alexander Leishman talk on Bitcoin for institutions and could not agree more with him on this:

“Lightning is a much faster and more efficient rail for settlement between financial institutions than on-chain”

Now, time for a few drinks at the Lightning Beer tap and for some sleep before Day 2!

🎚️ Day 2 - Scaling Bitcoin

Decouvre Bitcoin exposed the shortcomings of Chivo Wallet, the official Bitcoin wallet promoted by Salvadorian authorities, in this informative thread that went viral!

We hope Chivo can provide a better experience very soon. Meanwhile, Bitcoiners on the ground are trying to educate Salvadorans to better options, for example with the association Mi Primer Bitcoin.

Back to the summit! Day 2 was centered around scaling Bitcoin, both technically and geographically.

Giacomo Zucco started the day with a funny talk on the perfect Bitcoin wallet, which does not exist yet. Anders Helseth from Arcane Crypto shared fresh updates on their excellent "State of Lightning" report.

Bastien Teinturier, Stephane Richter and Chris Stewart all gave very pedagogical technical talks on privacy on Lightning and Optimally reliable & cheap payment flows on the Lightning Network, and DLCs on Lightning.

And it was our turn to discuss the challenges of running a big Lightning node. Thank you all for your support, we had a great time and we’ll share more soon with the video and a detailed article!

As for what happened in the Econ track, we’ll once again rely on Antoine!

In three separate talks, Alex Gladstein (from the Human Rights Foundation), Monica Taher (Trade & Investments Secretariat of El Salvador), and Ray Youssef (CEO of Paxful) all stressed that the goal of the Bitcoin law in El Salvador isn’t for foreigners to buy a coffee with Lightning but for the 70% Salvadorans without a bank account to get financial freedom: learn how to save money and invest for their future.

Bitcoin is often described as “digital gold,” meaning a digital store of value. But for Ray Youssef, the killer app in Nigeria was Bitcoin as a medium of exchange. It’s expensive to send and receive money from abroad, and credit cards are not widely available (many people are unbanked) and have low limits anyway for Nigerians. That’s why Youssef claims that Africa is leading Bitcoin adoption. Fodé Diop, from Sénégal, came to El Salvador as soon as he learned about the Bitcoin Law to learn how to accelerate Bitcoin adoption in Africa. Here’s a video about Fodé’s mission:

Now time to head up where it all started, Bitcoin Beach in El Zonte!

🌊 Day 3 - The Bitcoin Wave

The third day of the conference was more casual, with a visit to El Zonte, where Bitcoin adoption in El Salvador began. It is a small beach town which has been a popular spot for national and foreign surfers for a while. Social projects around sport and education had emerged before Bitcoin adoption thanks to the youth of the area. In 2019, an anonymous Californian offered to donate his Bitcoin fortune to El Zonte to create a local economy run on the cryptocurrency.

As Miles Suter puts it:

Bitcoin Beach is a first of its kind global experiment, attempting to kickstart a circular bitcoin economy in the name of financial inclusion and economic empowerment within a small community on the coast of El Salvador.

The experiment really took off when El Salvador’s tourism industry struggled amid the COVID pandemic, which eventually led to the Bitcoin Law making the currency legal tender in the country two years later.

On top of supporting local families, Bitcoin Beach funded the El Salvadoran surf team to go to the Olympics. But the frontier from fairy tale to tragedy can be very thin. The same day, Katherine Diaz who just signed her first ever sponsorship deal was tragically killed as she entered the water.

To honor her memory, Bitcoin Beach has launched a fundraising campaign to open a one-of-a-kind surf center. Feel free to learn more and donate here 🙏

We were happy to actually visit the place we had seen so much on Twitter. For the occasion, El Zonte was filled with kiosks, stands and food stalls all accepting Bitcoin of course.

We could visit the inspiring Hope House where volunteers gives give English classes and computer science lessons to kids.

Yes, the place is stunning! And we won’t mention anything related to surfing (just thank warmly Lucas de C. Ferreira for being there on the way to the hospital 😅).

Time to go back home? Not quite yet! After receiving this surreal message, we had to extend our flight:

El Presidente closed the week with a keynote “à la Steve Jobs”, where he announced his plans to build a “Bitcoin City” near a volcano along the Gulf of Fonseca. Bitcoin City will have its own geothermal power plant to help support crypto mining, and there will be no capital gains, income, payroll or property taxes, just 10% value added tax.

Bukele simultaneously announced a $1 billion “Bitcoin bond”, with a maturity of 10 years and paying a 6.5% yield, where half would be used for to build a green mining infrastructure and the other half to purchase Bitcoin. With a $100 minimum subscription amount, the bond could attract a wide range of subscribers, and should just be the first of many more to come to finance Bitcoin City. The bond would be issued on Blockstream's Liquid Network, with the trading infrastructure of Bitfinex Securities. Here is Bukele’s full talk:

Time to conclude this epic summit! What practical lessons could local communities and other countries all around the world draw from the Salvadorean example? Nicolas Burtey is prescient - his first observations last September proved to be much valid:

“More time for wallet development and rollout (eg, 12 months instead of 3 month).

Focus on educational campaign with consumers / citizens.

Provide transparent guidance to businesses / merchants (with the ability to test API well in advance of launch date).

Create physical stores / kiosks to provide in-person customer support (as was done with Chivo ATM kiosks)”.

We have had an amazing time at this conference. Massive congrats to Galoy, Nicolas, Chris, Noor, Kemal and the whole organization team for making your vision of a reality!

On top of getting a sense of Bitcoin adoption in the country and meeting very kind Salvadorians, having the opportunity to meet IRL some of our very first users (Joko, Arnold, Jeff, etc.) and some of people we have been working with for the past 2 years (Desiree, Liz, Roy, Ryan, John, Anders, Bendik, Vetle, Michael and many more) is a truly unforgettable experience. See you all at Adopting Bitcoin 2022!

😬 Seriously, when?

You can reach out to us on Twitter and Telegram.

Thank you for your support, let’s build the future of finance together!