#40 - Mesh networking, blood in the streets, and much more!

⚔️ LN Markets Fam

🏆 @Pa₿lo Freedom’s hegemony on the meme of the week award has finally come to an end! There is a new serious memer in town. Congrats @HodlSouth for this gem!

🏆 Our beloved Chief Meme Officer & Cypher Community Manager Koty has spoken. Degen of the week award is collectivist this time!

Congratulations to @gegelsmr2's Top 3 Worst Traders @Shqiptar_Bulls, @claudatio @1971Bubble. You need to tweet ''Bitcoin'' more!

📺 Koty has also spoiled all of us this week with two threads (here in English and Spanish), a series of tutorial videos (both in English and Spanish) for newcomers to LN Markets:

Please feel free to subscribe to our YouTube channel and like the videos, it helps a lot!

Koty also launched the first trading contest and the very degen, much LNM @mugenclown took the win 🏆

Overall, it’s been a rough week for all of us. But Bitcoiners never lose their sense of humour and are even more creative when markets drop! So here are a couple jokes we received to relax a bit 😅

📊 Blood in the streets

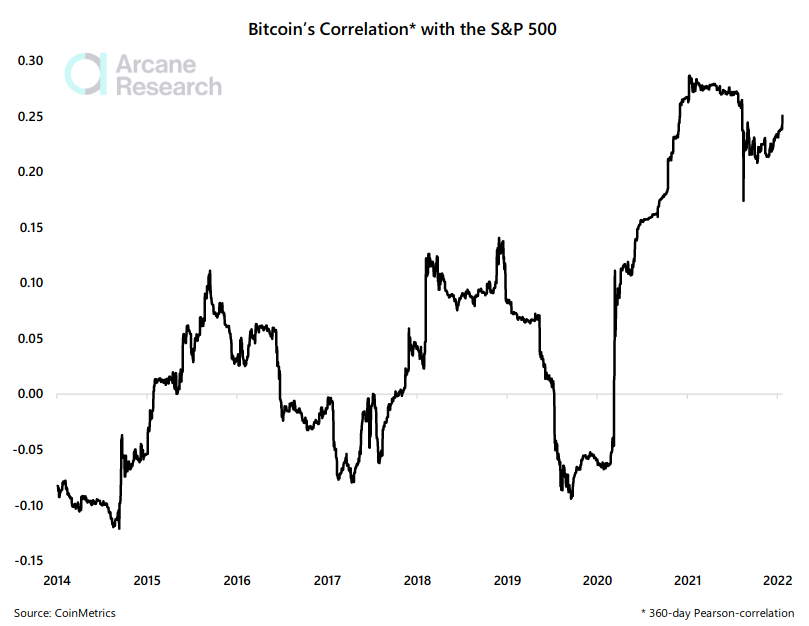

Bitcoin’s correlation with the stock market is increasing

Is the digital gold narrative starting to crack?

Between 2014 and 2020, bitcoin's 360-day correlation with the S&P 500 hovered around 0.

Bitcoin's correlation with the rest of the financial market started to increase at the onset of the COVID-19 pandemic. The bitcoin price plummeted almost 60% simultaneously as the rest of the financial market also panicked. Nevertheless, bitcoin's long-term correlation with the stock market was still relatively low even after this event- a catalyst for the massive increase in institutional interest we saw in 2020.

Then, many prominent investors purchased bitcoin, citing the asset's potential as a safe haven asset. The digital gold narrative was born.

As the digital gold narrative drove in institutional money, bitcoin's correlation with the stock market increased. Bitcoin's 360-day correlation with the S&P 500 has consistently laid above 0.2 since the summer of 2020.

With bitcoin's correlation with the broader financial market sitting at such highs, will bitcoin's digital gold narrative crack? Or will it see a resurgence as investors increasingly feel the need to protect their portfolios against inflation?

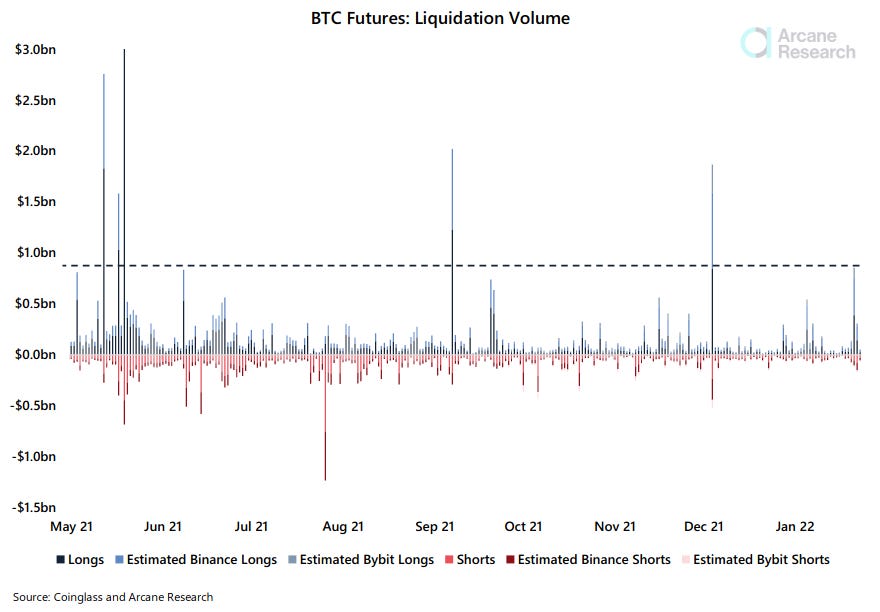

Liquidations picking up, but remain far below what we’ve seen earlier

Far lower liquidation volumes accompanied the weekend plunge below $40k than during previous shakeouts.

We estimate that the BTC futures and perp markets saw a total of $854 million worth of long liquidations on Friday as bitcoin plunged below $40,000 down towards $35,000. For reference, the last time bitcoin fell below $40,000 from the upside on May 19th, 2021, a total of $4.8bn worth of longs got liquidated in the BTC market.

Back then, the sell-off was far more intense than what we’ve seen this time around. Bitcoin fell from $58,000 to $29,000 over the course of seven days. Now, traders have had more time to re-allocate and add collateral to underwater trades, possibly explaining the less intense long liquidation volumes witnessed in the market.

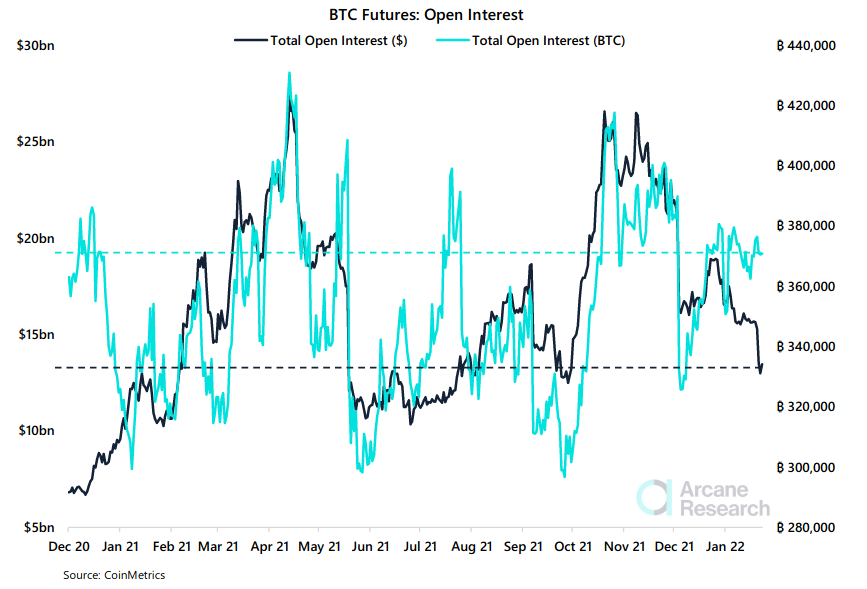

But the leverage remains high with 360,000 BTC worth of OI in the market

The open interest has taken a significant hit when measured in USD, but when measured in BTC, the leverage in the market still seems lofty.

The BTC denominated open interest maintains its size of 360,000 BTC, with perps still seeing an open interest above 240,000 BTC. In other words, the market is still exposed for further significant shakeouts.

Back in May, we saw that the open interest fell rapidly down towards 300,000 BTC as liquidations cleared the market. The OI then remained low until late July. In December, we saw a far more rapid recovery of the open interest which is slightly concerning.

A short squeeze lifted the market out of its sorrowing state in July. High leveraged shorts led the tide to change. A short squeeze could still be in play in BTC. Low funding rates and the declining basis lately suggest that shorts have been more aggressive than longs, and the constant downtrend in BTC might lead to further conviction from leveraged short traders.

However, the muted liquidations experienced amid the turmoil compared to what we’ve seen earlier might also suggest that underwater longs are exposed for further decline.

👉 Get full access to Arcane Research’s Weekly Update here.

🤔 Bitcoin and Mesh Networking

By Fanis Michalakis, Bitcoiner & Techno Padawan @LNMarkets

I am increasingly convinced that the future of Bitcoin (at least, its short term future) lies in mesh networking.

Mesh networks are networks were nodes connect to one another dynamically and without any hierarchy. There is no central authority, every node is connected to other nodes with which it exchanges data.

Bitcoin already looks a lot like a mesh network at the protocol level. Consider transactions or blocks propagation for example. When a node becomes aware of a new transaction or a new block, it transmits this information to its neighbours, which in turn pass it along to their neighbours, and so on. This way, information quickly reaches the whole network.

But at the transport level, Bitcoin still largely relies, in practice, on a non-mesh TCP/IP layer [1]. I believe that, as the pushback against Bitcoin increases in some jurisdictions, Bitcoin related traffic might start being censored. At least, in any adversarial thinking oriented planning of the future, this is a possibility that should be accounted for by any rational Bitcoiner.

There are a few ways Bitcoiners can circumvent that. Here are three I thought about, feel free to reach out if you see others that might play out:

create Bitcoin-friendly ISPs (“ISP for Bitcoiners, by Bitcoiners”),

build mesh networks between Bitcoiners homes,

satellite communications for long-distance data transfers.

In my opinion, the best solution is a combination of the three. A Bitcoin-friendly ISP could be able to delay the application of anti-Bitcoin laws and regulations, at least to some extent. When this bastion falls, a mesh network comprised of hundreds of antennas should be able to ensure a stable communication between nodes that are geographically close to one another. This works especially well for cities, but could be a bit more challenging in the countryside. Finally, satellite communication would allow Bitcoiners living in an anti-Bitcoin country to reach their peers outside of this jurisdiction.

An example

I always like to give this example when trying to explain how I see mesh networking and Bitcoin working together.

It doesn’t fully encapsulates what I have in mind, because in this example mesh is used punctually to route a transaction to the closest node with internet access, whereas I envision a stable mesh network. But it’s definitely a good place to start.

Plan ahead

Of course, Bitcoiners should not wait for the moment they need them to start building mesh networks. There are some initiatives such as TxTenna or Locha Mesh, but we’re not there yet. Maybe we should.

By Fanis Michalakis, Bitcoiner & Techno Padawan @LNMarkets

[1] Although TCP/IP doesn’t care how data packets are communicated, non-mesh networking is quite the standard todays, with centralised Internet Service Providers (ISP) giving access to the internet to their client. This is true for Bitcoin too: even if the communication between you and your peers is peer-to-peer at the Bitcoin protocol level, you often still rely on your ISP to send and receive data to and from your peers.

⚡ Bonus

⚒️ Now is a good time to BUIDL. And it’s always a good time to praise the legendary BUILDERS like @PieterWuille.

Nice to see Nouriel back to Bitcoin twitter, really wondering what made him pay a visit 🤔

☕ And finally, what a morning timeline!

🤝 Reach out on Twitter and Telegram to build the future of trading together!