#41 - AOPP, Bitcoin Options, and much more!

📊 Bitcoin options traders are bearish, but hesitant

The low implied volatility indicates that options traders haven't been more long-term bearish since May 2021, while the high volatility skew suggests they are hesitant to take directional bets.

Options enable traders to bet on movements in price. Therefore, the more volatile an asset is, the more expensive are its options. Implied volatility (IV) is inferred from option prices and shows how volatile traders believe an asset to be in the future. The lower the IV - the lower the options prices.

The volatility skew is the relative difference between prices of put and call options with otherwise similar characteristics. Historically for bitcoin, call options have been more expensive than put options, generally giving bitcoin a negative volatility skew.

Bitcoin's volatility skew is now the highest since May 2021, indicating that the demand for puts is higher than for calls. Bitcoin options traders are bearish.

Although bitcoin option traders are more bearish than in a long time, they seem hesitant on taking directional bets, showcased by the IV being at its lowest since May 2021.

The low IV shows that options are cheaper than in a long time, while the positive skew indicates that call options are relatively cheaper than put options right now.

This might be an opportunity to buy some cheap calls.

💥 Get prepared, Bitcoin Options are coming soon™️ to LN Markets!

👉 Get full access to Arcane Research’s Weekly Update here.

🤔 AOPP

A (heated) discussion on a specific piece of regulation and its application has quickly spread through Bitcoin Twitter in the last hours, following a tweet by shaquille o’atmeal:

I found the topic interesting enough to wrap up my thoughts on the matter in a short article. I hope it will also help the reader quickly get grasp of what is at stake here.

Some Context

In some countries (Switzerland and the Netherlands), regulated exchanges and alike (often referred to as VASP in the jargon, for Virtual Asset Service Provider) are required to collect proof of ownership of the address(s) their users withdraw their funds to. This is achieved by asking the user to sign a custom message (something like “I, Fanis Michalakis, hereby confirm the ownership of address bc1…") with the private key associated with the address they want to withdraw their funds to.

The official justification for this curious (to say the least) piece of regulation is that VASP must verify the identity of the person controlling the address they send funds to, in order to curb terrorism financing and money laundering. Of course, just as KYC, this measure does absolutely nothing against both mischief, but efficiently paves the way for even more mass surveillance and State overreach. One could also point out that this particular measure doesn’t prove anything regarding address ownership, as it is fairly easy for anyone withdrawing to the address of a third party to ask said third party to sign whatever message regulators may come with ; but a law’s ineffectiveness is no excuse for its enactment.

AOPP

Considering that the friction added by this requirement can drive away users from self custody, because they don’t want to take this additional step (or don’t know how to), 21analytics, a Swiss crypto-compliance software company, initiated the AOPP: Address Ownership Proof Protocol.

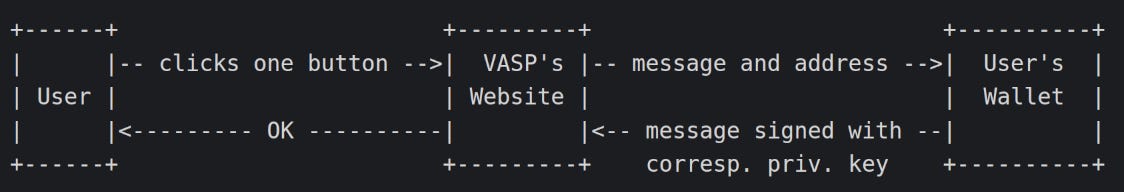

The goal is to enable wallets to provide a quick, easy way for users to provide the required proof of ownership to their VASP. If a user’s wallet and their VASP both implement AOPP, all the user has to do is click a link on the VASP website or app. It will automatically open the wallet, sign the appropriate message with the appropriate private key, and send it to the VASP. From one burdensome process of copy-pasting a message and signing it with the right private key (something non tech-savvy users might find difficult), we now have a one-click verification mechanism.

For this protocol to work, it is necessary that at least some wallets implement it. Some of them do: software wallets such as BlueWallet or Sparrow, and hardware wallets such as Trezor as well. Swiss and Dutch exchanges (like Relai for example) can also implement the protocol to provide easy, one-click verification to their customers.

Why is it a problem?

All this protocol does is making the application of law easier. The law being applied whether it is easy or not, implementing it could seem to be a good idea, as it would reduce the friction on the path to self-custody for users. Besides, I do think that it is what led to this protocol being crafted, and then adopted by many well-known platforms and wallets.

Yet, this law and its application materialize the anti-Bitcoin idea that self-custody requires permission, and permission is the first step to denial. Therefore, instead of being facilitated, this law should be fought against. If users are ready to make this compromise, so be it, but software and hardware self-custody solutions should stay absolutely neutral. This stance is very well detailed by Samourai in this thread:

Since then, Sparrow and BlueWallet have withdrawn themselves from the initiative, and will remove the AOPP functionality from their software in their next release.

[EDIT at B720786]: Trezor has also announced the removal of AOPP from their products.thanks for y

By Fanis Michalakis, Bitcoiner & Techno Padawan @LNMarkets

⚔️ LNM Fam

🏆 First meme award for the much talented Bitcoin graphic designer Andrej #StackingSats.

🏆 Degen of the week award goes to @LindoAvocado, winner of the second LNM trading contest.

The first two trading contests launched by Koty have been a big success, and we are cooking something big for the next edition.

And thanks to @jesperolsanajek, we finally make it to the tiktok game!

⚡ Bonus

💡 We somehow missed this gem thread but tons of alpha for lightning node management here

✅ He’s right you know

✅ He’s (also) right you know

🤝 Reach out on Twitter and Telegram to build the future of trading together!