#47 - Bitcoin Miami, State of Lightning, Options trading, and much more!

🌴 Florida Man Goes to Bitcoin Miami, Loses Everything in Hovercraft Accident

Our tech team went to Bitcoin 2022 in Miami to shake some hands, bump some fists, listen to the most brilliant bitcoiners, and toss some merch.

The two trends were without a doubt Mining and Lightning. With a dedicated stage and a high proportion of the exposition booths, mining definitely seems to be a thing in the US. Mining companies were everywhere, from hosting facilities to Upstream Data and their amazing BlackBox, which allows you to mine Bitcoin at home while avoiding divorce at the same time.

Lightning-wise, this year conference confirms the ever increasing shift of exchanges embracing Lightning, with Robinhood announcing their Lightning integration a month after Kraken officially announced Lightning-enabled withdrawals. On the main stage, Michael Saylor noted that “[he] think[s] every crypto exchange, if they’re going to remain viable and competitive, they need to build Lightning into their exchange”. Well, we couldn’t agree more!

Jack Mallers’ annoucement of Strike integration into a great proportion of Point of Sale softwares outlined how Bitcoin and Lightning can be used as a more efficient payment network, without even the need to touch bitcoin (the currency) for end users. Interestingly, the news was also the starting point of a very needed debate regarding whether the Lightning Network is ready to welcome thousands of new merchants. As Rene Pickhardt highlighted, Lightning might still be too unreliable as of today, which could result in bad user experience for both merchants and customers.

The topic of reliability was also addressed during the fascinating Mobile Wallets Bitcoin In Every Pocket panel, where CEO of Breez Roy Sheinfeld highlighted how hard it can be to create an easy-to-use Lightning wallet, notably due to Lightning being a liquidity market still in its infancy, both in terms of liquidity volumes and liquidity management tools.

Last but not least, Lightning Labs announced a new Taproot-based protocol they’ve been working on in the past months that will allow for the creation and transfer of assets on Bitcoin and Lightning. TARO - for Taproot Asset Representation Overlay - leverages the new Taproot script tree to commit data to the Bitcoin chain and track the transfers of arbitrary assets, both fungible and collectibles.

🤝 The conference was also a great place to connect and meet in meatspace our ⚡-friends from Lightning Labs, THNDR, Galoy, Voltage an so many others!

📰 The State of the Lightning - Volume 2

Arcane Research has released the updated version of their excellent analysis on the Lightning ecosystem and dynamics.

Some key insights:

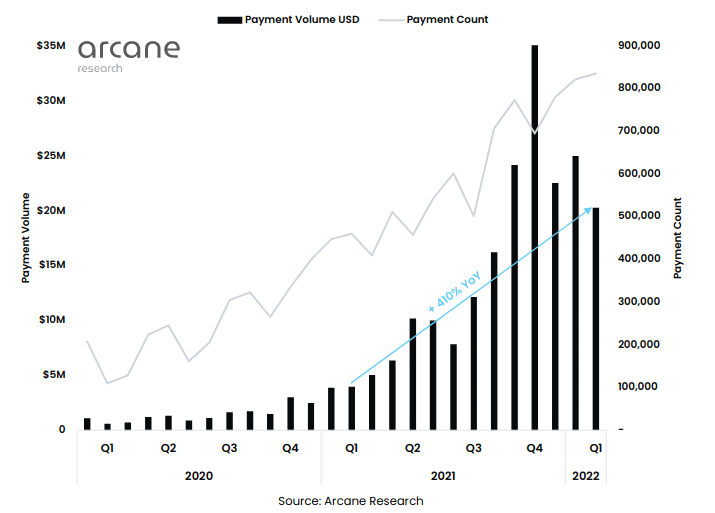

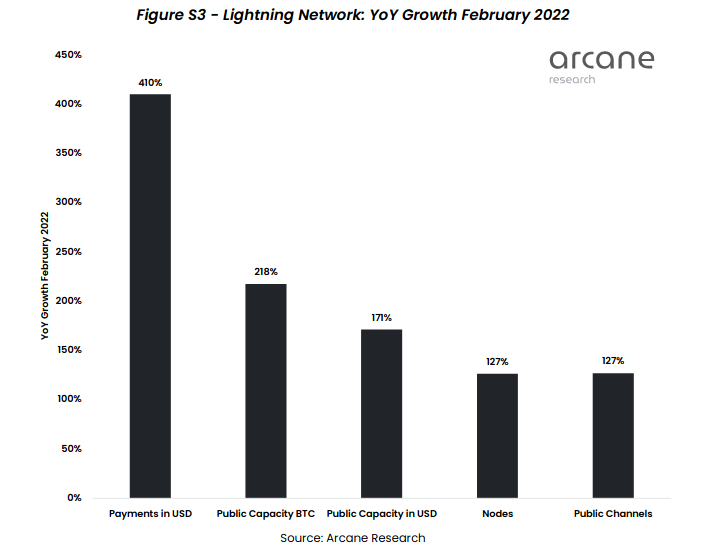

📈 Adoption is rising quickly: the number of payments has roughly doubled over the last year, while the value of the payments has increased by more than 400%

📊 Actual usage has risen significantly more than any of the public metrics!

🗺️ More than 80 millions people now have access to Lightning on an installed application

😇 Trading on Lightning (Deposits & Withdrawals) represents a 1/3 of Lightning payments volume in 2022

✌️ Bitcoin and the Lightning Network can drive more financial inclusion for the more than 2 billion unbanked people worldwide.

👉 Dive into Arcane Research’s State of the Lightning Volume 2.

🧙 Primer on Bitcoin Options trading on LNM

Bitcoin options trading at the speed of Lightning is coming very soon to LN Markets! Meanwhile, you can practice on LNM Testnet, with a 200k sats airdrop for new testnet accounts.

Trading options can be very useful in a choppy market.

Indeed, a future position can be liquidated quite quickly in a volatile market even if the initial position revealed to be correct in the long term: it is path dependent. However, a buyer of an option does not care about the path followed by the market, the only thing that matters is the level of the underlying at the time of expiry!

On testnet.lnmarkets.com, click on Options / Trading to access Bitcoin options trading

An option is a financial contract which offers the buyer the opportunity to buy or sell an underlying asset. The option contract specifies the strike price, the price at which the underlying asset can be bought or sold when it is exercised, and the expiry date.

The price of an option is called the premium. It is usually computed with the Black-Scholes model, which only requires two market parameters (Forward price at expiry of the underlying asset and Volatility) to price this premium correctly.

When we designed our options trading offering, we paid attention to making it simple and accessible to all. That’s why, for our first iteration, we have made several choices that we are detailing below.

You can only buy options, not sell them. You can buy two types of options: calls and puts. Buying a call option gives the right to enter in a long position and buying a put option gives the right to enter in a short position.

If you’re a bull, buy calls, if you’re a bear, buy puts.

They are all 24-hour options: they expire 1 day after opening the position.

The underlying of the option is the LNM perpetual future. The forward is the price of this future discounted at the time of expiry. Note that the forward is very close not to say equal to the price of the future because the expiry is only 24h.

We quote Bitcoin options with BTC as domestic currency, like is the case for inverse futures. Which means that the forward price parameter is expressed as USD/BTC. However, we display it as BTC/USD for simplicity reasons.

Quantity is the notional amount of options you want to trade. It is expressed in USD.

The Strike price parameter (price at which the option can be exercised) is expressed as USD/BTC, since BTC is the domestic currency. However, we display it as BTC/USD for simplicity reasons.

We list two strikes for calls (two next thousands up) and two strikes for puts (two next thousands down).

For example, if bid price = 45,684.5 and offer price = 45,749.86

for call: Strike 1 = K1 = 46,000; Strike 2 = K2 = 47,000

for put: Strike 1 = K1 = 45,000; Strike 2 = K2 = 44,000

For the settlement at expiry, you can choose between Cash delivery and Physical delivery.

With Cash delivery, you receive the PL of the option at the expiry = Max(Xt - K, 0), where Xt is the value of the underlying at the exact time of expiry. In other words, if the option is “In-The-Money” at expiry (if its strike price is favorable compared to the market price of the underlying at expiry), you receive the PL of the option.

With Physical delivery, if the option is “In-The-Money” at expiry, you receive delivery of a futures contract running for the given strike. This futures contract can be managed in the Futures section.

For the Volatility (%) parameter, we compute an implied volatility from market prices, which gives an indication of the expected movement of the underlying.

Delta is a risk metric that estimates the change in price of the option, given a 1 unit change in its underlying asset. It is computed with Black Scholes formula.

With Bitcoin as a domestic currency, Delta is expressed in USD. It corresponds to the number of BTCUSD future contracts you would have to sell or buy to be delta hedged.

Margin is the premium of the option, expressed in sats. It is computed with Black Scholes formula, and depends on the volatility and the forward price. Margin corresponds to the amount you have to pay to buy a call or a put option. This amount is deducted from your Margin Available and added to your Margin Used.

Expiry is the exact time at which the option expires, 1 day after opening the position.

In order to trade options, the steps are:

Decide whether to buy a call (go long) or a put (go short)

Set up the Quantity (in USD, the notional amount of options you want to trade)

Choose your strike price

Choose between cash and physical settlement

Click on buy to pay the margin (in sats) and you’re done!

After buying an option, you can see it in the Running section of the deal blotter, at the bottom of the screen. Each line corresponds to an option, with PL = Mark-to-Market - margin (Mark-to-Market of the option is its price with the current volatility level, other parameters remaining the same).

In the risk section, on the lower left hand side of the screen, you can see in the PL section your global PL (sum of the PL of your options) and your global Delta (sum of the Deltas of your options).

At expiry of an option with Cash settlement , if you are “In-The-Money”, you receive a PL + the initial margin paid for the option. This sum is added to your Margin Available.

At expiry of an option with Physical settlement, if you are “In-The-Money”, you get a futures contract running with liquidation price equal to the option strike, margin equal to the initial margin paid for the option, and PL of the future contract equal to the PL of the option at expiry.

✌️ Have fun trading Bitcoin options and let us know your feedback on Twitter, Telegram or Discord! For more information, check LNM Doc in English, French and Spanish.

⚡ Bonus

🔮 Wise words from for low time preference buidlers

👀 We are all psychopaths node runners

🎁 Well deserved dear ser

🤝 Reach out on Twitter, Telegram and Discord to build together the future of finance on Bitcoin!