#49 - SwissCryptoCat, LNM Fam, Big BTC move coming, and much more!

🎙️ Pleb Builder interview: 🇨🇭Swiss 🔑Crypto 🐈Cat

Free alpha here: if you’re an aspiring Bitcoin trader, it’s probably a good idea to follow @SwissCryptoCat! This funny cat shares his views on the market, his trading tips, his strategies (even when they don’t work 😅), his tastes on Bitcoin art, and (a lot of) cat jokes. You can also find him in the Bitcoin metaverse he started building during the pandemic and where he organizes Saturday Bitcoin meet ups, and on the LNM trollbox.

Hey @Swisscryptocat, can you tell us how you got into Bitcoin, what has been your journey in the Bitcoin space so far?

Swisscryptocat: I started to get very interested in Bitcoin at the beginning of 2017. I listened to a few conferences by A. Antonopoulos and also one in French by Alexis Roussel. I was already passionate about geopolitics and monetary history and already aware of the flaws of our global financial system. I knew that we needed to come back to a tangible standard like the gold standard that we abandoned decades ago.

When I understood Bitcoin could serve this role, that it was unstoppable, uncensorable, and non confiscatable, it was the start of a long journey into the Bitcoin protocol rabbit hole.

How do you use LN Markets?

Swisscryptocat: I use it for quick intraday leveraged scalps whenever I believe to have a decent tradable setup. When I first started to trade Bitcoin I didn't use leverage for the first two years, I was just trading altcoins BTC pairs to accumulate more bitcoin.

Then the last cycle’s bear market taught me to monitor my trades more actively and to not baghold underwater positions and cut losses early instead.

Over time, I learnt to care less of the direction of the market and to trade it both ways.

What advice would you give to someone who would like to start trading Bitcoin?

Swisscryptocat: I think it depends on people’s profiles, they just need to work on the part that seems harder for them at first.

Someone very organized and pragmatic might have to work on the ability to feel the market sentiment, the understanding of narratives, and the ability to anticipate changes in those.

I am quite the opposite of this kind of profile, I am pretty good at feeling the market and its rhythm and spotting harmonic figures, a chart is like a music partition to me.

So I had to work on being more organized, serious and consistent in monitoring my trades when I noticed most of my bad trades were due to a lack of monitoring.

Another advice I’d give is to start a trading journal, a small tip that worked for me is to create a discord server just for yourself for that purpose, use it to create channels for every pair you trade and to post charts, trade ideas and take notes.

You have been building a lot of stuff, even a Bitcoin metaverse before that was cool! What is CitadelleVR?

Swisscryptocat: CitadelleVR is the first VR community of people passionate with Bitcoin and cryptocurrencies in virtual reality.

We gather every Saturday night in a virtual world that I built during 2020 lockdowns called the Bitcoin Cyber City. It’s a small bitcoin-themed futuristic world, free and open all the time for Bitcoiners to have a place in the metaverse. It contains a stage for presentations, tons of Bitcoin art pieces displayed all over the world, easter eggs, 5 secret rooms and a sats faucet.

If you are curious enough to find the secret rooms when you visit it, you might win some free sats. The best experience is in immersive reality but you can visit the world from PC or Mac on a flat screen too.

How do you see the Bitcoin market in the coming days/months/years?

Swisscryptocat: It’s a tough question in such uncertain times. The markets can be influenced by everything in the short term and so can the price of Bitcoin ( monetary policies, global context, regulations…) so anything can happen, but the protocol and its adoption keeps growing at a steady pace.

I see the future of Bitcoin inevitably bright, because as time passes more and more people understand that it’s not just a speculative asset, but a decentralized protocol that has the potential to disrupt many parts of our societies. It’s a Pandora’s box that has been opened and can not be closed anymore.

You can’t fight an idea whose time has come.

⚔️ LNM Fam

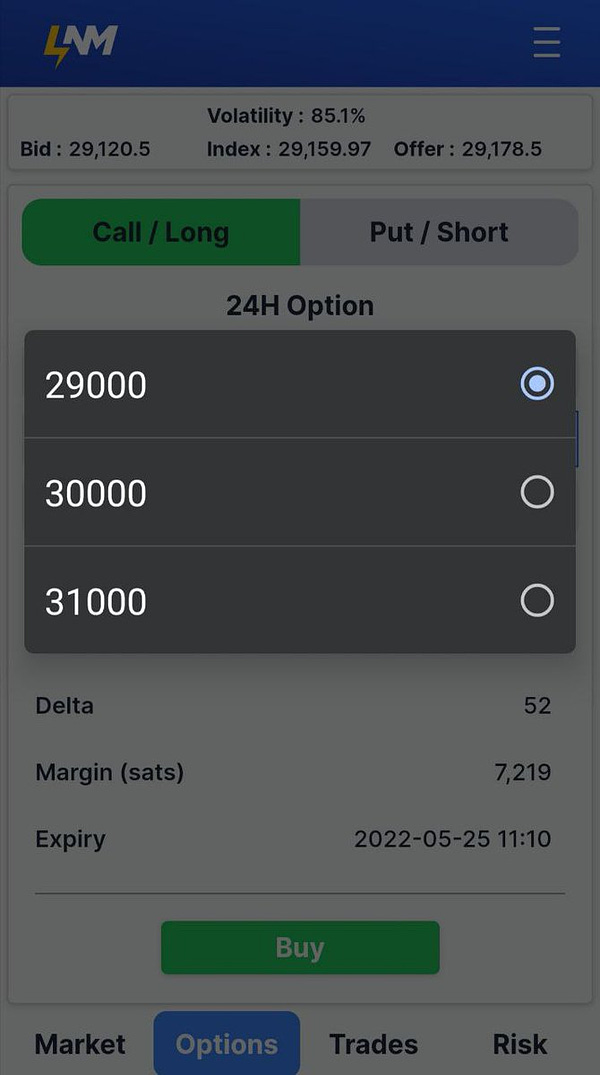

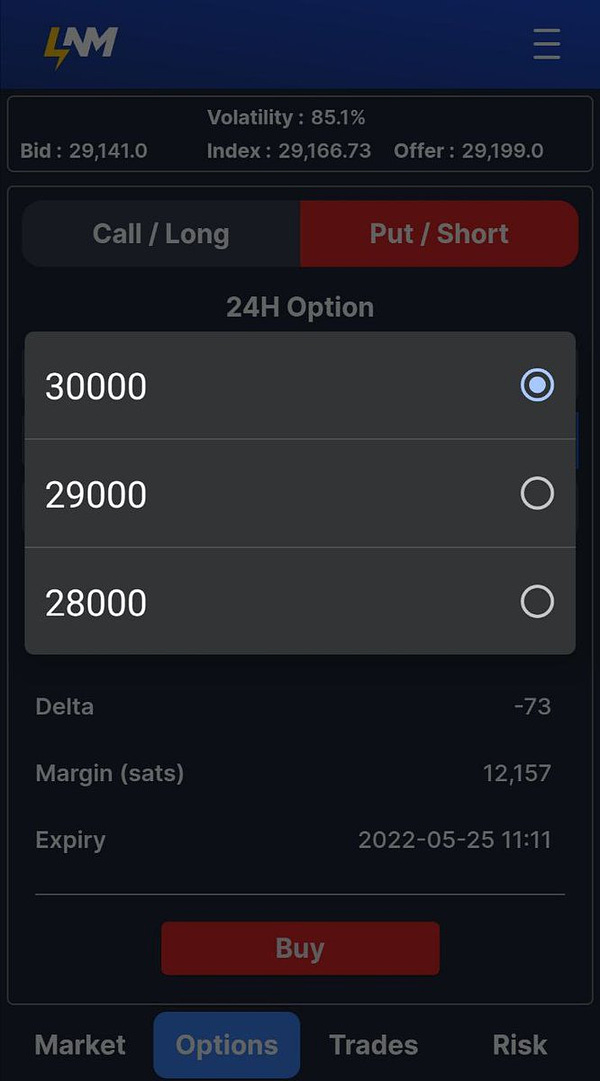

🆕 We have added 2 new strikes for Bitcoin options trading closer to the underlying to give you the possibility to trade options with a greater chance to finish In The Money (ITM) at the expiry.

For example, with BTCUSD around $29,150 you can buy a call option at strike $29,000. At maturity, 24 hours later, the probability that BTCUSD price would be higher than $29,000 is higher than for $30,000 and $31,000 strikes. Hence the price of the option (the margin paid) is higher, but so his the probability of gain on this option.

With BTCUSD around $29,150 you can buy a put option at strike $30,000. At maturity, 24 hours later, the probability that BTCUSD price would be lower than $30,000 is higher than for $29,000 and $28,000 strikes. Hence the price of the option (the margin paid) is higher, but so his the probability of gain on this option.

Plus you can now build a straddle, where you buy a call and a put of the same strike. A strategy to long volatility.

If you have any question or remarks on options, feel free to reach out!

🐳 LNM Weekly best trader shows strong long Bitcoin scalping to net 4.6 million sats this week

🎨 Thank you so much @jorgemunozart for making this, we’re very touched and we love it 😍. Find more of Jorge’s great art on Instagram.

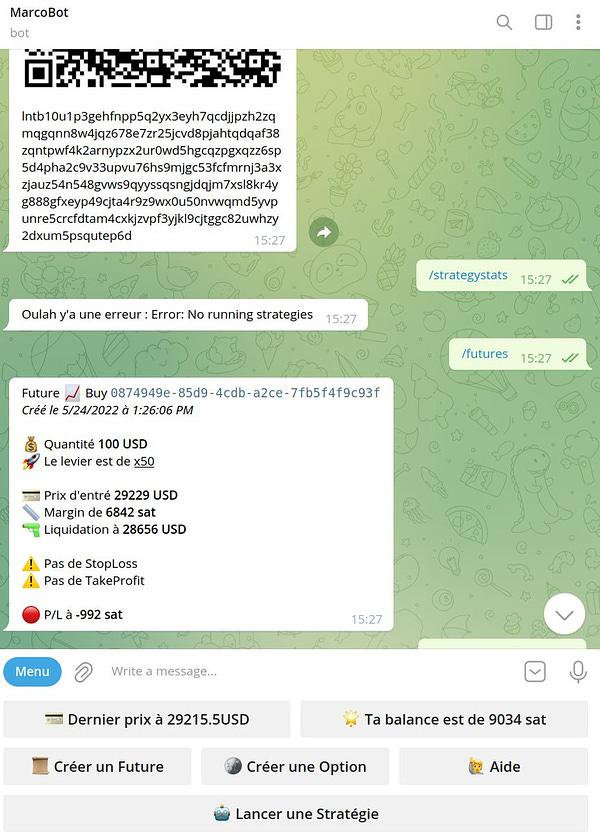

🏆 And the builder of the week trophy goes to @_blocs for making this super user-friendly Telegram LNM bot. It’s only in French for now, but we’ll definitely contribute to English and Spanish translations. If you want to contribute to the bot and/or have ideas for trading strategies to implement, here’s the GitHub repo!

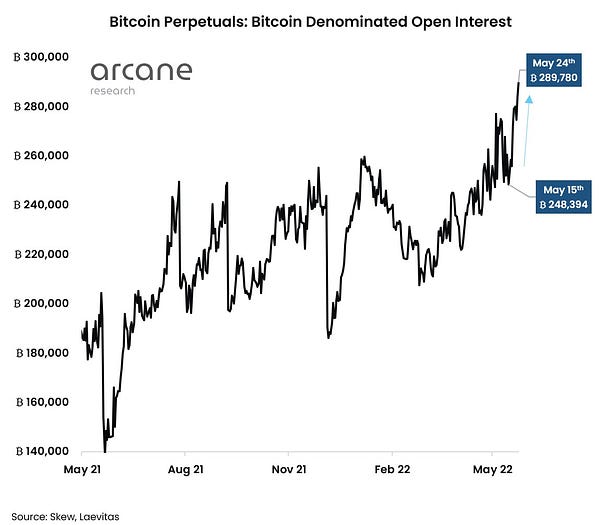

📊 A hedged options market while perp OI surges to new ATH

By @VetleLunde

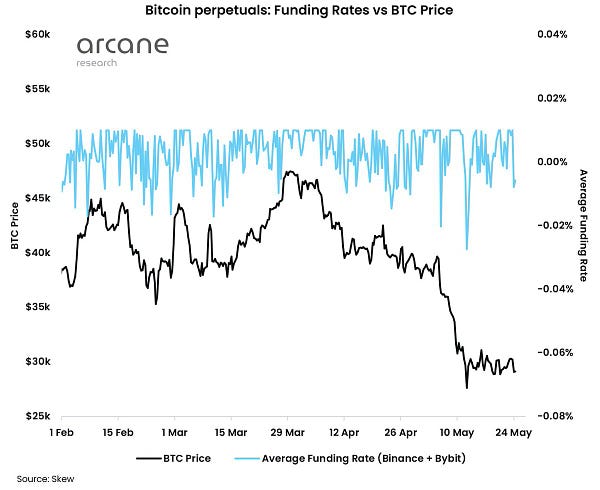

After a quiet week in the market, we see no noteworthy changes in the sentiment in perps as funding rates still trail at or below neutral, but under the hood BTC denominated open interest has surged to new highs.

Perps are seemingly taking a breather…

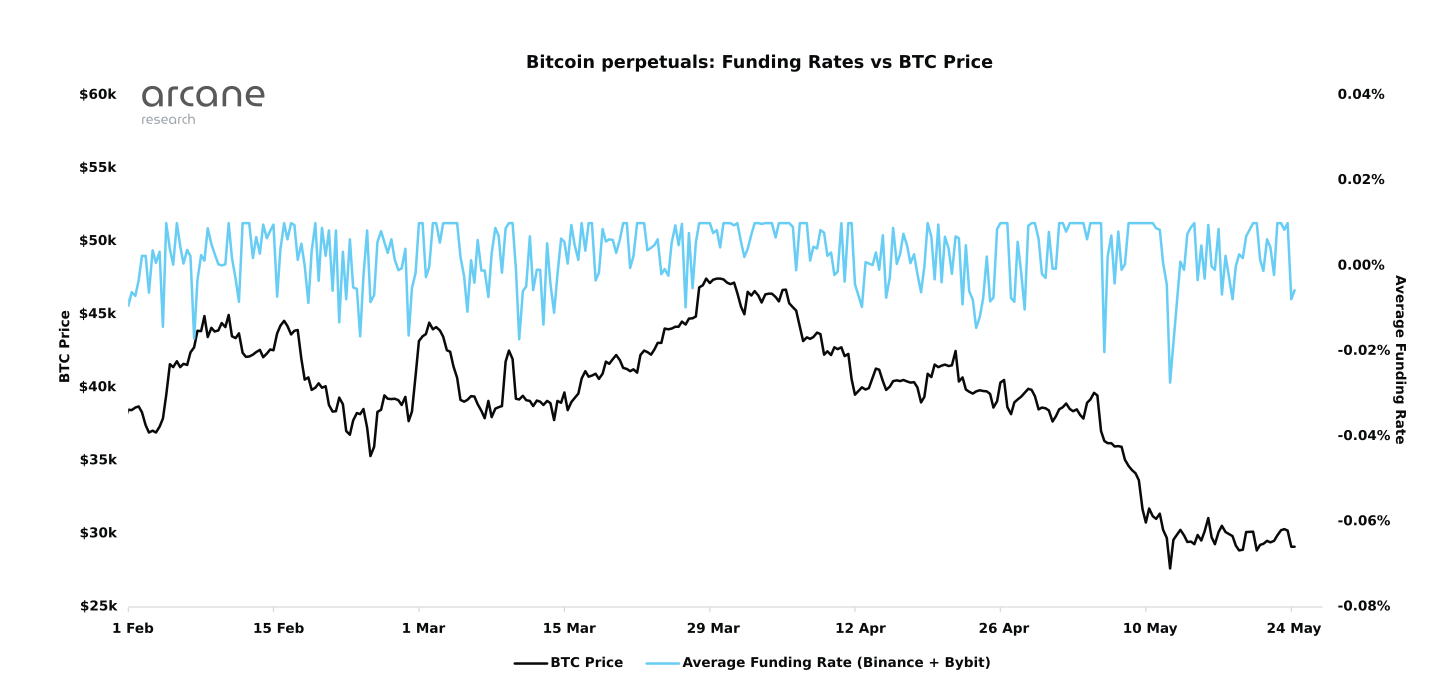

After a quiet week in the market, we see no noteworthy changes in the sentiment in perps as funding rates still trail at or below neutral.

Since the sharply negative funding rate on Binance on May 12th, funding rates have resumed to trailing below the neutral 0.01% level.

Five of the 21 funding rate intervals on Binance and Bybit have seen neutral funding rates, while the remaining 16 intervals have seen funding rates below neutral as perps continue to trade at a discount to spot.

…But under the hood leverage is surging

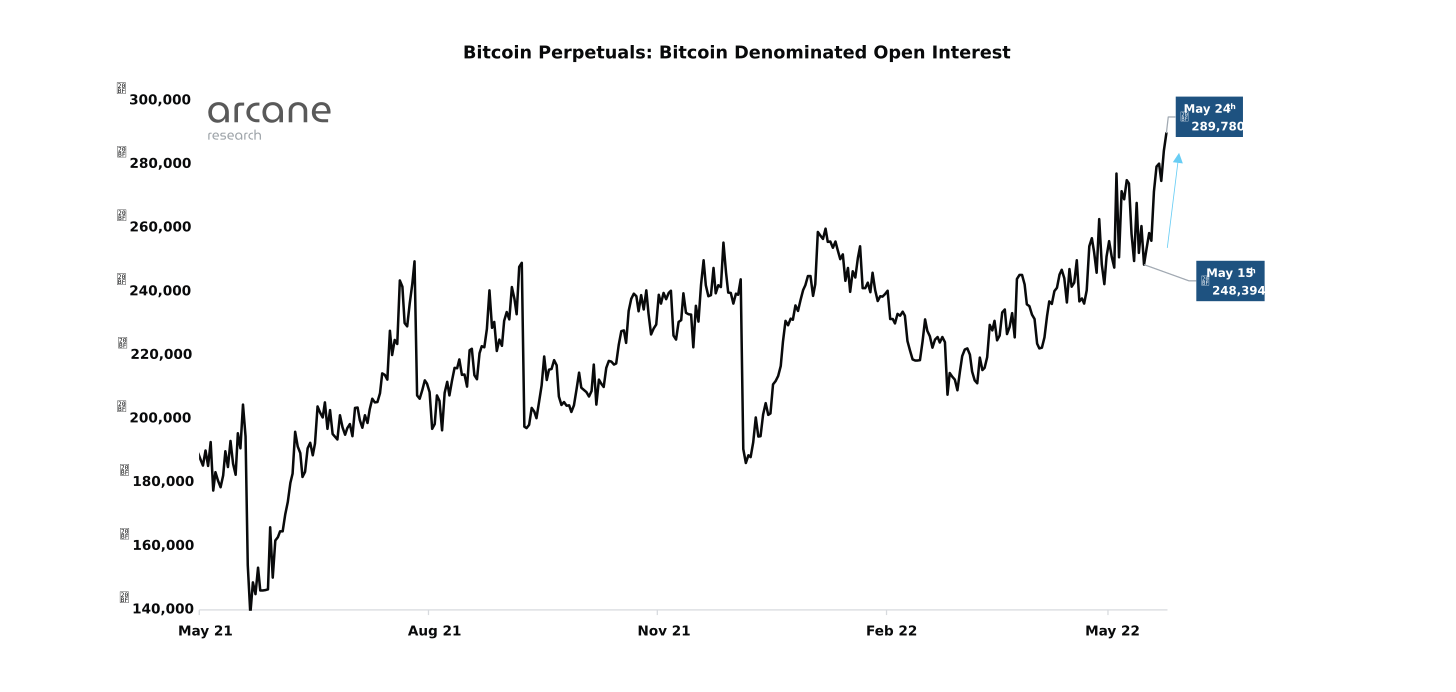

Open interest in perps is once again surging. The BTC denominated open interest has grown by 41,000 BTC since May 15th, leading BTC denominated OI to reach a new all-time high of 290,000 BTC.

BTC denominated open interest in perps has once again grown towards new highs in an otherwise dull and quiet market. Since bottoming on May 15th, the BTC denominated open interest has grown by 41,000 BTC while bitcoin has traded in a narrow range.

The BTC denominated open interest has thus returned to new all-time highs, surpassing the 282,000 BTC high recorded on May 4th.

The growing open interest has mostly been accompanied by funding rates below neutral, and the most pronounced growth over the last week has been seen on Bybit (+18%) and Binance (+12%). This could point in the direction of shorts being most the aggressive contributor to the recent growth.

Rapid surges in open interest tend to foreshadow large moves in the market. We saw a similar surge leading into the July 26th short squeeze and similar surges coinciding with the March top, the legal tender Tuesday sell-off, and the recent LUNA-related crash.

Don’t be surprised if we see surging volatility in the coming days. Buckle up!

👉 Check out the new Arcane Research’s platform

⚡ Bonus

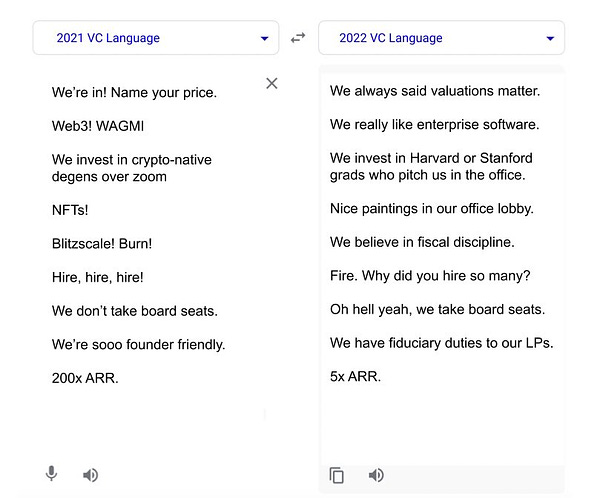

😅 Thanks for the translation! On this topic, an insightful read: Panic in Startupland! by @nbstme

⚡ Highly recommend watching this if you're curious about Bitcoin adoption in El Salvador 🇸🇻. Impressive proof-of-work 👏

👀 There’s a crew of French Bitcoiners (@nicolasburtey, @SebGouspillou, @RichardDetente, @jc_busnel, etc.) going to the Central African Republic 🇨🇫 to check how they could help regarding Bitcoin adoption in the country. Thank you 🙏

✅ She’s right you know

⚡ Any feedback on this much appreciated 👇

🤝 Reach out on Twitter, Telegram and Discord to build together the future of finance on Bitcoin!