#50 - Samson Mow, On-chain Bitcoin deposits, US hours' sell-off and much more!

✨ Samson Mow on hyperbitcoinization

You may know Samson Mow for various reasons: as the former COO of BTCC, one of the largest bitcoin exchanges and mining pools in the world, as a fierce supporter of Bitcoin’s User-Activated Softfork in 2017 (see the excellent UASF chapter from The Blocksize War by Jonathan Bier to dig deeper), as the one of the organizers of the Magical Crypto Conferences, as the former CSO of Blockstream, or for his work on El Salvador's Bitcoin strategy.

Samson recently hit the headlines when he announced his departure from Blockstream to focus on nation-state Bitcoin adoption with his new venture JAN3, which has since secured a $21 million funding. Samson has a lot to say about Bitcoin, and it’s been a pleasure to interview him 🙏

Hi Samson, can you tell us how you got into Bitcoin, what has been your journey so far, and what’s the mission of JAN3, your newly founded company?

Samson Mow: I first got interested in Bitcoin in 2013 after reading an article about mining. I usually give a date of 2014 or 2015 as my official “in Bitcoin” time as that was when I joined BTCChina as COO. So far my journey has been a great adventure and I’ve met many great Bitcoiners along the way.

The mission of JAN3 is to accelerate hyperbitcoinization. We’re pursuing a two pronged strategy of pushing grassroots adoption through our apps and software, while also engaging with governments and leaders.

El Salvador became the first country to adopt Bitcoin as an official currency in September 2021. The Lightning Network technology is at the center of El Salvador strategy. Could it have been possible to adopt Bitcoin as an official legal tender without a scaling solution? Which lessons can we learn from El Salvador so far?

Samson Mow: It could still have been possible for El Salvador to adopt Bitcoin without Lightning; they could have just put in place a reserve strategy for Bitcoin holdings. But of course it’s better to be able to adopt Bitcoin as a currency in addition to SOV.

The most important lesson to take away from El Salvador’s Bitcoin adoption is that they are Bitcoin only.

Occasionally a shitcoiner or two will get through and snap a photo with President Bukele, but for the most part they’ve done an excellent job staying away from shitcoiners. Keep in mind that it’s no easy task because nearly every shitcoiner has made great efforts to go to El Salvador to try and affinity scam.

We have recently seen a second country, the Central African Republic (CAR), adopt Bitcoin as legal currency as an alternative to the French-backed CFA franc. What’s your view on the opportunities and challenges for Bitcoin adoption there?

Samson Mow: The challenge for the Central African Republic will be fighting against the last vestiges of the French Colonial Empire and proponents of the CFA franc. Historically, African nations attempting to rid themselves of the CFA franc experienced many setbacks, sometimes violent ones.

Alex Gladstein wrote a very good article about that and it’s essential reading: https://bitcoinmagazine.com/culture/bitcoin-a-currency-of-decolonization

Argentina recently secured a loan from the IMF that included a provision discouraging the use of cryptocurrencies. The fight from international financial institutions is likely to intensify in the coming years. What do you think will be the other biggest threats to nation states adopting Bitcoin?

Samson Mow: Supranational organizations like the IMF are likely going to be a major hindrance as they go about trying to make deals where loans are granted on the condition of rejecting Bitcoin, but also FUD in the media and the popular ESG narratives are also challenges that must be overcome. It’s already challenging for people to understand Bitcoin and all of the misinformation makes it even more difficult.

The best way for us to counter it is to educate at all levels and share knowledge about what Bitcoin is - Bitcoin is permissionless, apolitical money.

As for the FUD and ESG attacks, we must break them down and counter whenever we can. Any application of critical thinking will nullify the best ESG attack they have, but we still need to be out there and doing that.

In the end, it’s just about who has more conviction and dedication. I’m sure Bitcoiners will win.

Your former company Blockstream is one of the leaders in Lightning Network development. After a few years of implementation what is your opinion on where we stand and what will be the direction for the next years?

Samson Mow: There’s still a lot of work to be done to make easy to use non-custodial Lightning offerings. Channel management can still be daunting for new users and that has to change. JAN3 will be operating the AQUA wallet moving forward, and I have plans to add Lightning support there.

I believe the key will be to automate a lot of the complexity for users so they don’t need to rely on custodial solutions but still have ease of use.

Hopefully we can also make some progress on the UX aspect to benefit the broader ecosystem.

⚔️ LNM Fam

🆕 We’re happy to onboard the next generation of Bitcoin derivatives traders to the Lightning Network with our latest release ⚡

Now you can choose to deposit sats to lnmarkets.com with a classic on-chain Bitcoin transaction in addition to instant deposit with the Lightning Network.

This release also includes the possibility for options traders to close their calls and puts before expiry.

💡 Here’s a new platform to share any suggestions you may have on how to improve LN Markets and vote for other ideas without any registration! So far, the most upvoted proposal is “wen $LNM token” 😅

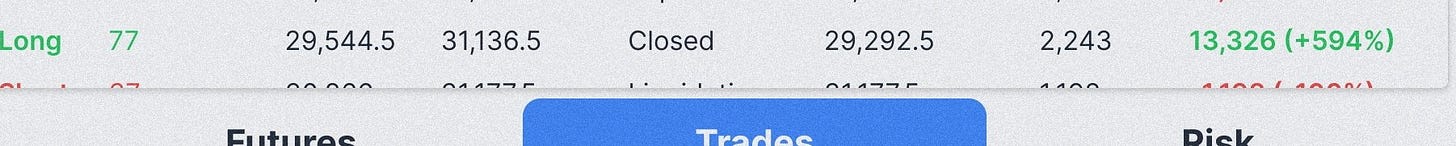

🏆 Congrats @mugenclown for a nice 100x long opened at $29.5k and closed at $31.2k to net 4 million sats and top the weekly leaderboard!

📊 The entire BTC sell-off since April occurred during U.S. market hours

🖊️ By Vetle Lunde

The entire bitcoin sell-off since April 1st has occurred during U.S. trading hours. The cumulative YTD BTC returns during U.S. trading hours YTD is -32.55% compared to European +16%.

Since early April, BTC has seen neutral cumulative returns during European and Asian trading hours. Meanwhile, BTC’s YTD cumulative returns during U.S. trading hours have plummeted from 4.2% on April 1st to -32.55% by June 6th.

This suggests that the sell-off in bitcoin since April has been driven by American traders, which aligns well with the trend of BTC being strongly correlated to U.S. equities ever since we entered Q2, 2022.

Nevertheless, this should not be interpreted as U.S. sellers alone contributing to BTC’s weak performance. Traders globally, and in particular, market makers and funds, have likely sought to de-risk alongside the broad equity markets, using Nasdaq and S&P 500 as a proxy for the overall risk appetite.

👉 For more insights, check out the new Arcane Research’s platform

⚡ Bonus

🤯 Fascinating insights on the future of Bitcoin

👋 hello Michael

😎 Well memed dear Cypher CM Koty!

🤝 Reach out on Twitter, Telegram and Discord to build together the future of finance on Bitcoin!