#54 - Bitcoin Reformism with Dennis Pourteaux, LNM World Cup, Latest Strikes, and much more!

🎙️ Bitcoin Reformism with Dennis Pourteaux

We are big fans Dennis Pourteaux's insightful and humorous writings and tweets on a wide range of subjects, including geopolitics, digital sovereignty, humanism, and of course Bitcoin.

Dennis is a native Iowan with an MPH from Harvard, MD from the University of Iowa and is a board-certified micrographic surgeon. He divides his time between academic and clinical pursuits, and support for entrepreneurs as an advisor and investor. His domain of expertise includes frontier technology in distributed systems (encryption, p2p) and in medicine (telemedicine, AI). He believes that encryption and p2p technology help protect individual sovereignty and human rights.

He opened his first account on MtGox in 2012 and has been an active advocate for bitcoin ever since. He taught bitcoin as a guest lecturer at Harvard Business School (HBS) and was a member of the HBS Bitcoin club. He is the co-founder of Huat Ventures, an industry agnostic VC firm which has invested in several cool companies such as Umbrel, Swan or Rain among others.

Many thanks to Dennis for his prompt and enlightening responses to our questions 🙏

You do a lot of stuff. You’re a Harvard graduate, a skin cancer surgeon, a VC investor, a human rights defender, a world traveler, and of course you’re on twitter everyday. How did you get into Bitcoin and what made you stay?

Dennis Pourteaux: I remember once in residency, one of my attending physicians (the ones who wear the long white coats and boss around the trainees with shorter white coats) gave me this as criticism—that I “lack focus.” I think it’s true! But it’s the way I am: I have a lot of interests and most of them don’t have any obvious overlap or synergies. However I let my interests lead where they may, I don’t try to steer them towards someone else’s expectations.

And, I think there are a lot of benefits to having far flung interests. First, you never know when the side thing where you have a pet interest may grow into something you spend most of your time on. That’s what happened to me with bitcoin, which I will go into more. Second, it helps you detect bull shit. I’m a skin cancer surgeon, so when I see someone make bogus claims about sunscreen or some other such health nonsense, it reminds me to be suspicious about other claims that person makes in bitcoin or geopolitics or whatever else. Third, sometimes there is overlap that you don’t expect.

When I first got into bitcoin, it had precisely zero geopolitical or human rights relevance, and nine years later all these interests converged.

Finally, learning should be an end in itself—learning is good just for the sake of learning without needing some concrete payout.

As for how I got into bitcoin: at the end of the Fall 2012 semester in medical school when I should have been studying for final exams, I instead was reading about the Silk Road and how it was enabled by this upstart payment technology, “Bitcoin.” Based on my experience with other peer-to-peer networks (like torrents), using internet moneys on MUDs, and informed by my years as an Objectivist and Libertarian from my high school days, I instantly groked that Bitcoin was going to be big. Back then, it was pretty hard to buy bitcoin, and with my busy medical school schedule I didn’t have any time to figure out mining. So I ended up opening an account on MtGox and sent MoneyGrams to Japan to fund it and buy my first bitcoins. I made a few more purchases and still mostly just hold these original coins. I don’t do any trading, apart from experimenting with things like lightning or OP_RETURN, or trying out different wallets, Omni, Liquid, and experimenting with my Umbrel node and getting liquidated on LN Markets, of course.

How do you think Bitcoin can help foster greater adoption of human rights all around the world?

Dennis Pourteaux: I didn’t realize the potential upside for human rights in bitcoin in those early days. I knew that bitcoin allowed people to bypass unjust drug laws, for example, but hadn’t considered how bitcoin might be useful to dissidents or refugees fleeing a tyrannical government. In part, this was because I wasn’t as well informed of the world in 2012/2013 as I am today (though I still have a long way to go). Over the last 5 years or so, I’ve spent a lot of time on the front lines between freedom and tyranny. I’ve had many trips to Hong Kong prior to their National Security Law, I visited Cuba before and after the US embargo, I visited the DMZ in Korea, traveled throughout Taiwan, and recently returned from visiting both sides of the wall on the West Bank between Israel and Palestine.

Along the way, I’ve met countless people who are victimized or threatened by tyrants in their own backyards.

What could be more valuable to them than the ability to shield all their savings in an immutable ledger, and out of reach from these authoritarians?

Alex Gladstein has done amazing work documenting specific examples of dissidents and refugees doing exactly that—when a Venezuelan wants to protect their wealth from inflation, or when a Ukrainian needs aid, or when a Hong Kong dissident is threatened with a frozen bank account—suddenly they have options.

What makes Bitcoin different?

Dennis Pourteaux: Bitcoin is special. Bitcoin has properties that can never be replicated on another protocol. I’m a bitcoiner first and foremost, but I do think there are valuable things happening elsewhere too. I wrote an article on this topic awhile back. I think I said it best there:

“Bitcoin was first. It has the Lindy effect: the longer it has been around, the longer it is expected to remain. You can’t re-engineer that on another coin. Bitcoin had the fairest launch: there was no “pre-mine” and for a long while, the value of bitcoin was essentially zero. Now that crypto is obviously valuable, this “immaculate conception” can never happen again. Bitcoin is crypto’s Schelling point: it’s the default for crypto natives and crypto newcomers. Bitcoin has the broadest distribution. It has the deepest markets. It has regulatory clarity. It has the smallest surface area for attack and is the most battle tested. It is the hardest to change so you can count on its monetary properties and technical robustness. It is being used today to protect dissidents and activists. Bitcoin is special.”

I first heard “Bitcoin is Special” from Andrew Bailey, and to me it is a more thoughtful way to express the primacy of bitcoin while also acknowledging and being excited about things like stablecoins, NFTs, and DeFi that just aren’t meaningfully possible on today’s bitcoin.

Your Bitcoin Improvement Proposal labelled “Bitcoin culture: burn it to the ground” has fueled a big debate around Bitcoin maximalism. Why do you think the cultural aspects of Bitcoin are important for its long-term success?

Dennis Pourteaux: It goes without saying, but I realized this “BIP 666” would be controversial when I wrote it. However, I wrote it from a place of love—like I said, I am a bitcoiner first and foremost, and I feel that criticism and reform only work when it comes from within. Basically, I’ve been disaffected by the culture war fads and charlatanism that has been stapled onto bitcoin in recent years. Some of the online bitcoin community has been captured by populism, reflexive contrarianism, and incel 4chan culture that discredits our bitcoin thesis and other bitcoiners like myself. It’s like what I mentioned before—I had the good fortune to study medicine and public health for a long time, so I can effortlessly pickup on nonsense health or diet advice when I see it, and it’s unfortunate to see bitcoin’s reputation dragged down with this dead weight. Similarly, when big bitcoin accounts stan dictators in El Salvador, Russia, or even nameless American ex-Presidents, it undermines bitcoin’s human rights value proposition.

Now, I know that “bitcoin is for everyone,” and that is the classic defense to these criticism I make above. The problem is, that today’s bitcoin culture isn’t the permissive, accepting place that it needs to be in order to be a big tent (or, “for everyone”). Its online narrative instead is this populist authoritarianism that may work as a growth hack online, but is a dead end for normies. Normies like the freedom to experiment and silly JPGs and don’t want to be converted to a certain diet or rigid political philosophy. I’ve been making this argument for a long time. Nearly a year ago, I lamented “the Tucker Carlson-ization of btc as something like a post apocalyptic bunker asset to store next to your meat locker and ivermectin stash.” I’m happy to see the message finally breaking through. In the end, only a bitcoiner (someone on the inside of our community) can change the culture, and more and more of us are joining this effort.

Are you bullish on Taro, RGB and tokens on Bitcoin & Lightning in general?

Dennis Pourteaux: I’m bullish on tokenization in general, I’m just not sophisticated enough to know which is the best route (ie, bitcoin L1, bitcoin L2, or better to have on another network). One risk that resonates with me is that we don’t want to create perverse incentives for bitcoin miners or MEV like we see on other protocols because it could undermine bitcoin’s core value as a neutral hard asset. I had an exchange with Vitalik about this a few months ago where he seemed to acknowledge this argument. At the end of the day, I see this more as an engineering problem—there must be ways to build tokens on top of bitcoin that doesn’t create perverse miner incentives or MEV, but I’m not sure what it will look like.

Tokenization is here to stay, so I’m glad there are people working on this.

I also think we need good bridges between bitcoin and other networks, so that bitcoin can be used there while letting those other networks bear the risk inherent with tokenization and new experimentation so that the bitcoin network doesn’t have to.

What are the main lessons you learned from investing in Bitcoin & crypto companies?

Dennis Pourteaux: I’m pretty stubborn and it took me a few years to learn to not be emotional or dogmatic about crypto investments. Apart from true ethical concerns, ideology should have no place in investment decisions and is a great way to lose money.

You have to be willing to change your mind and be honest with yourself about your own biases or blind spots.

For example, in the very early days I was a pretty ideological bitcoiner (what people today call maximalists, but without all this new culture war baggage). Back in 2016, I saw that I was wasting all this time and emotional energy fighting with internet strangers about Ethereum. In a moment of honesty with myself, I realized that a lot of the reason why I was so tied up in this drama was because I had this big bitcoin position, and for it to reach my expectation of being a platform on top of which everything else was built, I felt that it had to eat all these altcoins. Of course, I don’t get to decide which coins go up or down, but I do get to decide how I spend my time and energy. What I did was I just picked up a little Ethereum as a hedge. If it goes up, I can celebrate, and if it goes down, I can be reassured that my old ideology was correct. That small position also motivated me to read and experiment with Ethereum, and in the end, both assets went up a lot and I saved all that time I would have spent arguing with neckbeards on r/bitcoin over an outcome I had no control over.

The takeaway is this: if you find yourself wasting a lot of time and energy perseverating over an asset you disapprove of, consider whether you have some biases baked into your thesis as a consequence of your own holdings, and even consider picking up some of that forbidden asset. The worst case scenario is that you learn something.

(Not financial advice)

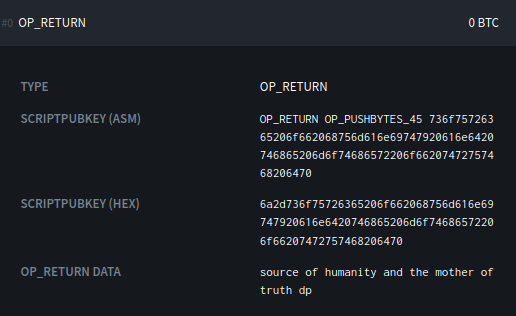

Finally, what does your OP_Return mean?

Dennis Pourteaux: OP_RETURN is an incredible speech tool and it overlaps a lot with my interest in human rights. I wrote a long thread on the history and importance of OP_RETURN. To those not familiar, OP_RETURN is a bitcoin operation that allows you to embed a message in a bitcoin transaction that benefits from all the immutability and censorship resistance of any bitcoin transaction. It has been controversial in the past because some developers thought that it was being abused and driving up transaction fees as a means to create tokens and perform other functions on bitcoin. OP_RETURN is how the Omni protocol worked to bring Tether to bitcoin, and how Counterparty worked to bring Rare Pepe NFTs.

But, you can also use OP_RETURN to write simple messages, like I did here. This phrase “source of humanity and mother of truth” is an excerpt from a speech by the famous Chinese dissident Liu Xiaobo. This speech was intended to be his Nobel Peace Prize acceptance speech, but he was in a Chinese prison and thus couldn’t attend the award ceremony. He died soon after his release. Here, he was describing the importance of the freedom of expression. The full quote is:

“Freedom of expression is the foundation of human rights, the source of humanity, and the mother of truth. To strangle freedom of speech is to trample on human rights, stifle humanity, and suppress truth.”

When I was first learning to create OP_RETURN transactions, I wanted to broadcast something that really deserved to be on the blockchain forever. Bitcoin blockspace is precious, after all. I spent an afternoon brainstorming what to include, and arrived at Liu Xiaobo’s famous speech and initialed it with “dp.” Ninety thousand confirmations later, this phrase is forever on the bitcoin blockchain, and the Chinese Communist Party could muster up all their resources trying to remove it and they’d still fail.

👉 To stay in touch with Dennis: https://linktr.ee/pourteaux

⚔️ LNM Fam

You talked, we heard. And bring you in LN Markets’ latest release:

⌛ Options with longer expiries: 24h, 1 day, 2 days, 1 week

👛 Taproot address support for on-chain #Bitcoin deposits

➰ Free Loop In (from on chain to Lightning) which respects your privacy

😋 New units view: easily switch between SATS, USD, BTC and decided whether to display icons or not in your settings

Any idea for new feature or product? Please let us know here!

We shared some cool Lightning metrics ⚡

We have been mind blown by the performance of our top tradooors:

⚽ And we are announcing a fun game for a good cause. Join us!

⚡ Latest Strikes

A brief recap of what’s new in the Lightning world (full version here). Fasten your seat belt and put on your helmet as we drive irresponsibly fast into the storm!

Ecosystem

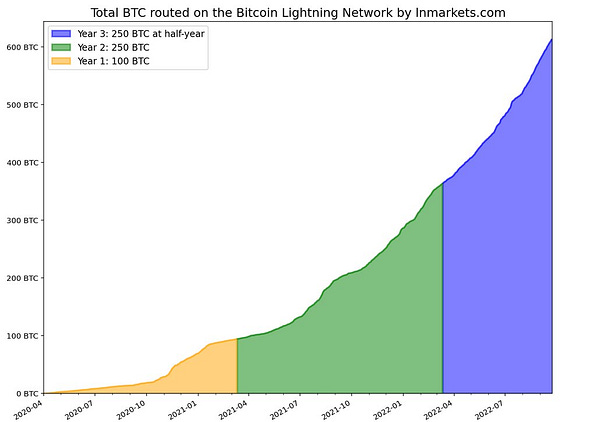

Some Numbers for the Nerds

Kevin Rooke opened the ball of statistics this week with an interesting comparison of exchange nodes capacity and its evolution over the last 30 days. We can see that the 13 exchanges considered in this analysis saw a collective increase of their public capacity of 349 BTC, which is a 20% increase! This major surge has been mostly carried by River and Kraken, with respectively a 56% and a 32% increase, while all other exchanges fall under the mean evolution of 20%.

Still, one should remain cautious when analyzing these raw numbers, as they don’t tell whether this increase comes from exchanges deploying liquidity, or other people (customers, other services and platforms, routing nodes, etc.) connecting to them. Some on-chain analysis could help us draw a clearer picture, but it is a work that remains to be done.

On the network-wide aspect, it also seems like we just broke 5,000 bitcoins deployed in public channels!

Strike Raises $80 million

Looks like Strike just raised 80 million dollars in a Series B led by Ten31. 🚀

Bitcoin Exchange Bitnob Now Live in Kenya

People in Kenya can now use Bitnob to buy, sell, receive and send Bitcoin, including over Lightning. As Bernard Parah higlights, this is a huge deal in a country where the Bitcoin market is increasing at great speed, but where remittances are still vastly carried out by Western Union and the like which impose their oligopolistic fees and conditions. Thanks to Lightning, Kenyans can no receive Bitcoin from anywhere in the world, instantly, and easily thanks to the support of Lightning Addresses by Bitnob.

First TARO Release

Lightning Labs just released an alpha version of the Taro daemon tarod to issue, send and receive assets on Bitcoin using the TARO protocol. I must confess I’m impressed because, even if the feature set is still limited today, I expected the development of this first alpha version to take more time, in spite of the amazing 70 million dollars raise a few months ago (money doesn’t provide everything, right?). Well done team!

StackerNews Release

Stacker News latest release introduces downvotes to the forum. Each downvote costs 1 sat and effectively lower the rank of the downvoted item. If enough downvotes are cast on an item, this item will be outlawed and removed from view. At the same time, a new Wild West Mode is available, which allows users to opt-out from this new feature and wander in the website as they did before, without any effect from downvotes. Sounds like moderation done right!

New THNDR game drop

A new THNDR game dropped, and it’s already decimating the productivity of Lightning enthousiasts at large! Club Bitcoin: Solitaire reinterprets the iconic Solitaire game, with a Lightning topping and sprinkles of sats everywhere. You can download the game with my link (super cool and free way of supporting the content you’re reading) or without (still cool, love ya). (productivity notice: higly addictive!)

👉 Dig deeper on Wallets & Tools, Papers and much more here. If you enjoyed this recap, you can show your appreciation by throwing a few coins in the jar. Thank you!

⚡ Bonus

👀 Focus on the outstanding Bitcoin Ekasi project in South Africa. Join us here, have fun, and assist them in creating a Bitcoin-based economy in a township in South Africa!

🎯 The Minneapolis Fed President is absolutely correct on CBDCs!

😬 Monkey’s right, you know

🤝 Reach out on Twitter, Telegram and Discord to build together the future of finance on Bitcoin!

Any suggestion to improve LN Markets? Please share it here.