#63 - Roy Sheinfeld, LNM fam & Lightning friends

We first met Roy “in real-life” in El Salvador for the first Adopting Bitcoin conference in 2021. Prior to this, we had extensive discussions with Breez team to prepare the integration of LNM directly into their Apps store, where we could note their responsiveness and high degree of professionalism.

In San Salvador, we were also pleasantly surprised with Roy's immediate kindness and willingness to help. On the very first night we met, he connected us with several VC fundsand provided valuable insights on how to maximize our experience at the conference.

Roy is absolutely dedicated to his mission of revolutionizing Bitcoin's role from a store of value to a widely adopted medium of exchange for everyday commerce. That’s why he founded Breez. That’s why he thinks and writes extensively on the future of the industry. And that’s why we are most pleased that Roy accepted to be part of our humble newsletter 🙏

Hey Roy, how did you fall into the Bitcoin rabbit hole?

Roy Sheinfeld: In 2013, I held the position of CTO at harmon.ie, an enterprise B2B software startup. During that period, Akiba, who was the IT department manager at the time and is now one of my partners at Breez, began enthusiastically discussing Bitcoin. His relentless enthusiasm prompted me to read the whitepaper, and I was captivated by its ingenuity and the underlying game theory. Intrigued, I purchased some bitcoins and began monitoring the industry from a distance. However, it wasn't until the emergence of Lightning in late 2017 that I truly immersed myself in the world of Bitcoin, devoting nearly all my time to it.

Why Breez?

Roy Sheinfeld: In 2018, we established Breez with the intention of revolutionizing Bitcoin's role from being merely a store of value to becoming a viable medium of exchange. During that time, there was a prevailing belief that Bitcoin should solely function as digital gold, disregarding its potential as an everyday currency. However, I firmly believed that Bitcoin could achieve its maximum potential only when people began utilizing it as a currency in their daily transactions.

The introduction of the Lightning Network provided an opportunity to realize Satoshi's vision of peer-to-peer electronic cash, enabling the use of Bitcoin in everyday commerce.

Nonetheless, as a layer 2 solution, Lightning brought forth a new set of challenges, tradeoffs, and user experience issues. Recognizing the need to address these obstacles, we embarked on the journey of creating Breez, with the primary objective of enabling individuals without technical expertise to seamlessly incorporate Bitcoin into their everyday payment activities.

You’re a great writer on several topics, including of course the development of the Lightning Network. How do you view the maturation of the ecosystem?

Roy Sheinfeld: Thank you! In this article, I delve into the maturation of Lightning Network, highlighting the vertical differentiation and specialization that indicates its progress. The current trend within the Lightning ecosystem is that companies are increasingly focusing on specific niches to deliver exceptional user experiences. Unlike the early days, where the emphasis was on building generic infrastructure software like nodes and wallets, the ecosystem has now diversified significantly. Various companies are developing products tailored for specific industries, such as merchants (e.g. OpenNode, IBEX), gaming (e.g. Zebedee, THNDR Games), streaming media (e.g. Wavlake, Fountain), financial trading (e.g. LN Markets, Kollider), social platforms (e.g. Sphinx, Geyser), and news (e.g. Stacker News), among others. This specialization enables these companies to provide more targeted solutions and cater to the unique needs of their respective industries.

However, I believe this vertical specialization is just a single step in the right direction. In order to further scale the Lightning Network, it is crucial to connect it with other technologies.

Instead of solely focusing on developing more Lightning apps, we should strive to integrate Lightning functionality into new and existing applications.

By doing so, we can unlock the immense value of programmable, peer-to-peer money. The key lies in making the Lightning technology accessible to developers outside of our current ecosystem. So, while the vertical differentiation and specialization within the Lightning ecosystem demonstrate its maturation, the next crucial step is to integrate Lightning into a broader range of applications. This will expand its reach and impact by making it accessible to developers beyond the current Lightning community.

Which potential developments or features are you most excited about in Bitcoin/Lightning?

Roy Sheinfeld: Everything about Lightning excites me lol. There are several notable enhancements to Lightning that I think have the potential to significantly improve the current user experience:

Splicing: Lightning is a liquidity network and liquidity allocation is a critical aspect of it. Splicing allows for variable channel capacity rather than fixed capacity which enables Lightning Service Providers (LSPs) to reallocate liquidity while maintaining a seamless user experience.

Asynchronous payments: Currently, non-custodial Lightning app users need to keep their app open to receive payments. Asynchronous payments, facilitated by LSPs, address this issue. The sender's LSP holds the payment until it receives an onion message from the receiver's LSP, indicating that the receiver is back online and ready to accept the funds. This approach improves the user experience and opens the possibility for features like Lightning addresses, which are currently more prevalent in custodial wallets.

Stuckless payments: Occasionally, payments on the Lightning Network can become stuck and remain unsettled or canceled due to various reasons, such as an intermediary node going offline or a malicious node locking the HTLC (Hash Time-Locked Contract). This situation ties up the sender's funds until the HTLC's timelock expires. Several proposals, including PTLCs (Point Time-Locked Contracts), aim to address this issue and enhance the Lightning user experience.

These enhancements represent significant steps forward for Lightning and by implementing these advancements, Lightning can become even more robust and user-friendly.

What are 3 pieces of advice you would give to someone who wants to build a business in the Bitcoin space?

Roy Sheinfeld: When it comes to building a business in the Bitcoin space, there are a few key pieces of advice that can set you up for success:

Embrace the Bitcoin community: Bitcoiners are a passionate and purpose-driven group. Engage actively within the ecosystem and leverage their energy and enthusiasm to your advantage. Foster transparency and collaboration, as working together with fellow Bitcoin enthusiasts can accelerate your progress towards achieving your goals.

Prioritize open communication with the market: Building in public and engaging with your target audience early and frequently is crucial. By involving them in the development process, you gain valuable insights and feedback. This approach enables you to better understand your audience, refine your products or services, and deliver solutions that truly meet their needs. Bitcoiners are known for their willingness to test new ideas, making them an excellent source of input and validation.

Seek partners, not just investors: While securing funding is important, it's equally vital to find the right partners who align with your mission. Look for investors who not only bring financial resources but also offer expertise, connections, and a shared vision. These partners should be genuinely invested in helping your company grow and succeed. By considering them as true collaborators, you can tap into their knowledge and support to elevate your business to the next level.

If you enjoy LN Markets’ newsletter, help us spread the word 🤗

⚔️ LNM Fam

We have pushed another release release on LN Markets with:

🔥 An increase in trading limits:

0.1 BTC = 10,000,000 sats of Margin per trade

1 BTC = 100,000,000 sats of Margin Used for open positions per account

✅ A single price reference for options: the Futures price

📊 A new order type: the stop limit order. It's a limit order that can be triggered when the Futures prices:

goes down to a given price for Long orders (example: setting a long limit order if BTCUSD goes down to $25,000)

goes up to a given price for Short orders (example: setting a short limit order if BTCUSD goes up to $40,000

☂️ LNM Umbrel app update with a minimalist approach to simplify further releases

On a different note, the second quarter of 2023 is already behind us (less than a year before next halving 🥳) . We would like to thank you all for another fantastic quarter and a record-breaking June with $50 million in monthly trading volume on the platform. In Bitcoin terms, June achieved a significant 1,750 BTC in monthly trading volume, marking it as the second-best month in LN Markets’ history.

👉 More info on our Q2 performance in our investor Arcario’s press release.

🧮 Deep dive into Oracle-Based Conditional payments

In our previous blog post on DLC (Discreet Log Contracts), we discussed the essential cryptographic primitive required, which is a verifiable witness encryption scheme. However, it's important to note that the evolution of this concept was not a straightforward process and involved the collaborative efforts of many individuals, starting with Dryja's original application idea.

In this post, we begin by explaining the process of utilizing a private key as a decryption key for signature, thereby transforming it into a trigger for a transaction. This leads us to delve into the concept of adaptor signatures, specifically in the context of Schnorr's signature for the sake of simplicity. Subsequently, we delve into the definition of an oracle attestation, enabling efficient communication of which private key will be revealed based on the attested event.

Finally, we present the three main proposal protocols for DLC (Discreet Log Contracts). We start with an overview of Dryja's original proposal, followed by the current proposal that incorporates adaptor signatures. Additionally, we present the most ambitious proposal, known as ObC payments (Oracle-Based Conditional payments), developed by Llyold Fournier. ObC payments leverages a truly verifiable witness encryption, optimizing efficiency through the interaction between BLS signatures, identity-based encryption of Schnorr's signature.

This post will be technical, there will be maths! Do you have time ahead to focus? If yes, then grab your mug of tea or coffee and enjoy the ride!

☕ https://blog.lnmarkets.com/cryptography-of-dlcs/

⚡ Latest strikes

👉 Do you know that you can get a weekly email with the best of what happened in the Lightning space? Just subscribe to LN Markets blog and enjoy the delicacies prepared by our chef Fanis Michalakis!

👀 Need to see it to believe it? Check the latest issue here where we cover Ambucks, Lightning in the Pocket, VLS beta release, updates on specifications and implementations and much more!

🎁 Bonus

😇 More importantly, it seems like our friend Javier Bastardo, new Forbes contributor, is already pushing in the right direction!

🏃♂️ Bitcoiner Nomad is launching his iron man preparation with style. Give him a follow to support him!

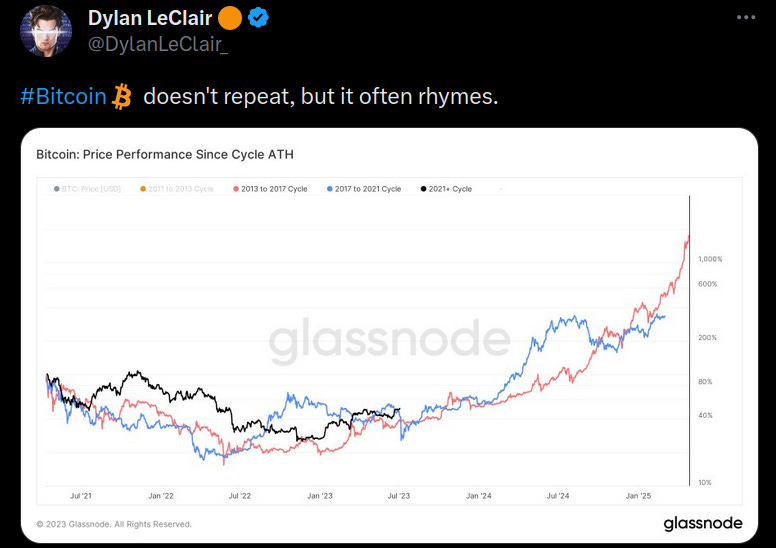

🐂 And some free hopium to conclude this issue!

🤝 Reach out to build together the future of finance on Bitcoin!