#8 - July 24th, 2020

⚡Our two sats on DeFi, Lightning proposal, 1-click LN, GPT-3, and much more!

Welcome to the 8th issue of this newsletter which covers market trends, Lightning Network developments and updates about LN Markets.

If you enjoy this content, feel free to spread the word!

👨🌾 DeFi

We have been following the DeFi craze from a distance, since well, as you know, we are more focused on building on Bitcoin’s Lightning Network.

Sam Bankman-Fried, co-founder and CEO of the exchange FTX , has recently published a great thread to demystify the dynamics of this very hot topic:

Quick summary:

DeFi numbers look good: total locked value has exploded, from $1 billion in June to more than $3 billion today, Automated Market Makers trading volumes are also rising (above $80 million for Curve Finance on July 19th), DeFi governance tokens (MKR, LEND, COMP, etc.) are worth billions.

But this volume is currently mainly driven by stablecoins and governance tokens of DeFi platforms locking, trading, and lending stablecoins against each other.

Why? Because in their quest for liquidity, each DeFi platform incentivises (=pays) its users to lock, trade and lend: around $1 million total national value is paid to “yield farmers” daily.

How can DeFi platforms pay such amounts? Usually, they airdrop governance tokens to their users, these tokens can quickly gain huge valuations and attract retail traders. In the end, that’s retail traders purchasing DeFi governance tokens at higher and higher valuations who enable DeFi platforms to pay yield to their farmers.

So, this is the current state of the DeFi-nomics: more liquidity incentives lead to more total locked value, which drive higher token valuations, which leads to more liquidity incentives, etc. All subsidised by governance token buyers.

Sam concludes that if the DeFi growth so far has been almost entirely marketing-driven, that does not mean there is no substance in it, quite the contrary. But the real question is whether these platforms will start creating revenue and value for users?

If you caught the DeFi fever, Qiao Wang, certainly one of the best “DeFi analysts” recently shared some sobering thoughts:

Side note: Ethereum fees are currently skyrocketing due to the DeFi hype, a layer 2 solution would certainly make sense here 😘

🧐 Our two sats on DeFi

How can we define the value proposition of decentralization for finance?

In our view, Bitcoin is the first decentralized financial network, and the value proposition of its decentralization mainly boils down to censorship resistance.

By analogy with Bitcoin, a truly decentralized exchange would enforce censorship resistance: it would guarantee that its trading rules are transparent and can not be altered by anybody, not even a government.

The term DeFi is mostly used to refer to the so-called “Decentralized Exchanges” and “Automated Market Makers”. They have mainly been developed on Ethereum so far, but coding public smart contracts is highly challenging. And the possible attack surface increases exponentially with the complexity of the code. Hence, most DeFi contracts have back doors in case of major issue, meaning that they are not censorship-resistant.

As we do no expect Ethereum design to change anytime soon, DeFi built on Ethereum will probably never be able to deliver the true value proposition of decentralization: censorship resistance.

Decentralization will not happen on Ethereum.

To label these financial contracts, the term open source finance would be more relevant (but certainly less catchy) than DeFi in our view. They are more transparent in the way they deal with the funds. But they remain centralized, since there is trust involved in a smart contract, or in the person that can freeze assets locked in a smart contract…

Over the long run, after the rise of DeFi governance tokens stops subsidising the whole field, end users will be faced with a trade-off.

Trading on open source finance services, they will benefit from a better transparency, NOT a better control over their funds. We do not think that the benefit of transparency will be sufficient for large players like hedge funds or big whales to take the risk of having their assets stuck in a smart contract.

With LN Markets, we took a different road. We have decided to focus on the speed of fund transfers. We believe that it is a strong value proposition, much stronger than transparency. Anyone who has regularly transferred large amounts of bitcoins knows the terrible feeling of having to wait for an hour to be sure that your transaction is finally done.

Time is a risk. The faster you move your funds, the happier you are!

🤓 Upgrading channels without on-chain transactions

Olaoluwa Osuntokun, CTO of Lightning Labs, shared a new proposal that would allow on-the-fly upgrades of Lightning channels commitment mechanisms to support new channel constructions without having to close channels:

It is a big deal since with the upcoming Taproot Bitcoin soft-fork, the design space of channels will dramatically increase, and being able to swap out channel types on-the-fly will add “yet another level of extensibility which'll allow LN to continue to evolve in order to support new use cases and functionality (there won't be one channel type to rule them all)”.

🖱️ 1-click Lightning Networks

A key to the success of the Lightning Network is a vibrant ecosystem of Lightning Applications. Therefore it is crucial to provide developers with easy, reliable, and open tools:

Please feel free to retweet or reply if anything comes to mind!

On our end, we strongly recommend Polar for really fast and easy Lightning development and testing. Polar has beed developed by Jamal James, who lated joined Lightning Labs as Lead Frontend Engineer. A very useful tool as showcased here:

🔮 Reading

When we started falling down the Bitcoin rabbit hole, we did not expect that it would lead us to learn so much about the inner workings of national and international payment systems!

Great read by Nicolas Burtey and Chris Hunter on the current digital dollar landscape, how Fedwire and BTC compare as a base settlement layer, how most retail payments systems are Layer 2 networks built on top of Fedwire, and how the Lightning Network, Bitcoin’s Layer 2, will flourish as an open and permissionless payment system in the coming years:

🤯 GPT-3 on Bitcoin

OpenAI has released GPT-3, a text generator trained on an unprecedentedly large dataset. While we are still waiting for our invite to the beta, we already had a lot of fun toying with community experiments.

GPT-3 does not always seem to work properly, but when it does, it’s stunning.. It can write its own articles, or even write some code.

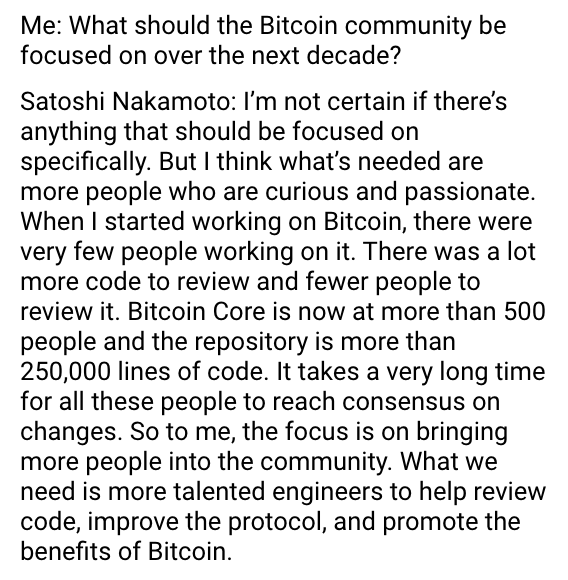

So far our own use has been much more prosaic and centered around GPT-3’s views on Bitcoin. And we have not been disappointed by its impersonation of Satoshi Nakamoto or its Bitcoin tweets:

⚡ Bonus

Thank you Alex Lielacher for a very interesting chat and your article on LN Markets!

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!