Welcome to the 9th issue of this newsletter which covers market trends, Lightning Network developments and updates about LN Markets.

If you enjoy this content, feel free to spread the word!

😃 Why LN Markets?

In this short section, we want to describe LN Markets “raison d’être”.

What is LN Markets?

LN Markets is a new type of Bitcoin derivatives trading platform, one that can only be accessed via the Lightning Network.

Trading is done directly from any Lightning wallet and enables super fast access to derivatives markets. Open a position by making a Lightning transaction, close the position and receive the money directly in your wallet, as easy as that!

Why LN Markets?

We have long been frustrated by our own experience trading on exchanges.

Deposits and withdrawals are slow, complex, lead to bad practices such as leaving funds at-risk on the exchange and overall result in a poor user experience.

We saw in the Lightning Network the perfect technology stack to radically change the trading experience.

On LN Markets, trading is done directly from any Lightning wallet and enables super fast access to derivatives markets. Open a position by making a Lightning transaction, close the position and receive the money directly in your wallet, as easy as that!

What difference with popular crypto derivatives platforms like BitMEX, Binance, FTX, etc.?

Where these platforms focus on the financial aspects of Bitcoin as an investable asset and aim to offer the best liquidity, we rather focus on product simplicity and user’s interaction to access the market.

LN Markets changes radically the way users interact with the market: using the lightning network as an authentication and a settlement layer for margin payments allows to heavily simplify the trading process.

We place the personal wallet at the center, everything is done from there.

Access to trading is not any more limited to a closed interface but can be deported to any kind of support: chat room, web widget, social media platform, etc.

We also simplify a lot the financial product we quote: there is no funding rate, no maintenance margin, no complex fee structure. Everything is quoted in the bid-ask we offer.

Bitcoin is a financial asset and a very powerful infrastructure and we intend to develop both aspects of it.

Bitcoin and the Lightning Network can deeply disrupt the logics in place in the legacy financial system. Programmable assets are very powerful tools that will reshape the standard for a better transparency and risk control.

Our main goal is to offer new types of trading experiences to our users based on the Bitcoin infrastructure and our success will only be measured by the number of people to whom we manage to deliver this message.

🤓 P2P Derivatives

We covered the topic of Discreet Log Contracts (DLCs) in a previous issue. DLCs is a system that could enable setting up contracts between two parties directly on the Bitcoin blockchain, while minimizing the trust required in the oracle that provides external data. The parties can determine the outcome of a contract without them having to notify the oracle.

Crypto Garage has just released their Beta application of P2P Derivatives, an application that uses DLCs, to allow anyone to conduct Bitcoin based financial transactions without the need to put funds in the hands of a third party:

Beta testers can already start deploying financial transactions referencing BTCUSD rates on Bitcoin testnet and regtest, connecting it to a bitcoind instance. Developers can also contribute to the open-source client and supporting libraries.

An exciting step towards more decentralized financial services!

🔮 Reading: LNP/BP

Our favourite kind of reading: when you learn a lot and have fun at the same time! Giacomo Zucco nails it with a very didactic article explaining why the analogy between TCP/IP and LNP/BP makes sense, with hilarious memes along the way.

A great overview of the concept of layers in computer science, their reinterpretation in Bitcoin, and why what we call second layers in Bitcoin is very different than monetary credit systems. Indeed:

Ironically, while the foundational "layer 1" has disappeared from the modern fiat system (central bank certificates aren't redeemable in anything anymore), there has been a proliferation of new "layers" in the upper section of the tower. As an example, when final users today pay via some "FinTech" application like PayPal, Venmo, GPay, AliPay, or ApplePay, they operate on a technical "layer 6", which is mostly based on traditional banking relationships under the hood, which in turn represent a "layer 5" on top of a network of international corresponding banks, which are "layers 4" on top of the local central banks acting in legal monopoly within their jurisdictions, which are but a "layer 3" on top of the more fundamental "layer 2" of the Federal Reserve of the United States of America (again: the "layer 1" is sadly missing: no physical gold redeemability anymore).

🔮 Reading: The Alchemy of Hashpower

Bitcoin mining is a fascinating, opaque and often poorly understood topic at the intersection of energy, hardware and finance.

Leo Zhang, founder of Anicca Research, releases an other mind-blowing, detailed, and data-driven read on the economics of mining. After defining hashpower as an asset class, different types of hashpower assets and their economic value, he details hashpower valuation models similar to the ones used in finance, hashpower-based financial contracts, and hashpower investment strategies:

While we’re at it, it’s worth noting that Bitcoin mining platform Nice Hash has now implemented the Lightning Network for zero-fee Bitcoin deposits and withdrawals!

📺 Video: Hard Money

Have you ever wondered what the terms “sound money”, “Austrian economics”, “low-time preference” or “Cantillon effect” really meant? Or why Donald J. Trump though it was a bad idea to print money 9 years ago?

Well, if you do not have time to delve into The Bitcoin Standard by Saifedean Ammous, this half-an-hour video made by Richard James is here for you:

By the way, what an iconic shot:

⚡ Bonus

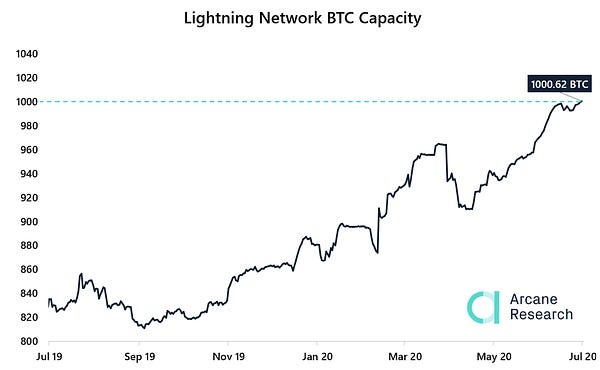

Another Bitcoin metric gets closer to its all-time-high!

All we want for next Xmas is this kind of choir singing the merits of LN Markets:

Special thanks to Chris Stewart from Suredbits for his kind words:

And now dear friends, enjoy your summer!

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!