Bitcoin Futures: mechanics, risks and the Bitcoin paradox

The imminent launch of Bakkt Bitcoin futures contracts will make it much easier for financial institutions to buy and hold Bitcoin. Will the long awaited institutional investors finally enter the Bitcoin market? Hard to say, though Bitcoin futures markets didn’t wait for Bakkt launch to grow big: they already average more than $3 billion in trading per day.

The goal of this article is to provide an overview of Bitcoin futures markets and the risk mitigation policies implemented by different exchanges. We will focus on 3 Bitcoin futures exchanges:

BitMEX, the undisputed leader of the crypto derivatives exchange category, famous for his 100x leverage,

CME Group, which has enabled regulated institutions to get a synthetic exposure to Bitcoin price,

And Bakkt which makes it for the first time possible for financial institutions to physically own bitcoins.

BitMEX Co-founder & CEO Arthur Hayes (left) and CME Chairman & CEO Terrence Duffy (right)

What are futures contracts?

Futures contracts are standardized financial instruments that allow market participants to offset or assume the risk of a price change of an asset over time. Transactions are facilitated through futures exchanges : the largest include the CME Group and the Intercontinental Exchange (ICE) in the US, and Eurex in Europe.

A futures contract is standardized: it clearly specifies the quality, quantity and delivery conditions for a given product (1,000 barrels of crude oil, the 3-month deposit rate in Euros, a bitcoin, etc.). Hence, the only variable of the contract variable is price, which allows buyers and sellers to easily transfer contract ownership.

The Dojima Rice Exchange, the earliest recognized futures trading exchange, established in 1710 in Japan for the purpose of trading rice futures

All futures contracts have a specified date on which they expire. Prior to this expiration date, traders have a number of options to either close out or extend their open positions without holding the trade to expiration. Thus, they can get a financial exposure to the variations of an asset without having to owning it.

But some traders will choose to hold the contract and go to settlement: the fulfilment of the legal delivery obligations associated with the original contract. There are two types of contract settlement: physical delivery and financial delivery (i.e. cash settlement).

Physical delivery of the underlying commodity can be important for some contracts, for example a food producer looking to acquire grain may be looking to take delivery of physical corn or wheat. Or an institutional investor looking for a regulated way to own bitcoin units.

When a contract is cash-settled, settlement takes place in the form of a credit or debit made for the value of the contract at the time of contract expiration. The most commonly cash-settled products are equity index and interest rate futures.

Bitcoin futures contracts landscape

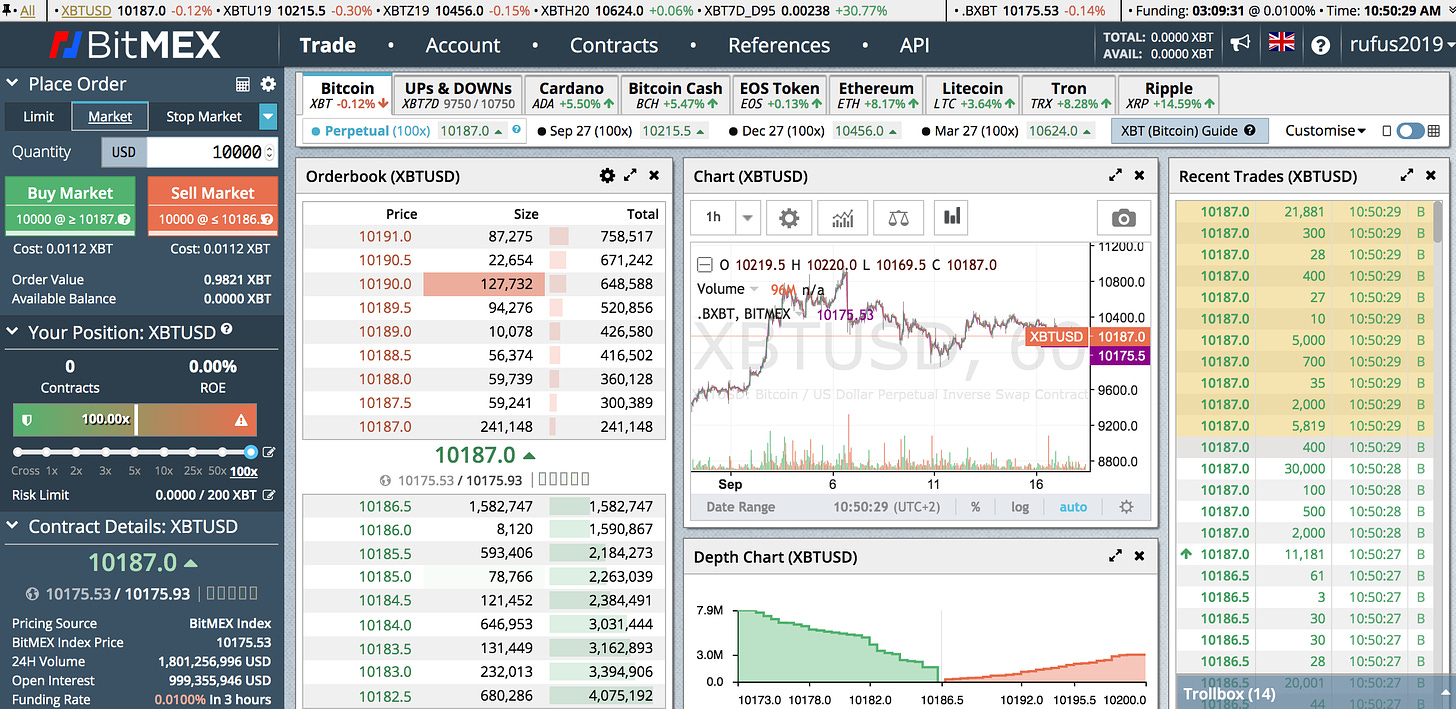

Until the end of 2017, Bitcoin futures traded only on crypto exchanges (such as BitMEX and OKEx) as unregulated assets. These contracts are generally quoted in USD, but all positions are opened and managed in BTC. As these exchanges never deal with USD (or any fiat currency whatsoever), they can operate with much less regulatory constraints than traditional futures market. Hence, they mainly target a retail, crypto-friendly audience.

BitMEX trading interface with its famous 100x leverage

With the rise of volumes traded on these platforms (BitMEX recently traded $16 Billion in one day..), traditional futures markets started to pay attention and work on their own regulated contracts. During the same week, in December 2017, while Bitcoin price was reaching its latest all-time high at around $20k, two major derivatives exchanges: the Chicago Board Options Exchange (Cboe) and the Chicago Mercantile Exchange (CME) started offering Bitcoin futures contracts, financially settled in USD. Regulated institutions could for the first time get involved in trading Bitcoin. However, since these contracts are cash settled in USD, they do not enable financial institutions to actually own bitcoins.

CME Bitcoin futures reached a record $1.7B in notional value traded on June 26, 2019

Since then, Cboe halted listing Bitcoin futures in March 2019 amid declining volume. And another much-anticipated Bitcoin futures was delayed by almost a year : Bakkt futures contract. Indeed, during summer 2018, Bakkt company was formed by ICE with the first mission to list physically delivered Bitcoin futures contracts along with physical warehousing, to enable regulated financial institutions to actually own bitcoins. Bakkt later received a $182Mio from high-profile investors including the BCG and Microsoft’s VC arm.

We have some news https://t.co/ykUvQ31cGz

— Bakkt (@Bakkt) August 16, 2019

After the recent opening of its warehouse, Bakkt’s futures will start trading on September 23rd, 2019. Bakkt’s futures volumes will be highly interesting to follow. Today, BitMEX averages more than $3 billion in trading per day and CME Group $370 million.

Here is a summary table outlining the main differences between Bitcoin futures listed by the CME Group, Bakkt and BitMEX:

CME Group Bakkt BitMEX Each contract is worth 5 bitcoin 1 bitcoin 1 USD of bitcoin Minimum Price Fluctuation $5.00 per bitcoin ($25.00 per contract) $2.50 per bitcoin ($2.50 per contract) $0.5 Listed Contracts Monthly contracts Monthly contracts Daily contract Monthly contracts Perpetual swap contract Settlement Method Financially Settled in USD Physical Delivery in the Bakkt Warehouse, a regulated custodian for Bitcoin storage Financially Settled: quoted in USD, Settled in XBT Settlement price CME CF Bitcoin Reference Rate, which includes prices from Bitstamp, GDAX, itBit, and Kraken N/A yet BitMEX index, derived from equal parts from Bitstamp, Coinbase Pro, and Kraken Trading Hours Business Days Business Days 24/7/365

Futures margin

Margin is a critical concept for people trading futures. Indeed, the matching of buyers with sellers is only the beginning of a successful transaction. In the absence of instantaneous transfer of goods with payment, there is a need for financial intermediaries to manage inherent "counterparty risk": the potential for either side to not fulfill their contractual obligations.

This risk is particularly acute for derivatives instruments where settlement is much further out than the T+2 or 3 period for cash equities for example. This leads us to the concept of futures margin and to the role of the clearing house.

Futures margin is the amount of money that you must deposit and keep on hand with your futures broker when you open a futures position. It is not a down payment: you do not own the underlying commodity.

Futures margin rates are set by the exchanges’ clearing houses, and generally represents a smaller percentage of the notional value of the contract, typically 5-15% per futures contract for traditional markets. Futures margin rates move with the markets: when market volatility moves higher in a futures market, the margin rates rise, and vice-versa.

Since margin is only a small percentage of the total futures contract value, there is a tremendous amount of leverage in futures markets.

There are different types of futures margin:

Initial margin: the amount of money required to open a buy or sell position on a futures contract

Maintenance margin: the minimum amount that must be maintained at any given time in your account

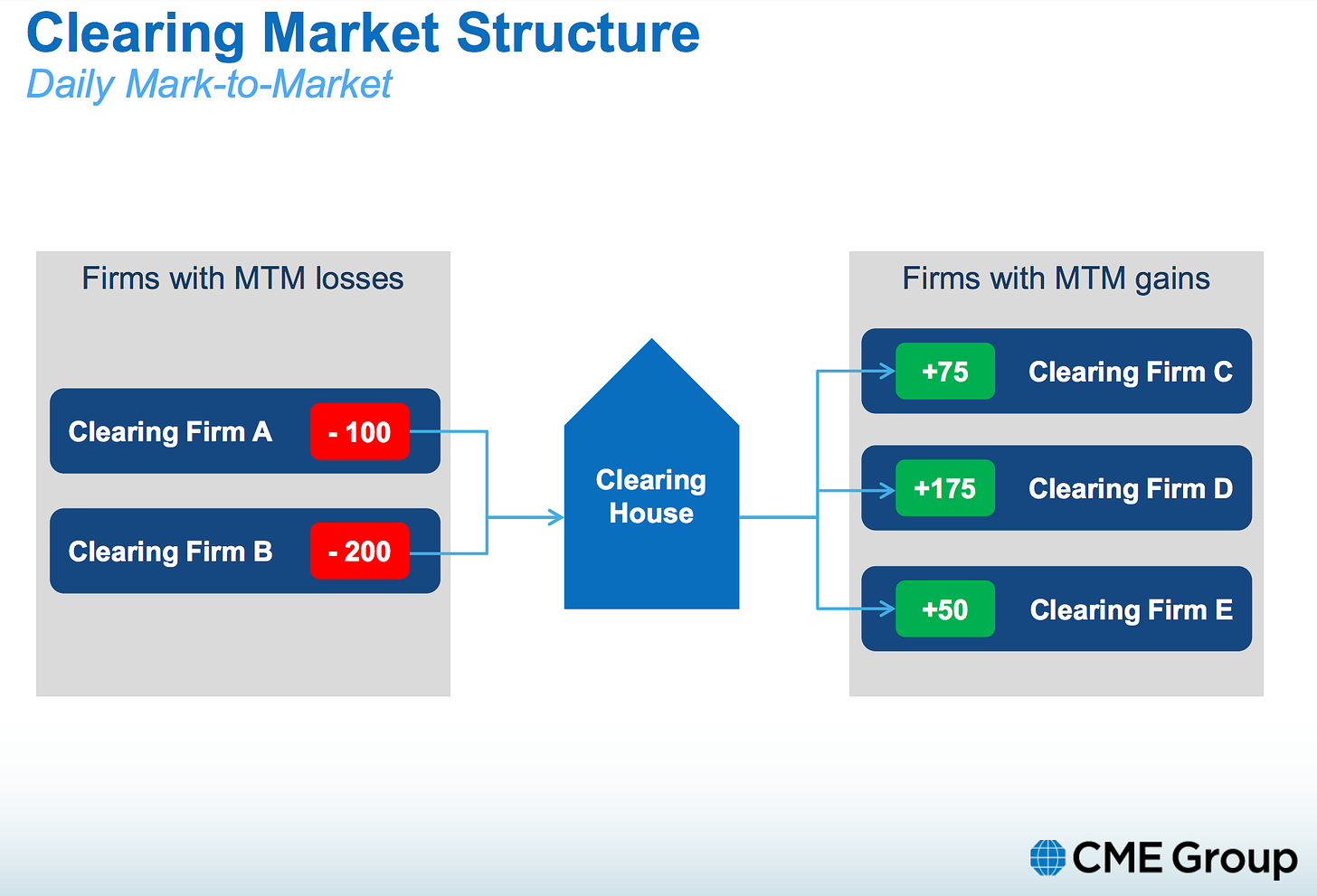

Source: https://www.cmegroup.com/education/files/webinar-II-clearing-overview-may-28-2013.pdf

If the funds in your account drop below the maintenance margin level:

You will receive a margin call where you will be required to add more funds immediately to bring the account back up to the initial margin level

If you do not or can not meet the margin call, you may be able to reduce your position in accordance with the amount of funds remaining in your account

Your position may be liquidated automatically once it drops below the maintenance margin level

Moreover, in the event of significant fluctuations in the markets, regardless of the cause, the markets can apply “circuit breaker” measures in order to allow them to issue margin calls in order to limit the risks that would be incurred by the default of a market participant.

Futures margin are managed by the exchange’s clearing house and their goal is to allow market participants to trade with confidence that others will meet all obligations at all times.

Here are the current futures margins requirements for the CME Group, Bakkt and BitMEX:

CME Group Bakkt BitMEX Initial Margin 100% of the maintenance margin $3,900 per contract 1% (minimum) Maintenance Margin 37% of position size N/A yet 0.5% Leverage 37% 39% 10000% Circuit breaker 7%, 13%, and 20% price limits applied to the futures fixing price N/A yet Position closed if it breaches the liquidation price. Margin lost in full Maximum position size 1000 contracts (5 bitcoins each) 100,000 bitcoins $10,000,000

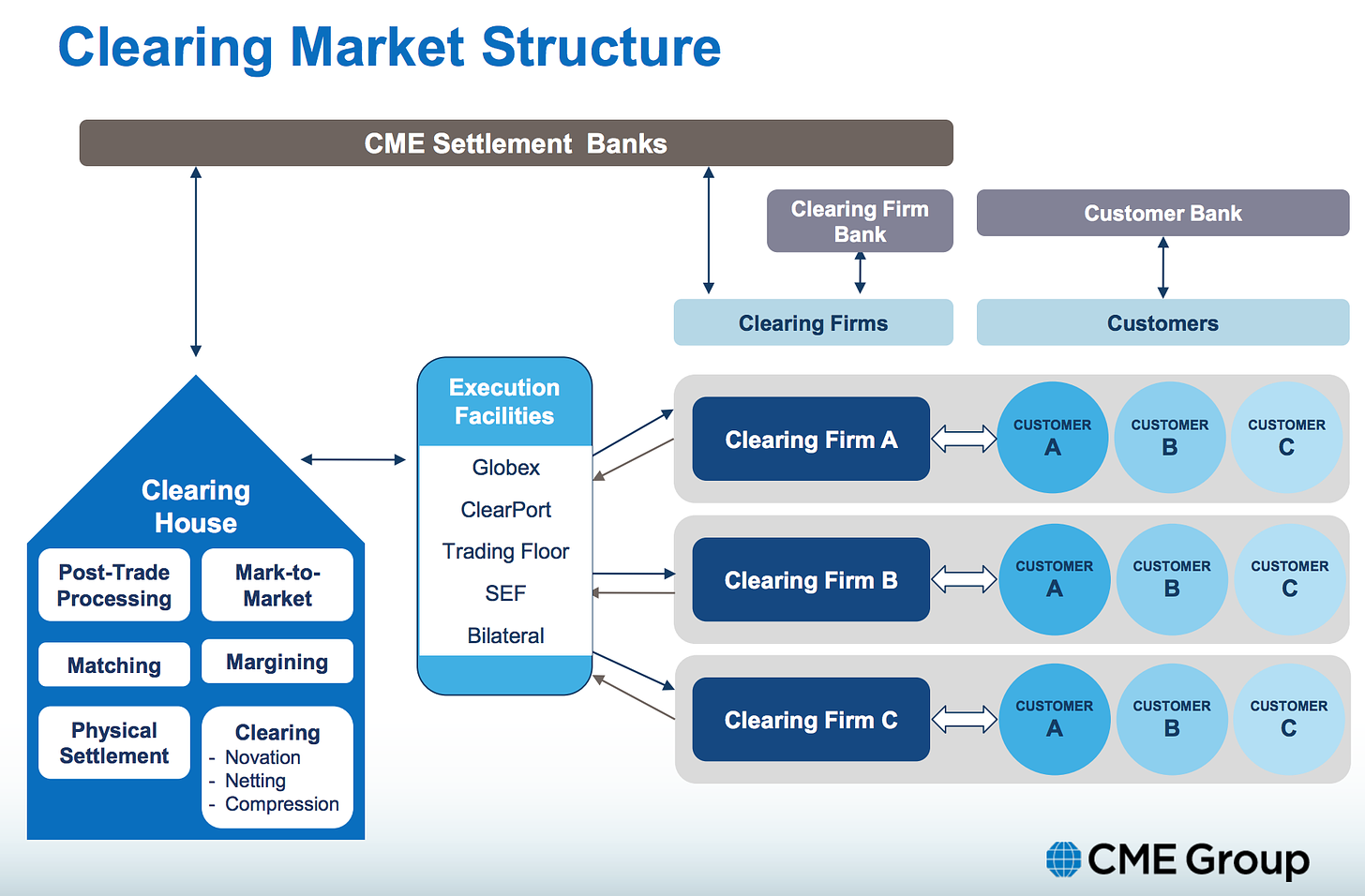

The role of the clearing house

A clearing house acts an intermediary between buyers and sellers of financial instruments. Each futures exchange has its own clearing house, and some of the largest are agencies or separate corporations of the main futures exchanges.

A clearing house plays two main roles : it is the central clearing party (CCP) to all market participants and it manages futures margin :

A clearing house takes the opposite position of each side of a trade, that is acts as the middle man on behalf of both parties. This process is called novation: the replacement of a contract between the original counterparties with two new contracts; one between the buyer's broker and the clearing house, and another between the clearing house and the seller's broker.

All members of an exchange are required to clear their trades through the clearing house at the end of each trading session and to deposit with the clearing house a sum of money sufficient to cover the member's debit balance.

Source: https://www.cmegroup.com/education/files/webinar-II-clearing-overview-may-28-2013.pdf

CME and Bakkt Bitcoin futures are respectively cleared through CME Clearing and ICE Clear US and are both covered by existing guarantee funds (with an incremental $35 million being added on ICE Clear US with the addition of Bitcoin futures). This clearing mechanism does reduce counterparty credit risk for participants, but it is not a risk-free solution as we will see in the last part. Furthermore, the Bakkt warehouse is protected by $125 million in insurance.

BitMEX is exposed to much larger risks than CME and Bakkt, since it operates without a clearing house and its underlying instruments are much more volatile, since they offer up to x100 leverage! Hence, BitMEX developed a different approach to mitigate counterparty risk: the combination of an insurance fund and an auto-deleveraging system.

On traditional futures markets, when a market participant’s position drops below her/his maintenance margin level, her/his position is closed forcefully: it is liquidated. The market’s participant P&L will reflect the actual price her/his position is closed. It is not the case on BitMEX, where if a market participant is liquidated, her/his equity associated with the position will always go down to zero.

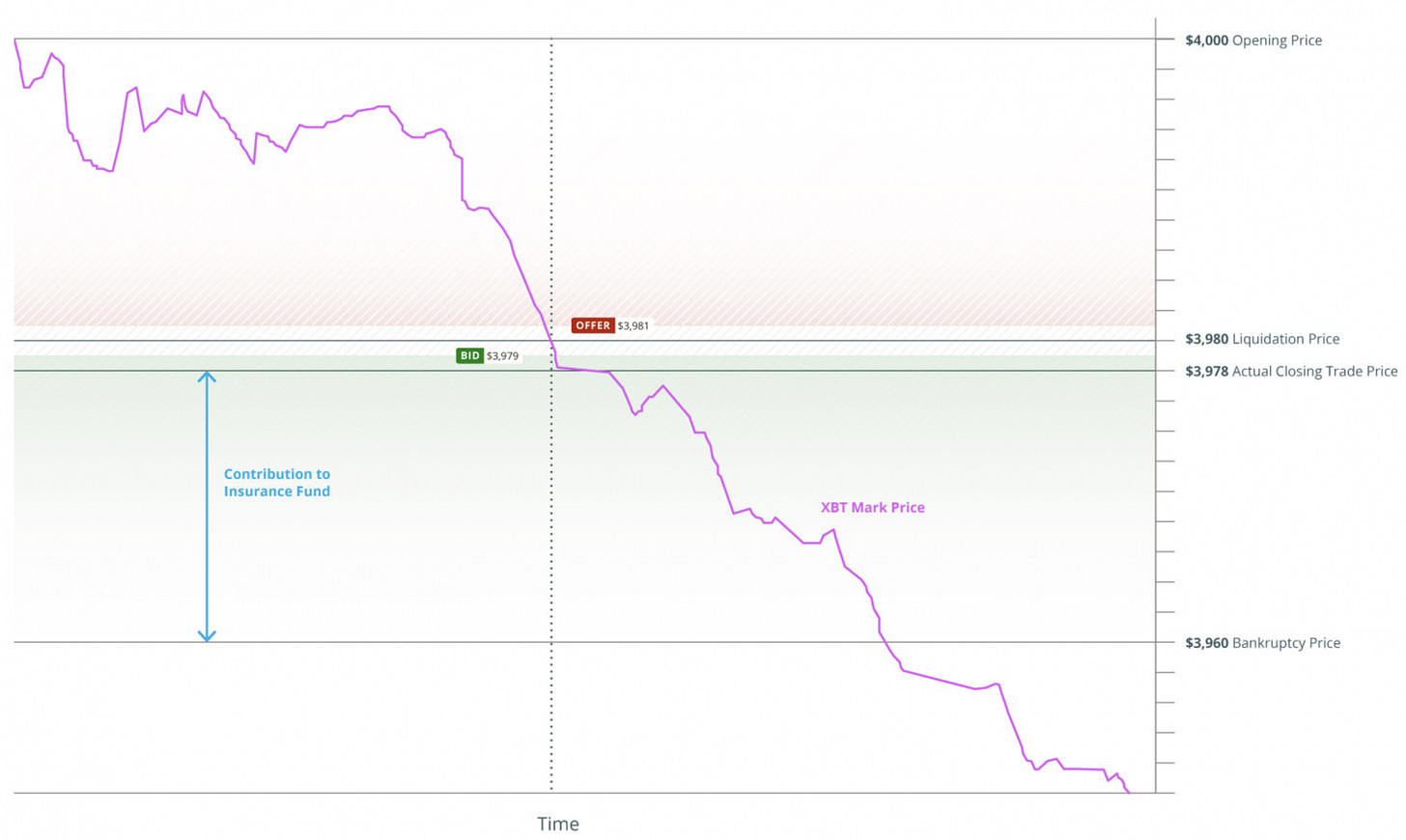

Let’s assume you entered a long leveraged position on BitMEX (the average leverage on BitMEX is around x8.6), BitMEX will set a liquidation price a fraction above the bankruptcy price (the price where the margin balance is zero). When the market moves adversely and breaches the liquidation price, a liquidation engine will take over your position and automatically liquidate it at market. Any profit made during this process (the difference between the closing trade price and the bankruptcy price) will be added to the BitMEX insurance fund. And should the closing trade occur at a price lower than the bankruptcy price, the insurance fund will be used to ensure the winning traders receive their expected profits.

Illustrative example of an insurance contribution – Long 100x with 1 BTC collateral (Source: https://blog.bitmex.com/the-bitmex-insurance-fund/)

The BitMEX insurance fund current balance is around 31,000 BTC (~$310Mio), which represents around 0.03% of of BitMEX’s notional annual trading volume (~$1Tn).

In the event that the insurance fund becomes depleted, market participants need to make a contribution to cover the losses of the exchange: this process is called auto-deleveraging.

Perspectives

BitMEX, CME and Bakkt serve different purposes. BitMEX futures proved to be much appealing for retail investors looking for highly leveraged bets on Bitcoin future price. CME futures has allowed institutional investors to get a synthetic exposure to Bitcoin price. Bakkt futures have been long awaited since they could finally allow to gauge institutional investors’ appetite for Bitcoin.

CME and Bakkt clearing houses do reduce counterparty credit risk for market participants compared with BitMEX. However, clearing houses themselves are exposed to several major risks that need to be closely monitored (counterparty, liquidity, principal, legal and operational risk).

And clearing houses can now be viewed as super systemic: since the 2009 global financial crisis, regulators worldwide ensured the vast majority of derivatives trades would now be centrally cleared. The notional value of all derivatives outstanding globally stands at $639 trillions (!!), of which 68% are centrally cleared through a handful of clearing houses.

The probability of a clearing house going bust is considered today as very low. However, the bankruptcy of a clearing house is certainly not impossible, and its impact could be devastating to the entire financial system.

The Bitcoin paradox is once again at play here: market participants invest in Bitcoin, an asset whose value comes from its censorship resistance, but entrust its ownership to trusted third parties.