LN Markets is on Bitcoin mainnet

Leverage your sats!

We are very proud to announce that LN Markets, the first derivatives trading platform built on the Lightning Network, is live on Bitcoin mainnet in its public alpha.

LN Markets radically improves derivatives trading: transfer and trade at the very same time, in one click.

Now is the time to #leverageyoursats!

Ok, that's a lot of fancy words, let's unpack all this in the following sections.

TL;DR:

LN Markets is a Lightning Network application for derivatives trading

Leverage your sats in a trust-minimized environment

No email or registration, connect your funds instantly with your Lightning Wallet (Phoenix, Blue Wallet, Joule, etc.)

This is just the beginning: the Lightning Network will be used as a settlement rail by all leading financial institutions

Wait, what is the Lightning Network?

The Lightning Network (LN) is a protocol on top of Bitcoin which enables fast, secure, private, trustless, and permissionless payments.

There is a ton of resources should you want to dig deeper this topic. However, as an overall introduction, we like this description in the draft of Mastering the Lightning Network (Andreas M. Antonopoulos, Olaoluwa Osuntokun, Rene Pickhardt ):

The Lightning Network is a protocol for using Bitcoin in a smart and non obvious way. Thus it is a second layer technology on top of Bitcoin. It is changing the way people exchange value online and it’s one of the most exciting advancements to happen to the Bitcoin network over the past few years. [...] We’re only beginning to see the opportunities LN provides including improved privacy, speed, and scale.

Lightning Labs co-founder and CEO Elizabeth Stark sees LN as the Visa network for Bitcoin, without Visa as a gate-keeper: “What I think is powerful, is unlike Visa, anybody can build on top of it”.

LN Markets node on the Lightning Network - Visualisation https://graph.lndexplorer.com/

So, why trade derivatives on the Lightning Network?

The Lightning Network has been primarily designed as a payment protocol on top of Bitcoin. The Lightning Network is also perfectly suited to trade derivatives products.

The most convenient way for retail traders to enter a Bitcoin derivatives position is through exchanges. Today, these exchanges play two main roles, trading venue and clearing house.

To make sure that buyers and sellers honor their contractual obligations, exchanges require traders to deposit and maintain an account funded with Bitcoin as collateral: this is called the margin.

By doing so, traders give the ownership of their asset to a third party : they take a counterparty risk. To mitigate this risk, traders could transfer their bitcoins out of the exchange whenever they are not in an active position and do the opposite when they want to enter into a position.

This is painful, as it means navigating through various interfaces and wallets. It is a slow process since Bitcoins transfers usually take around one hour to be confirmed. And is expensive since each Bitcoin transaction incurs transaction costs, on top of exchange fees.

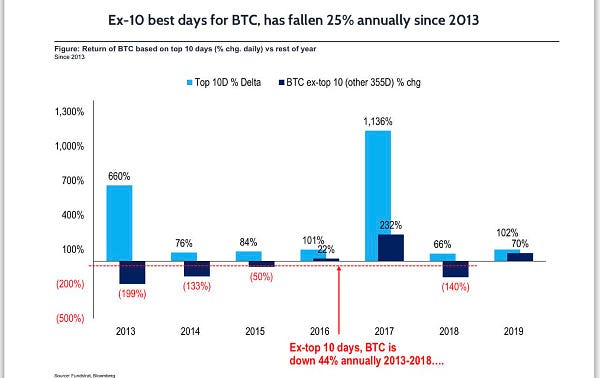

And on top of this, due to this cumbersome process, traders may miss market opportunities. As a result, in the Bitcoin derivatives market, much more funds than needed “stay at risk” on the exchange.

As a Bitcoin trader, you don't want to miss these market opportunities.

Finally, bitcoin derivatives investors face a dilemma: what to do with my bitcoins? Shall I transfer out of the exchange, through a painful process, or leave them on the exchange to be ready to trade anytime, but taking counterparty risk?

More information about Bitcoin derivatives and margin calls on this post.

LN Markets: instant payments

With the advent of the Lightning Network, we can design a whole new trading paradigm, where traders are much more in control of their funds.

LN Markets leverages the Lightning Network as a settlement layer to provide a completely new experience where trading and transfer of bitcoin funds are done at the very same time, in one click.

Bitcoin funds that are not used in a position never stay at risk on an exchange: traders minimize their risk.

With LN Markets, traders can instantly access Bitcoin markets, post margin and claim P&L instantly in a trust-minimized environment.

Counterparty risk is reduced at its minimum.

After funding a lightning channel with LN Markets, traders’ funds are connected to LN Markets and ready to enter a position.

When submitting an order, a trader agrees to transfer a margin to LN Markets. A lightning invoice is sent to the trader and the lightning payment confirms the order.

LN Markets then plays the role of a broker and automatically takes the position in the market on behalf of the user.

Closing a position is the opposite process: once the closing is confirmed, either manually or via an order, the funds are instantly transferred to the trader’s wallet with a lightning payment.

In a way, LN Markets does leverage Lightning Network payment channels as a new kind of trading account, which is:

Non-custodial: traders keep ownership over their funds

Auditable: channels' balances can be audited by both parties at all times

Connected: funds are streamed instantly for payments (margin & P&L)

More information about the financial products available on LN Markets:

How to log in to LN Markets?

We have worked hard to make the onboarding process seamless and as quick as possible.

No email or registration is required to access LN Markets.

The only prerequisite is to fund a Lightning wallet, with a direct channel, or a path to, LN Market’s node on the Lightning Network.

Funding a Lightning wallet can be compared with a transfer of funds to a custodian bank for a future investment. But with a major difference: here one keeps full ownership over his funds in the Lightning channel prior to the investment.

LN Markets is accessible through desktop and mobile wallets.

The quickest and most simple way to sign up and trade on LN Markets is with a mobile wallet. For example, with the following non-custodial mobile wallets:

Phoenix, by ACINQ - Android app

Blue Wallet - iOS & Android app

Of course, feel free to use the Lightning wallet of your choice (Zap, Bitcoin Lightning Wallet, Wallet of Satoshi, Breez, etc.).

An other option, for more experienced users, is to run your own Lightning node and to connect to LN Markets with Joule wallet.

Here is a guide on how to easily run and set up your Bitcoin & Lightning Network node and to set up Joule wallet.

For channel opening, here is LN Markets node:

Node: lnmarkets.com | 1ML - Lightning Network Search and Analysis Engine - Bitcoin mainnet

To open a direct channel with LN Markets or find a payment route with our node, here is our <pubkey>@host:

03271338633d2d37b285dae4df40b413d8c6c791fbee7797bc5dc70812196d7d5c@3.95.117.200

More information about how to log in to LN Markets: https://lnmarkets.com/lightning

What's next?

Beyond trading, LN Markets could fuel a new wave of Bitcoin use cases for payments.

Indeed, LN Markets can be used by Bitcoin & Lightning merchants to hedge their BTCUSD currency risk. Merchants can benefit from the speed, convenience and control over funds provided by Bitcoin payments without being exposed to Bitcoin's price volatility. All they have to do if they are long Bitcoin is enter a short position on LN Markets to be completely immune to Bitcoin's price variations.

More broadly, our view is that the impact of the Lightning Network on financial market activities shall be as big as the impact of dematerialization of securities on financial market activities.

Dematerialization of financial securities refers to the substitution of paper-form securities by book-entry securities. It has been a major trend since the late 1960s, with the result that by 2010 the majority of global securities were held in dematerialized form, which has vastly improved the liquidity and security of financial markets.

We think the Lightning Network is going to revolutionise finance the same way: it is going to be the preferred settlement rail for the leading financial institutions because it is a fast, secure, private, trustless, and permissionless way to settle payments.

In addition, the Lightning Network could enable the rise of peer-to-peer clearing between financial institutions, without the need for a central clearing house.

To support this claim, it is interesting to note that Stella, a joint research project of the European Central Bank and the Bank of Japan, that focuses on the future of payments, has built an architecture based on the Lightning Network:

And this is just the beginning: with the advent of new protocols currently in active development such as RGB, any type of financial security such as USD, Gold, a stock, a fund share will be represented on the Lightning Network and available for instant and cost-efficient settlement.

Any type of asset could be issued on the Lightning Network (Source)

Welcome to LN Markets!

Now is the time for you to join LN Markets and try this whole new trading experience!

Support:

Telegram : https://www.t.me/lnmarkets

Twitter : https://twitter.com/LNMarkets

Mail : hello@lnmarkets.com

LN Markets is an alpha software under active development. Please use with care, preferably on Testnet or with small amounts. LN Markets comes with no guarantees, use at your own risk.

LN Markets has been developed with love by ITŌ.

ITŌ offers an innovative and secure environment for digital assets risk management and trading.

With a deep expertise in both finance and tech, and an acute understanding of the cryptocurrency disruption, our team develops inventive products and services designed for digital assets investors.