LN Markets - April 20th, 2020 - Issue #2

⚡Building, metrics, a math problem, our CTO's live talk, and much more.

Welcome to the second issue of this newsletter, which covers market trends, Lightning Network developments and updates about LN Markets.

If you enjoy this content, feel free to spread the word!

⚒️ IT’S TIME TO BUILD

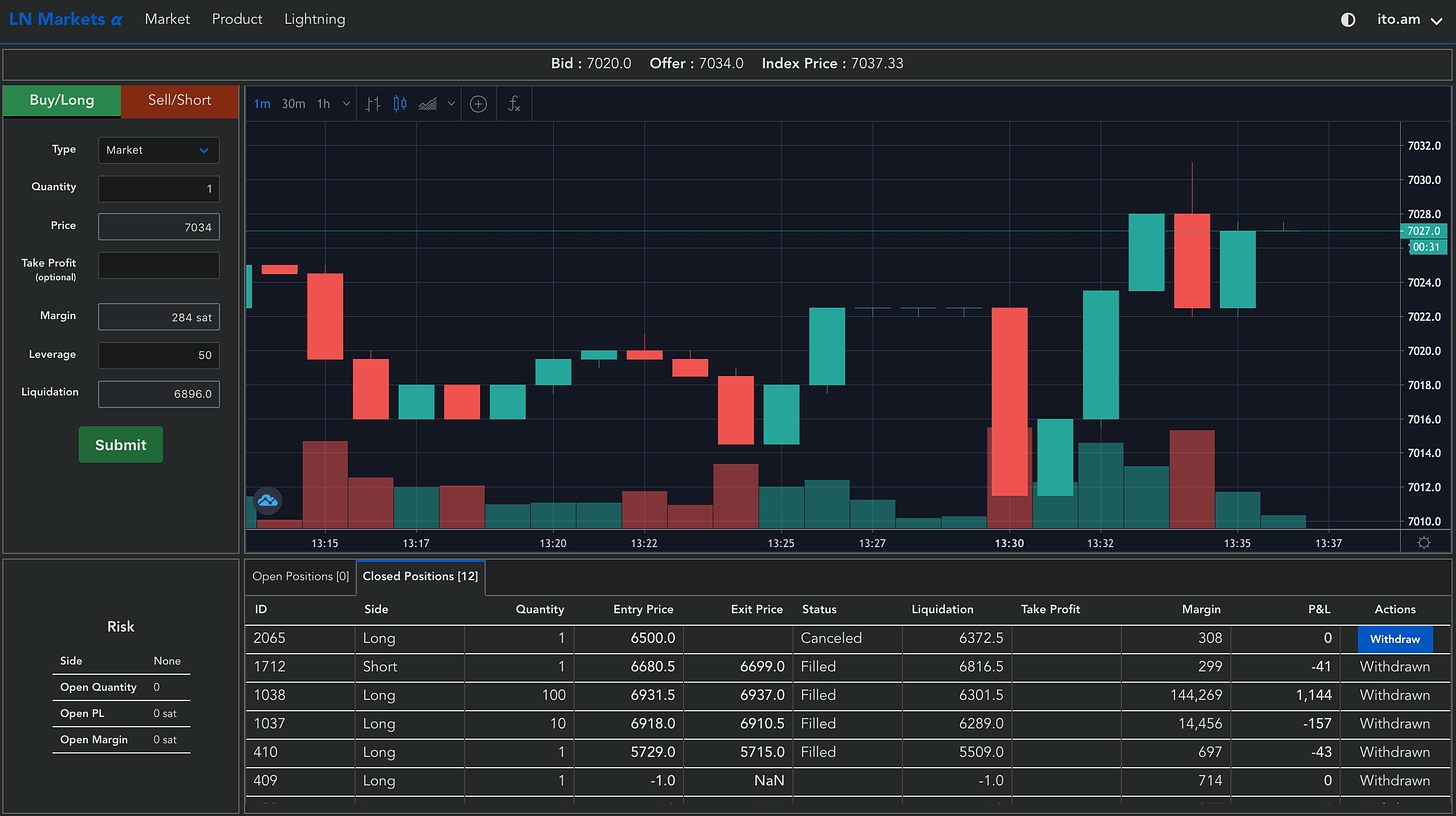

We shipped our first lnmarkets.com upgrade with several bug fixes, UX improvements, QR-connect to our node, and a fresh new dark mode:

We thank you all for your feedbacks and help on debugging!

Our next release will include LNURL-AUTH and stop-loss orders.

Also, great news from LND with the announcement of multi-part payment in LND 0.10. This new feature shall be really helpful to deal with liquidity issues in the future:

🔥 Metrics

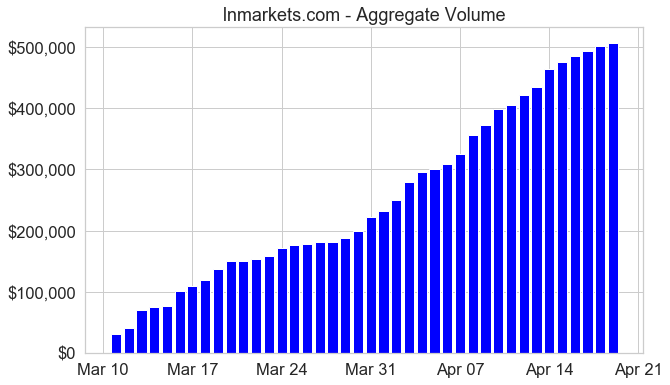

Quick take on market activity, we doubled our metrics since our first issue two weeks ago:

400 weekly active users

3,000 trades

Aggregating $500k of volume

Please note that the maximum margin available for trading per wallet is still set at 1 million sats.

We have also been amazed to be featured in Token Daily’s State of L2 investments research article and in Jimmy Song’s Bitcoin Tech Talk #183:

🤓 Math exercise

One could try to figure out the necessary capacity of the Lightning Network to be able to support the trading volume of a major derivatives exchange.

Let’s say we want the network to support $100 million of open interest and let’s suppose an average leverage around 20, then the total margin transferred for $100 million of open interest is $5 million. In other words, the node capacity of that exchange shall at least be $5 million.

The 10 biggest nodes currently account for 40% of the total network capacity. Let’s assume that the node capacity for such exchange would represent 5% of that of the whole network. From the first part of the calculation, we need this 5% capacity to be equal to $5 million.

Hence, total network capacity should be at least equal to $100 million to support the trading volume of a major derivatives exchange.

Right now, it is around 1,000 BTC or $7 million. One order of magnitude smaller but not that far away!!

📺 Video

We had a great time talking about LN Markets’s technical development on the second episode of #Potzblitz. Our CTO Victor Afanassieff gave a full picture of our experience building on the Lightning Network, his favourite tools, the main challenges faced, and his wish list for the future, in this new weekly Lightning by Jeff Gallas, Fulmo’s founder and co-hosted this week by Joshua Scigala, CEO of Vaultoro. Full video here:

🔮 If you are in trouble, double!

Federal Reserve Chair Jerome Powell and his colleagues decided to get creative. More creative, in fact, than any Fed leaders since the birth of the central bank in 1913. They not only relaunched the special lending programs built for the 2008-09 financial crisis, but they invented entirely new ones to rescue both big and small businesses. For the first time, the Fed is buying bonds from and making loans directly to companies. It’s buying municipal debt; rolling out the Main Street Lending Program for companies with fewer than 10,000 employees; and backing the Small Business Administration’s Paycheck Protection Program, which is for companies with fewer than 500 employees. A fifth of the money in the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act—$454 billion—is earmarked for such lending.

Until now, Quantitative Easing had no effect on inflation because it never reached the real economy. More precisely, the only way it did reach the real economy is through real estate prices appreciation. Which helps some people, at least those with sufficient money to be landlords, to feel confident. The other notable has been effect was on stock prices. Companies used this cheap money to buy back their own stocks. It was a risk-on signal. With the old-fashioned way to inject money and the new measure for Main Street, we may observe a more direct impact on the real economy and see inflation coming back at some point. Risk-on mode + inflation is probably not a bad equation for Bitcoin…

The Fed isn’t supposed to lose money on its lending, which is why it ordinarily sticks to investing in ultrasafe Treasury bonds and government-guaranteed mortgage-backed securities. The gambit that allows the Fed to lend to weaker borrowers is a guarantee from the Treasury Department to absorb losses. Some of its new lending makes the Fed essentially an agent of the Treasury Department, raising questions about its independence. Powell portrays the Fed’s choice as no choice at all, but a necessity. However, the Fed will start to lose money if the losses exceed the amount the Treasury Department puts in. “Given how fast our thinking about the virus is evolving, we have to be open to that possibility—that things could be much worse than the Fed staff forecast,” says JPMorgan Chase’s Feroli. In the worst case, the Fed might have to go to Congress to ask for more money, which would be a blow to its independence.

Powell is certainly not working for Trump’s reelection, still he does exactly what Trump wants: talk to Wall Street AND to Main Street. And on top of that, possibly losing Fed’s independence for the benefit of politics. Once Trump will be in a position to leverage the situation he will not hesitate to do it. And for Trump, the mandatory way to get reelected is to keep Wall Street happy. More money coming…

Source: The Fed Loves Main Street as Much as Wall Street This Time, by Peter Coy for Bloomberg.

⚡ Bonus

We have enjoyed this really cool demo of sphinx. As Marty Bent nailed it, this looks like WeChat but without the surveillance. Also having to pay a few sats to be able to send a message may reduce the more and more frequent messaging spamming.

By the way, it’s interesting to note that Adam Back invented the concept of Proof-of-Work with HashCash in 1997 in order to fight email spamming. And more than two decades later, Bitcoin and the Lightning Network could rely on these same mechanisms to fight this new kind of spamming!

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!