LN Markets - May 5th, 2020 - Issue #3

⚡Parabolic metrics, new release, lightning glass ceiling, RGB and much more!

Welcome to the third issue of this newsletter which covers market trends, Lightning Network developments and updates about lnmarkets.com.

If you enjoy this content, feel free to spread the word!

🔥 Metrics

We saw a sharp increase across all our metrics in the past few weeks: new users, average trade size and global trading volume:

The upcoming Bitcoin Quantitative Tightening is certainly a factor driving this growth. The ability to close a position and instantly withdraw your funds also proves to be a strong value proposition for our users.

Indeed, for dozens of trades, the time between closing a position and withdrawing funds directly to your wallet is less than 5 seconds!

Our lightning node is now in the top 100 in terms of capacity and has 80 channels currently opened.

⚒️ IT’S TIME TO BUILD

We shipped another lnmarkets.com upgrade with bug fixes, UX improvements and the most requested features by our community:

Trading

Stop-loss orders

Possibility to enter your trade either with a desired quantity (number of contracts) or with a desired margin amount (amount max = 1 million sats)

Lightning

Node upgrade to LND v0.10.0

Decentralised authentication with LNURL-AUTH

This latter feature is a very efficient and safe way to log in to lnmarkets.com with a mobile wallet. Your wallet can sign a message with its Private Key. Hence, identification can be done just with your wallet’s Public Key. No other information is needed.

The first Lightning wallet to implement LNURL-AUTH is BLW and others shall follow. Here is how this seamless authentication process looks:

We thank you all for your feedbacks and help on debugging!

🤓 Lightning Glass Ceiling

When we explain what is lnmarkets.com, we sometimes hear: “build a trading platform on the Lightning Network and you will hit a glass ceiling”, that is, a cap in volume and users.

Let’s try to put a number on this hypothetical glass ceiling!

Right now, the Lightning Network public capacity is around 1,000 BTC (not taking into account all private channels).

Let’s assume a derivatives exchange’s node represents 5% of this total capacity, which is the case for ACINQ for instance. With a 5% of total network capacity, this derivative exchange could be able to have 50 BTC for maximum margin. Average leverage on lnmarkets.com is around 25, meaning that the maximum open position for this maximum margin transferred would be 1250 BTC.

To get a max daily volume from there, we assume that the volume traded is a multiple of the open position (e.g. BitMEX has an open position of USD 500 million and daily volume of USD 3 billion).

Hence, max daily volume for such an exchange would be 7500 BTC or ~ $60 million (with BTCUSD = 8000 USD).

A glass ceiling, yes, but at the level of an exchange like Gemini or Bittrex!

Not too bad for a “niche of the niche” network.

🌈 RGB

You may have heard about the ambitious RGB protocol, currently in development.

RGB is a smart contract system, able to work on top of the Lightning Network, that aims to offer private & scalable smart contracts for the Bitcoin ecosystem.

In a nutshell, RGB shall make it possible to create and manage on the Lightning Network:

Securities and other digital fungible assets, anonymously or publicly

Decentralised exchanges (DEX)

Collectibles and other non-fungible assets

Decentralised digital identities

In order to solve both scalability and privacy issues met by current blockchain protocols, RGB is developing a novel approach:

Smart contract state is not a “public good” as with Ethereum, it must always have a well-defined ownership (private, multi-sig, etc.), assigned by a Bitcoin transaction output.

Smart contract ownership is distinct from its validation rules. Ownership defines who can change the state of the contract. Validation rules define how it may change.

Validation rules are controlled by RGB Schema with Simplicity script (Turing-complete).

Smart contract code and data are kept off-chain (client-side validation).

This approach shall make it possible for private & scalable smart contracts to operate on top of the Lightning Network.

RGB was originally envisioned in 2016 by Bitcoin developers Giacomo Zucco and Peter Todd. Since mid-2019, Pandora Core AG has become main contributor to the technology development, which became based on a set of standards maintained by LNP/BP Standards Association.

The first RGB implementation shall be ready by the end of 2020, and we are looking forward to explore this new protocol. Given that there will certainly be a USD-stablecoin issued on RGB, we could first use this protocol to develop a USD-denominated CFD for lnmarkets.com. We also have several more ideas that we will expand on later.

For more technical information on RGB, you can reach out to the developers on GitHub & Telegram.

📺 Video ⚡🇫🇷

We took part in a live talk hosted by French Bitcoin association Le Cercle du Coin dedicated to the Lightning Network, including Fabrice Drouin, ACINQ CTO, Antoine Poinsot (@darosior) C-Lightning contributor and others.

Though the talk is in French, you can add English subtitles easily and in our view it is a great introduction to the Lightning Network foundation, history, and challenges:

⚡ Bonus

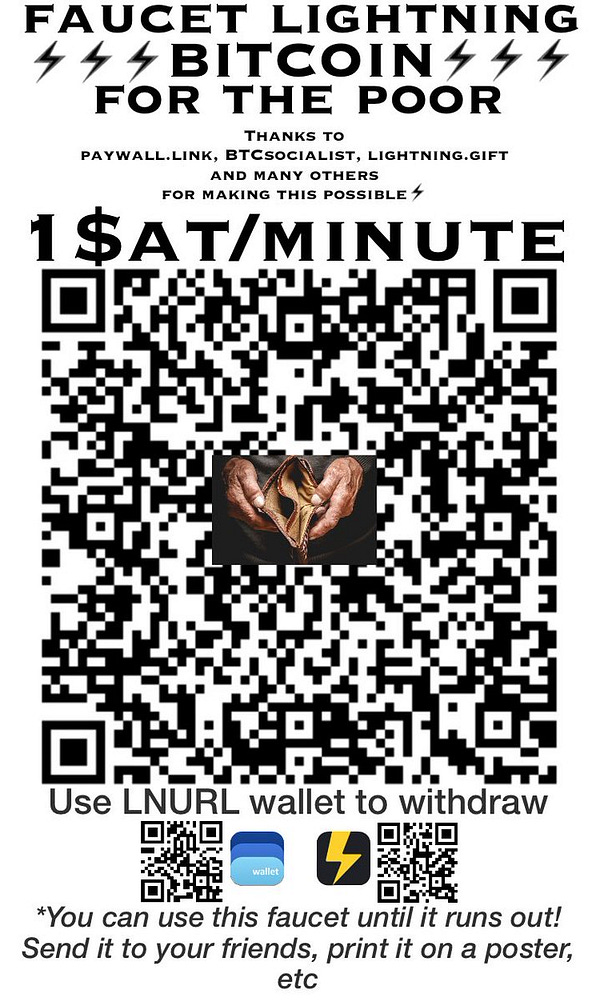

You can grab your first sats for free thanks to this awesome Lightning faucet. Seems like a great free option to leverage your first sats on lnmarkets.com!

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!