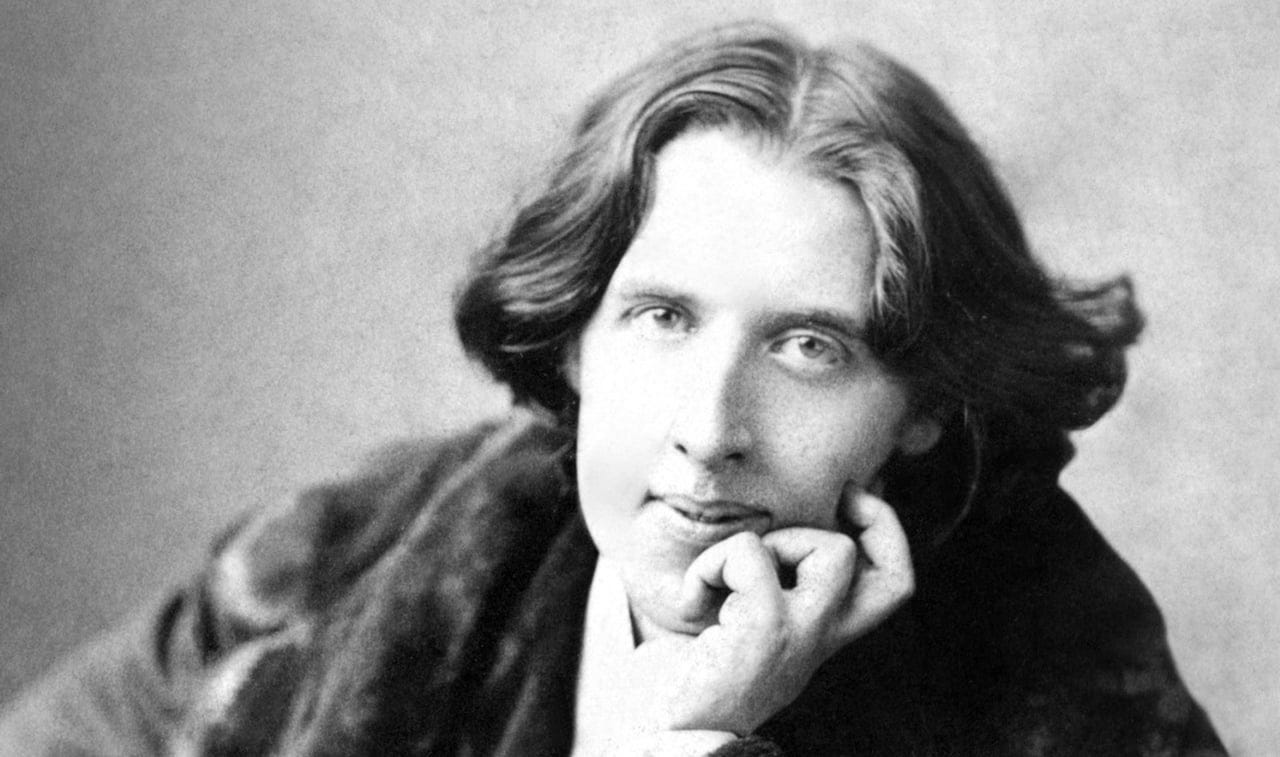

“The pure and simple truth is rarely pure and never simple” Oscar Wilde

Bitcoin is an infrastructure

Bitcoin innovation is the creation of a new type of database. An online database, open to all, in which transactions are recorded in such a way that nobody can ever modify its history. It is a tamper-proof database. From a technical perspective, Bitcoin achieves a very high level of security thanks to its decentralized nature, its organization by interdependent blocks of transactions and its type of consensus (proof-of-work).

Bitcoin is a community

This infrastructure is always evolving and keeps improving over time. For instance, the current version of Bitcoin software includes less than 15% of the original code released in 2009. Rule change proposals and technological evolutions are drafted by the Bitcoin community. Anybody is free to follow or not an evolution, and whenever a significant percentage of Bitcoin community is not in line with a proposal, a schisma can occur and lead to two distinct infrastructures. This governance model may seem chaotic. It may sometimes lead to internal wars. But it ensures an autonomous development which favours the majority.

Bitcoin is a digital asset

Bitcoin security model relies on a specific actor called a miner, which, on a voluntary basis, provides the network with its computing power to validate bitcoin transactions. Miners receive a financial reward for this service. Yet, to ensure Bitcoin infrastructure a complete autonomy, to make sure it does not have to rely on a central entity (such as a bank), the network rewards miners with the issuance of an endogenous form of money: bitcoin units. In the real world, outside of the Bitcoin network, this money does not have the fundamental functions usually attributed to money: medium of exchange, store of value or unit of account. Therefore we will use the term digital asset to characterize bitcoin. Bitcoin is issued at a fixed supply, it is a scarce asset, hence reminiscent of commodities or precious metals such as gold. With a major difference: storage and transfer costs of this “digital gold” are close to zero.

Bitcoin is a software

Bitcoin units transfers are enabled by a programming language called script. Transactions assign bitcoins to a locking script, which is a sort of lockbox where some money is deposited, that only a particular key can open. The money inside the lockbox can only be accessed by the owner who has the key. The unlocking of the lockbox proves ownership and authorizes spending of the funds. Bitcoin programming language makes it possible to create more complex transactions, to define new business logic registered in the asset itself. For example, the ownership of the asset can be split amongst several individuals, or conditioned upon the knowledge of a secret. It is also possible to create new digital assets, using Bitcoin infrastructure, but different than the digital asset bitcoin.

The field of possibilities

Bitcoin is a multifaceted object. It is at the same time an infrastructure, a community, a digital asset, and a software. Bitcoin enables the development of a new vision, which offers an alternative to traditional systems gravitating around a centralized entity. And indeed, a whole new ecosystem has developed around the Bitcoin innovation, leveraging more one of its properties or an other depending on the type of application. From the “Virtual Machine”, a sort of world computer on which one can develop shared business logics, to the synthetic replication of real-world assets as with stablecoins, a wide spectrum of applications has emerged.

Some think Bitcoin is the foundational layer of our future economy, others see it as a hopeless chimera. The only thing that is sure is that Bitcoin is the source of heated debates. Whatever their sides, those who dare to forecast what the future of Bitcoin will be had better be careful. As often, Bitcoin will evolve in an unexpected manner, echoing Oscar Wilde “the pure and simple truth is rarely pure and never simple”.

Investing in digital assets

As with any disruptive innovation, there will be failures, but as we saw with the advent of the Internet, Bitcoin opens vast possibilities: an alternative to the current system, running on the web, open to all and censorship-resistant.

In the same way that opposition is necessary in democracy, it seems beneficial for the whole society that an alternative to centralized systems might emerge. Bitcoin could be the base economic layer of this alternative. And as long as the emergence of this alternative is deemed likely, the only suitable stance, from an investor point of view, is to think in terms of risk and rewards.

ITŌ develops its offer of services following this philosophy: a pragmatic and technical approach of an investment universe still too young to afford certainties. Anything is possible, nothing is certain, but the adventure is worth trying!