Welcome to the 20th issue of this newsletter which covers everything at the intersection of the Lightning Network and Finance, as well as updates about LN Markets. If you enjoy this content, feel free to spread the word!

💬 Lightning Kraken with Pierre Rochard

Pierre Rochard has made the headlines when he announced Kraken’s upcoming support of the Lightning Network:

By the first half of this year, Kraken will launch lightning withdrawals for a fee of a fraction of a penny (versus ~$10 for on-chain withdrawals). Lightning deposits will follow and enable traders to avoid waiting for 3 blocks confirmations. Users should also be able to top up their Lightning wallets on Kraken. After this, the team will evaluate user feedback and decide what else to prioritize.

We had several questions on the drivers that make a major exchange support Lightning and Pierre was kind enough to answer them 🙏

When Kraken assesses whether to add support to LN, from a pure business perspective, what are the main benefits and challenges that arise?

Pierre Rochard: The main benefit for Kraken joining the Lightning network is fulfilling its mission: accelerating the adoption of cryptocurrency.

Lightning's instant finality and efficiency have and will continue to increase the value users get from Bitcoin.

It would be great to see more leading exchanges adding support to Lightning and create a low latency and cost efficient inter-settlement network. That would imply channels to be fully collateralized by all counterparties ahead of time. Do you think other exchanges are ready to move in that direction?

Pierre Rochard: Exchanges already have fully collateralized omnibus hot wallets and are experienced with managing the liquidity between their hot and cold wallets.

Many exchanges will be joining the Lightning network in 2021 to both improve the user experience of API-based arbitrage traders who are transferring between exchanges and for retail users who are using Lightning payments for commerce.

You mentioned that if we zoom-out, DLCs on Lightning could be a game-changer. Which use of DLCs do you see getting more traction first?

Pierre Rochard: Leveraged BTC/USD trading will get traction with DLCs first, it's the most liquid pair and there is an insatiable appetite from leveraged traders to speculate on the exchange rate.

In the end, what do you think the Lightning Network is the most efficient for? Merchant payments? Settlement layer for finance? Messaging? Micro-payments? Other?

Pierre Rochard: The Lightning protocol itself is neutral, relative adoption will be driven by teams' ability to build high quality product experiences and, most importantly, how good they are at marketing their product to mainstream audiences.

⚒️ Building

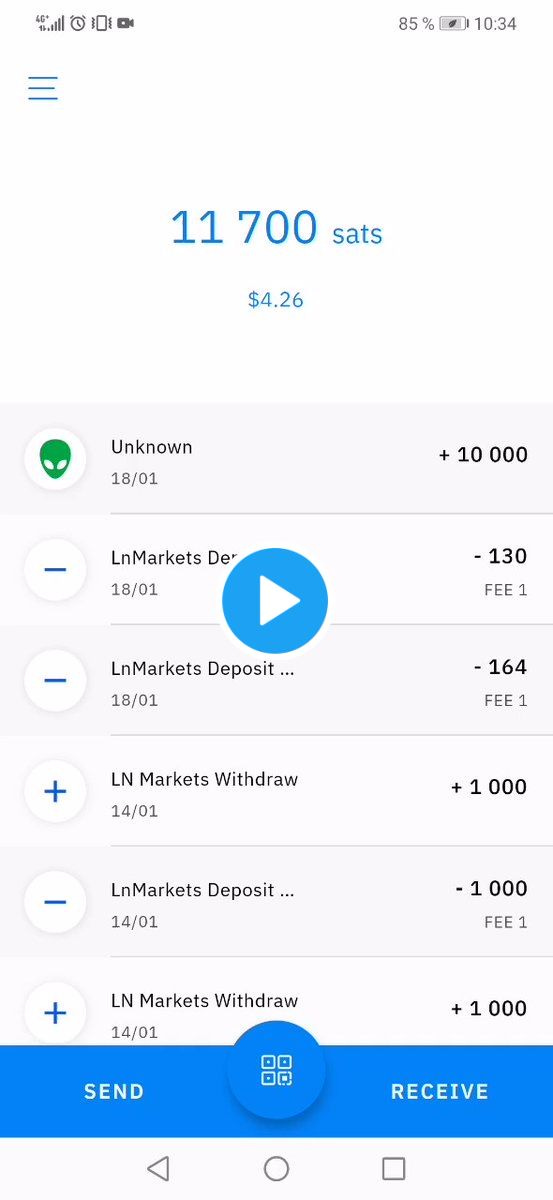

LN Markets’ seamless integration on Breez Lightning wallet has attracted a lot of new users! Always nice to see this kind of smooth collaboration and we thank Breez for their support:

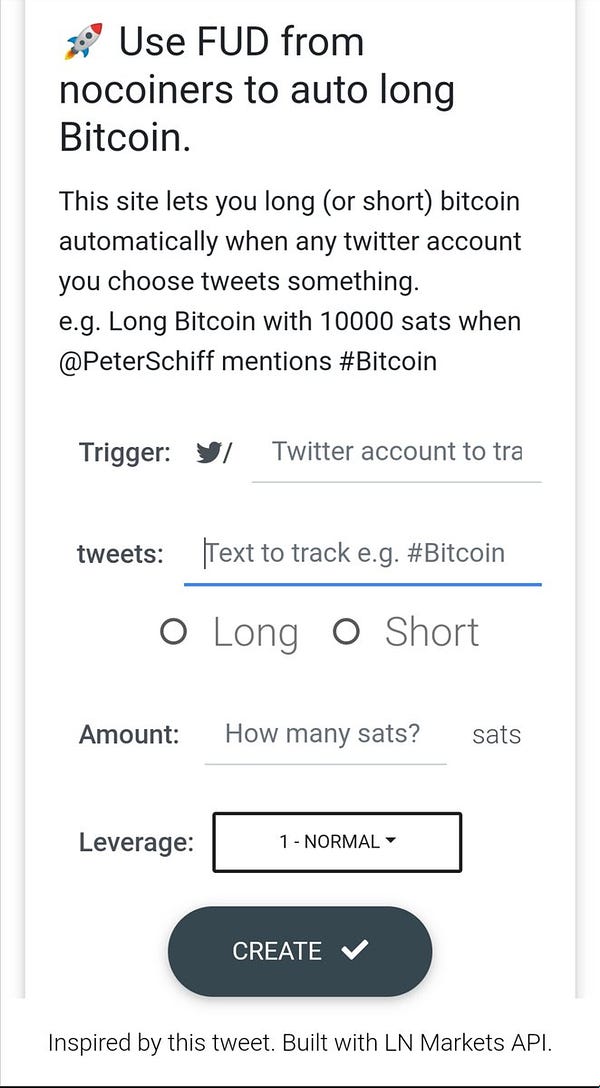

We feel very grateful for the people who build on LN Markets! We found out that pseudozach has built IFTTL (If This Then Long) with LN Markets API to enable anyone “use FUD from nocoiners to auto long Bitcoin”. We tried it out and it’s an elegant way to earn sats when your favourite Bitcoin skeptic can not help but tweeting about it!

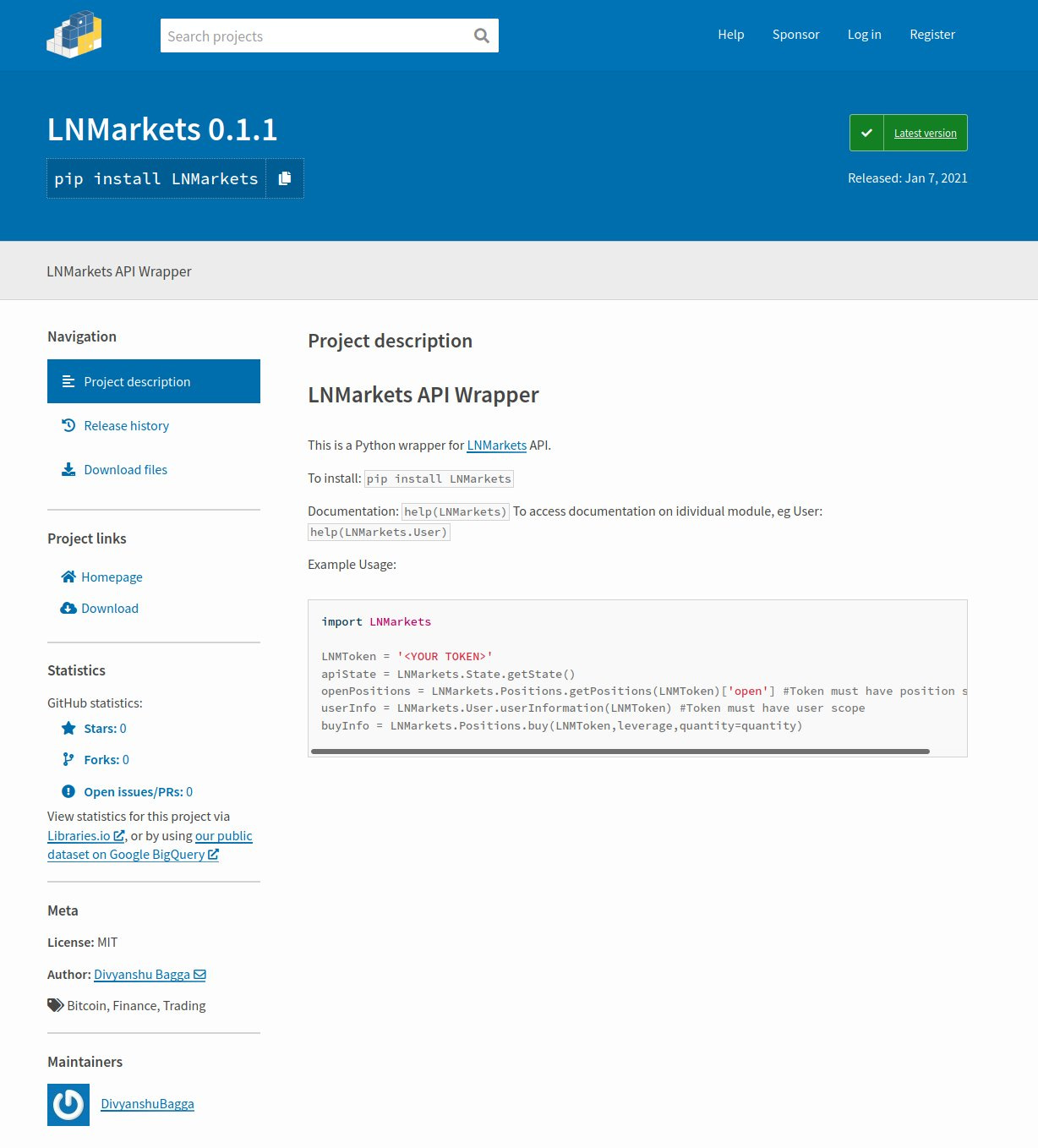

We had another great surprise when we saw that Divyanshu Bagga had built a Python LNMarkets API Wrapper:

And after our step-by-step tutorial in Python, we published the Node.js and cURL versions 🤖.

🌱 Ecosystem

Pierre Rochard: “many exchanges will be joining the Lightning network in 2021”. Well, this is already happening with the fresh addition of OkCoin and VBTC. David Coen has made a useful repo to follow the status of exchange LN integration:

The possibility that most major Bitcoin exchanges would open massive private lightning channels between themselves to form an instant inter-settlement network has become a major theme. A lot of the comments turned around whether Lightning or Liquid was most suited to enable exchanges to implement a low latency inter-settlement Bitcoin network. It seems like Stephen Livera is soon going to host Ryan Gentry (pro-Lightning) and Shinobi (pro-Liquid) for a heated debate. An interesting listen for sure!

In all cases, a fresh set of developer tools is definitely the kind of tools we need to attract more engineers to the Lightning space! Kudos to Lightning Labs on their tutorials.

We have also had good news on several fields:

💰 Economics: more and more liquidity flowing through the network

😀 UX: another easy to setup LN wallet to attract more newcomers to the space

🔧 Tech: with a more efficient method to keep in sync with the rest of the network

🤝 Convergence: with the rise of a mutually-beneficial ecosystem of LN apps

🔮 Good stuff to read

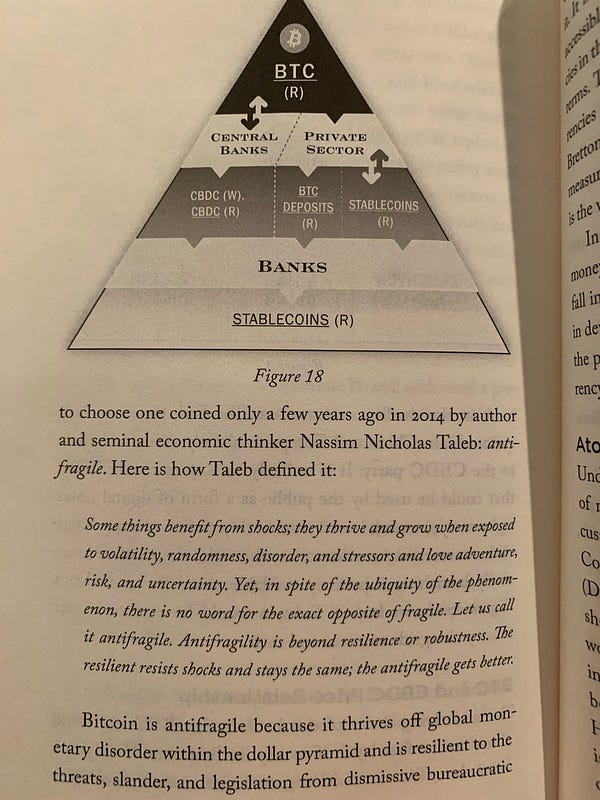

Nik Bhatia’s book “Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies” is finally in store:

Our favourite part of Lyn Alden’s Economic Analysis of Ethereum:

“In my view, the biggest risk for Ethereum is that it could end up like the 🇫🇷 Concorde.”

Hasu has delivered a great technical explainer on the “double-spend” drama we had last week. And a sane reminder that a fix for griefing attacks (explained here by Joost Jager) is still needed.

⚡ Bonus

Always funny how fast things can turn in the Bitcoin world..

Some Satoshi’s impersonator’s lawyers demanding a number of website operators to enforce copyright on the Bitcoin white paper has led a government (Estonia), Members of Congress and the city of Miami to host it directly themselves in support:

But the main story this week has of course been the fascinating story of r/wallstreetbets. We look forward to this becoming a reality:

Please feel free to reach out to us on Twitter and Telegram.

Thank you for your support and let’s keep building the future of finance together!