Welcome to the fifth issue of this newsletter which covers market trends, Lightning Network developments and updates about LN Markets.

If you enjoy this content, feel free to spread the word!

🔥 Beyond the Lightning ceiling

When we introduce LN Markets, people sometimes ask: “You are building on the Lightning Network: aren’t you afraid to quickly hit a ceiling, a cap in users and volume?”

Well, as we computed in a previous issue, an LN-based derivatives exchange could already have a max daily volume comparable to Gemini or Bittrex.

On top of that, it is interesting to note that market activity on LN Markets is more and more correlated with that of other large exchanges. Of course, the size of our trading volumes can not be compared with them.

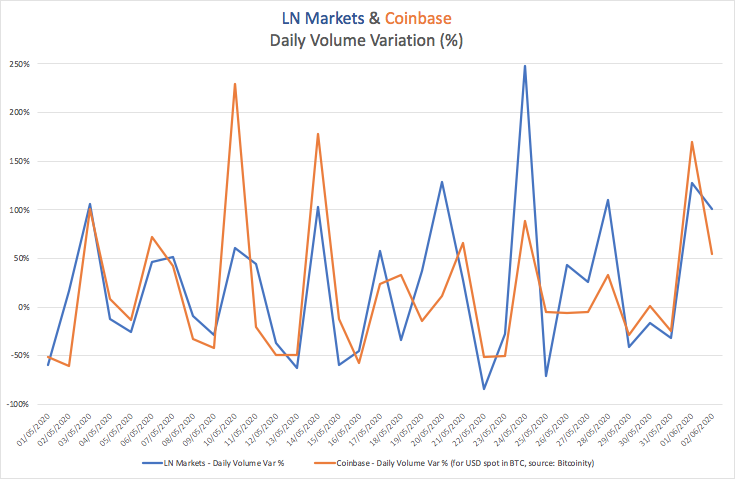

But over the past month, there has been a correlation of more than 84% between volumes on LN Markets and volumes on leading trading venues like Coinbase or BitMEX. As an illustration, we can see here the daily volume variation for LN Markets and Coinbase over the past month:

We see it as an encouraging trend as it means that our user base goes beyond pure Lightning enthusiasts and our platform starts being a go-to place for trading in times of volatility!

Quick update on our metrics, we have now reached over 15,000 trades processed and $5 million in aggregate volume traded (while max margin amounts are still limited to 0.01 BTC per wallet). And we have a new max P&L of more than 4 million sats!

LN Markets lightning node now has a capacity of 4.4 BTC with 110 channels opened.

⚒️ Building

Our most recent upgrade includes:

An optimisation of our withdrawal method to fix some issues we had for invoice payments not immediately settled

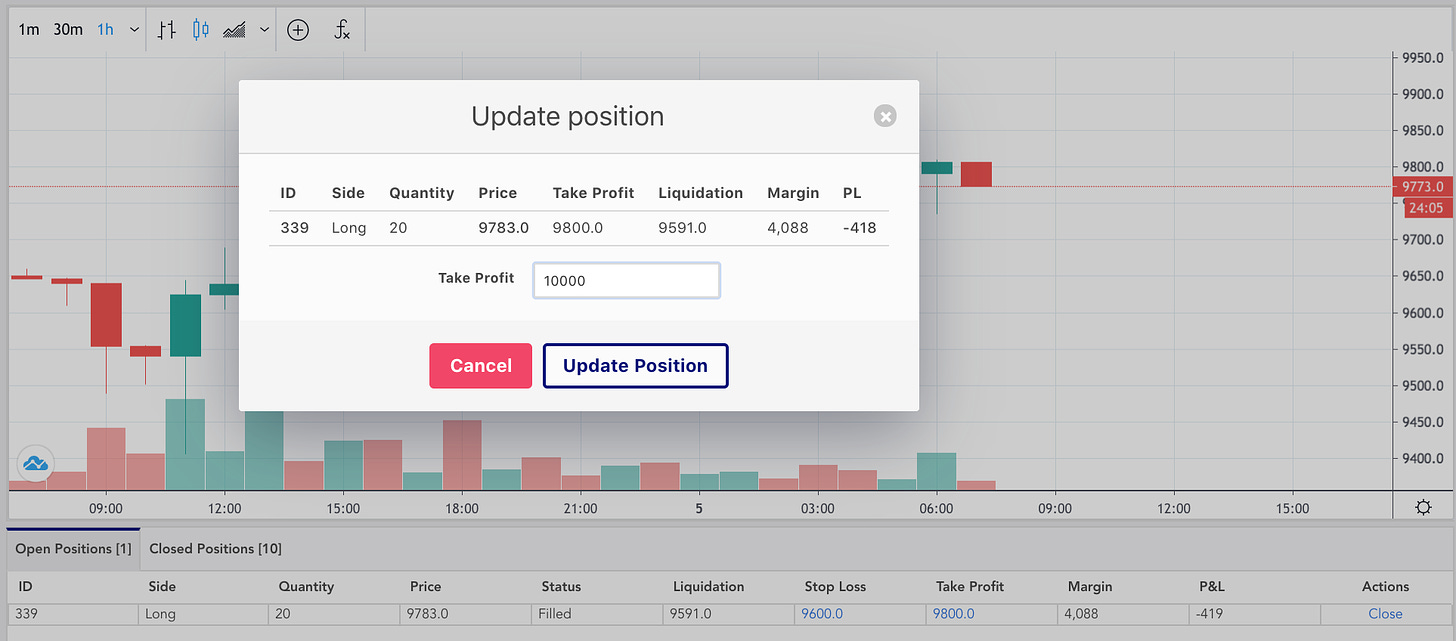

The ability to modify your (optional) take profit and stop loss orders for open positions: an important feature for a better risk management in times of high volatility

In our next upgrade, we will implement an individual trading account for your global position management. It will give you the possibility to deposit sats in advance, to have a global balance on the platform, and that will enable you to group multiple withdrawals together.

We also worked on security and back-end improvements to be able to provide you with a seamless trading experience and fix any issues you may have as quickly as possible.

🤓 Liquid

You certainly remember March 12th, the day Bitcoin price fell down steeply from $8,000 to below $4,000.. That day, some trading venues halted their operations. Thus, it became very complex for crypto hedge funds to respond to this selloff and to manage their risks properly. Some even had to shut down their activity, blaming poor exchange infrastructure.

Today, traders and exchanges mainly rely on on-chain operations to conduct their business. Doing so, they are exposed to extreme volatility risk: proof-of-work takes time to settle transactions while markets can move much more quickly!

In our view, the Lightning Network, as a trustless, fast and scalable settlement network can solve these issues, enabling market participants to move money around trading venues instantly. But channels between participants must be collateralised in advance, which is not capital efficient.

The Liquid network developed by Blockstream also seeks to improve crypto markets infrastructure. Liquid is not a layer 2 built on top of Bitcoin, but a Bitcoin sidechain.

This network is designed for traders and exchanges, and its stated goal is to provide confidential, fast and final settlements: around 2 minutes for Liquid Bitcoin (L-BTC). Liquid also enables the issuance of securities and other digital fungible assets on top of it.

Yet, there is a trade-off: instead of being extremely robust and secured by proof-of-work like Bitcoin, Liquid consensus is federated and relies on a set of trusted functionaries, primarily crypto financial institutions.

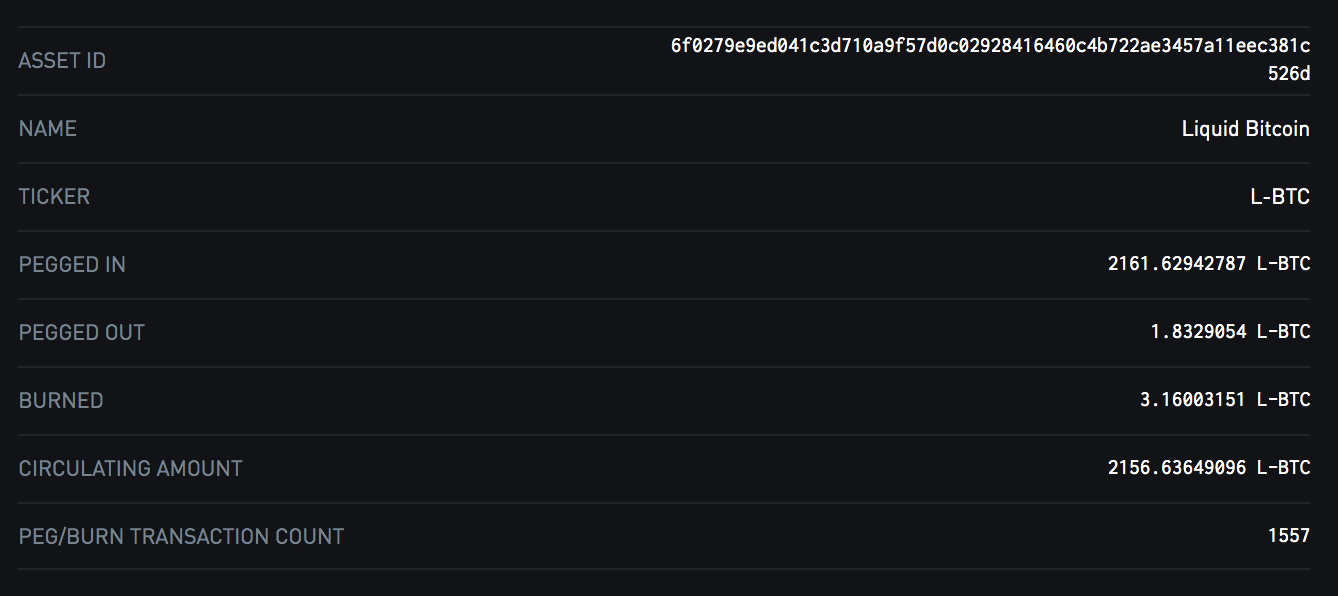

There is a 2-way peg between Liquid and Bitcoin. To join the Liquid network, users must peg-in their Bitcoins, sending their BTC to a specific peg-in address. After 102 blocks confirmations (~17 hours on average), users can claim the equivalent quantity of Liquid Bitcoin (L-BTC) that can be used on the Liquid network. To exit Liquid, users create a peg-out transaction in the Liquid transactions, which will be processed in between 11 to 35 minutes.

Functionaries validate blocks in the liquid network (each block needs to be signed by at least two-thirds of the functionaries) and manage and secure the BTCs held by the federation on Bitcoin blockchain.

There are currently over 2,000 L-BTC in circulation:

Lightning and Liquid are frequently opposed, but in our view they are instead complementary networks, it’s all a matter of trade-offs:

Or as BitMEX Research puts it:

We are currently building on the Lightning Network, but we also plan to develop innovative products on Liquid for traders and crypto financial institutions at a later stage.

And overall we believe that there will not be a sole layer / sidechain winner, but that it is the combination of the Lightning Network, Liquid and maybe of other protocols such as RGB that will reshape the legacy financial system.

🔮 Reading

Bitcoin mining is a fascinating, complicated, opaque and often misunderstood topic. We really enjoyed this deep-dive into the dynamics of the Bitcoin mining industry by Leo Zhang, founder of Anicca Research:

⚡ Bonus

Referral links are quite popular for trading platforms, though we have not implemented any program yet for LN Markets.

But if we do, it would be cool to create a Lightning-native referral program: an instant and private way to receive and share sats.

There could be several ways to build it but LSATs and LNURL seem like good options. Thanks Ryan Gentry for pointing out that idea to us!

And finally, even if it’s still the early days and a lot of the tools we are using are fresh new, we thank you all for your patience and understanding when technical glitches occur on the platform. Special thanks to BlockchainBoog for the kind words:

We hope to keep the same level of service if we scale to Coinbase level!

At least our volumes are correlated, that’s a start 😆

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!