#7 - July 16th, 2020

⚡Markets, Building, Lightning for hardware wallets, Lightning Finance and much more!

Welcome to the seventh issue of this newsletter which covers market trends, Lightning Network developments and updates about LN Markets.

If you enjoy this content, feel free to spread the word!

📊 Markets

As you may have noticed, Bitcoin has officially morphed into a stablecoin for the past month:

This has not helped trading activity, both for centralized and decentralized exchanges . According to The Block, monthly volumes of Bitcoin futures fell by 40% in June, while DEX derivatives earnings fell from $1.9 million in Q120 to $260,000 in Q220 according to Bankless.

On our end, we are now at 1,000 weekly active users, 18,000 trades and $6.5 million aggregate volume since we launched mid-March (with max margin amounts are still limited to 0.01 BTC per wallet). Numbers still going up!

⚒️ Building

Front-end design is not our best skill yet, but we have tried a quick win on our front page:

To be fair, this new design has not been to the taste of all of our users 😅.

Do not worry folks, we have more been focused on Lightning engineering than front-end so far, but a full revamping of the front-end is in our roadmap.

We also have been working on a few improvements requested by our community that will be shipped shortly:

F.A.Q.: your perfect companion to start your journey on LN Markets! This detailed F.A.Q. is made up of four parts: how to start using the Lightning Network, a primer on trading, how to trade derivatives on the Lightning Network on LN Markets and lastly frequent issues and how to fix them.

Liquidation: the exact Liquidation Time will now be displayed in the Closed Positions blotter.

Order: the Margin Max button enables you to quickly use all your Available Margin for a trade.

Last but not least, two developers are joining our team full-time with the mission to keep delivering an awesome trading experience: welcome Kilian and Yoann!

🤓 Lightning in your hardware wallet?

We talked last week about Lightning integration in Electrum software wallet. The question which follows is when Lighting integration for hardware wallets such as Ledger or Trezor?

Indeed, with the latest Electrum release, as Electrum developer SomberNight told Coindesk:

“You can [now] use Lightning directly with your hardware wallet: channel-opens and channel-closes can directly pay from and to addresses backed by a hardware device. Your Lightning balance, while in channels, will not be secured by the hardware but all your on-chain balance will be, and it’s very convenient to have a shared single wallet that you can use to pay both on-chain and Lightning”

Having an off-chain Lightning balance secured by a hardware wallet is clearly not an easy task, as Nicolas Bacca, Ledger’s Head of Innovation, pointed out to us:

But it’s interesting to see initiatives such as the Lightning Signer Project, which benefits from a grant from Square Crypto, that could enable hardware wallets to sign directly Lightning transactions (more details here):

🏛️ Lightning Finance

Our most fundamental belief is that Bitcoin and the Lightning Network are reshaping finance. While delivery-versus-payment of traditional financial instruments (equity, fixed income, currency, commodity) takes one to three days , the Lightning Network enables the transfer of value online instantly, at very low cost, without counterparty risk. This is just mind-blowing.

Paolo Ardoino, CTO of Bitfinex, the first large exchange that has implemented LN deposits and withdrawals, has recently summarised our views and unveiled an interesting new project: the first fund settling trades via the Lightning Network!

If that was not enough, Paolo mentioned the possibility to settle these trades in Tether on Lightning with the RBG protocol (whose first beta version is now live) and the possibility to open dedicated wumbo channels (lifting channel size limit) for large-size trades.

🌱 Ecosystem

We are big fans of Jack Mallers’ work since we first tried the Lightning wallet Zap, and we believe projects like Strike, which allow anyone in the world to interact with Bitcoin and LN using only a bank account and/or debit card is huge for mainstream adoption.

Indeed, a seamless fiat to Lightning on-ramp can ease drastically the on-boarding of new users to Lightning Apps such as ours. And we look forward to a team building the same kind of service in for non-US based users.

Jack also recently announced Zap’s partnership with Visa and a quiet $3.5 million fundraise led by Green Oaks Capital, which previously backed FinTech unicorns Robinhood and Stripe. Not bad!

Fun Fact: we also learnt that in 1973, Jack’s grandfather Bill Mallers helped found the Chicago Board of Exchange (Cboe), a leading derivative exchange that listed one of the first cash-settled Bitcoin futures at the end of 2017. When we told you that Bitcoin is going to eat traditional finance…

By the way, here is a great podcast episode he recorded end of 2019 with Peter McCormack, if interested to know more about him and his views on Lightning Network path forward.

⚡ Bonus

Welcome to the Lightning fam Olympia Lightning, new daughter of the fastest man on earth Usain Bolt! With such a name we look forward to seeing her on the Olympics podiums very soon:

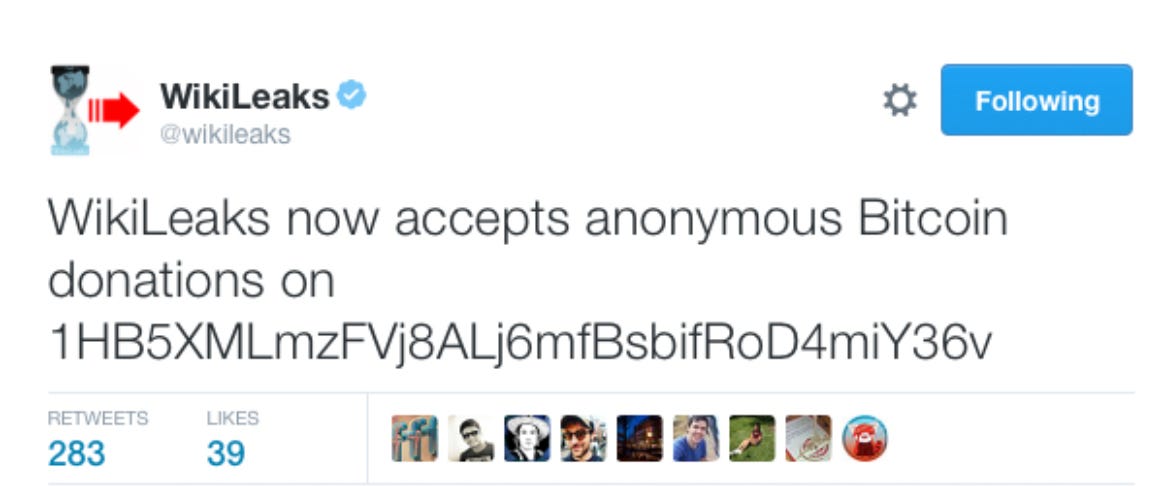

WikiLeaks, one of the first websites to accept Bitcoin after being blocked from traditional financial transactions in 2010, with more than 4,000 BTC donated since then, now accepts Bitcoin Lightning payments:

And finally, special thanks to Vortex and Viva Mola La Lightning for their kind support, much appreciated!

Please feel free to reach out to us on Twitter and Telegram.

Thank you all for the support and let’s keep building a BILLION sats company together!